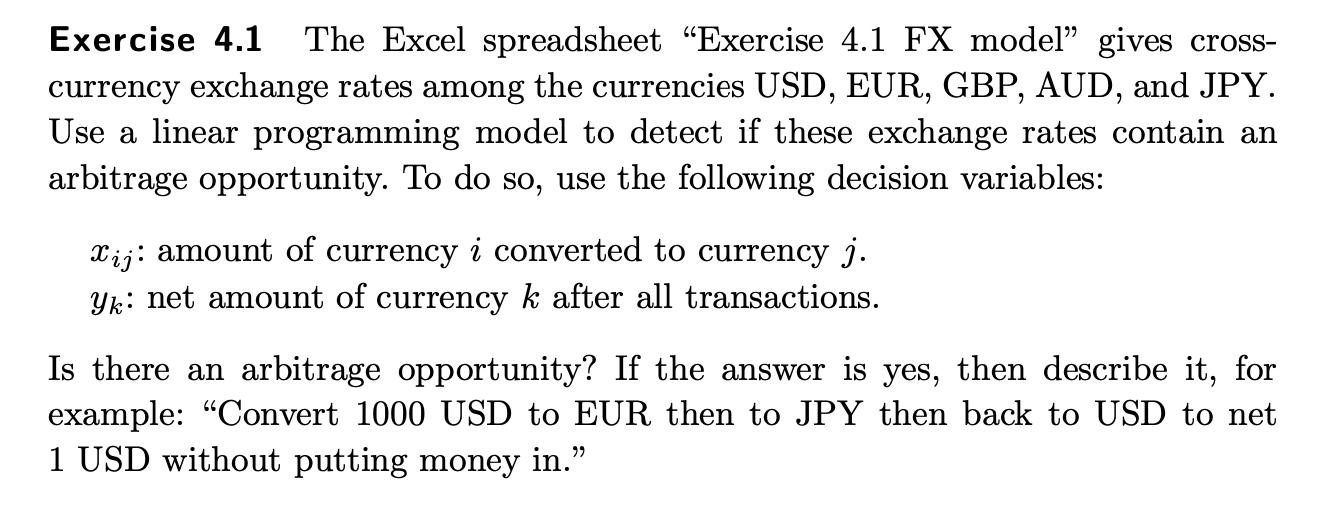

Question: Exercise 4 . 1 The Excel spreadsheet Exercise 4 . 1 FX model gives cross - currency exchange rates among the currencies USD, EUR, GBP

Exercise The Excel spreadsheet "Exercise FX model" gives cross

currency exchange rates among the currencies USD, EUR, GBP AUD, and JPY

Use a linear programming model to detect if these exchange rates contain an

arbitrage opportunity. To do so use the following decision variables:

: amount of currency i converted to currency

: net amount of currency after all transactions.

Is there an arbitrage opportunity? If the answer is yes, then describe it for

example: "Convert USD to EUR then to JPY then back to USD to net

USD without putting money intableUSD,EUR,GBPAUD,JPYUSDEURGBPAUDJPY

CREATE A LINEAR PROGRAM THAT SOLVES THIS PROBLEM. Please go very in depth as Im not very familiar how to do this. thanks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock