Question: + ID Page view A Read aloud V Draw Highlight Erase Case 1 Hamilton & Jacobs (H&J) is a global investment company, providing start-up cap

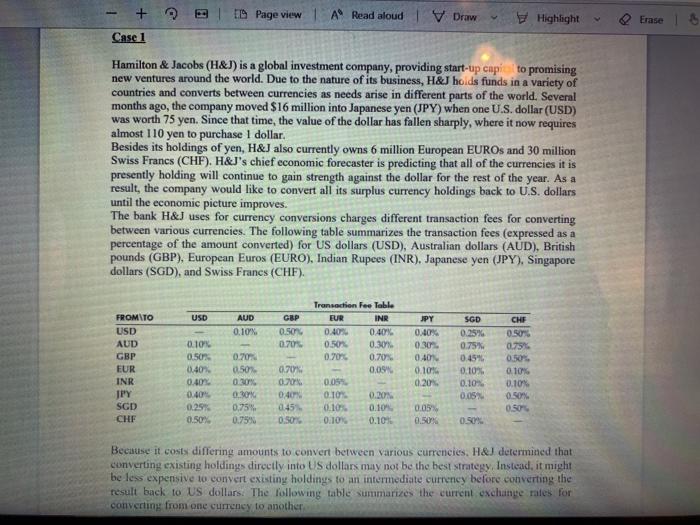

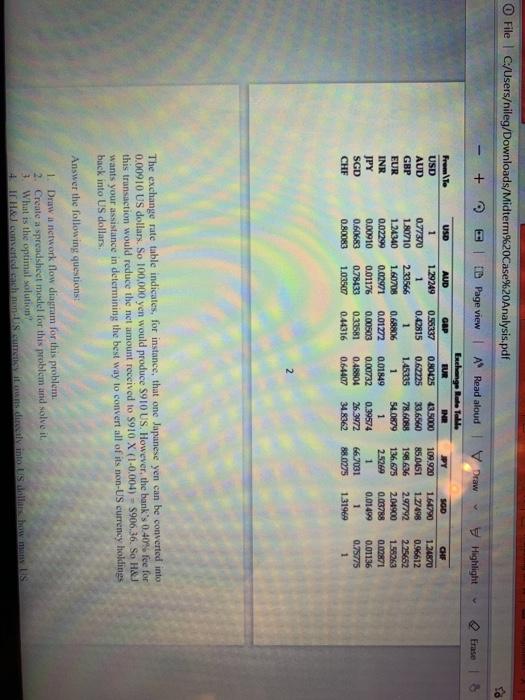

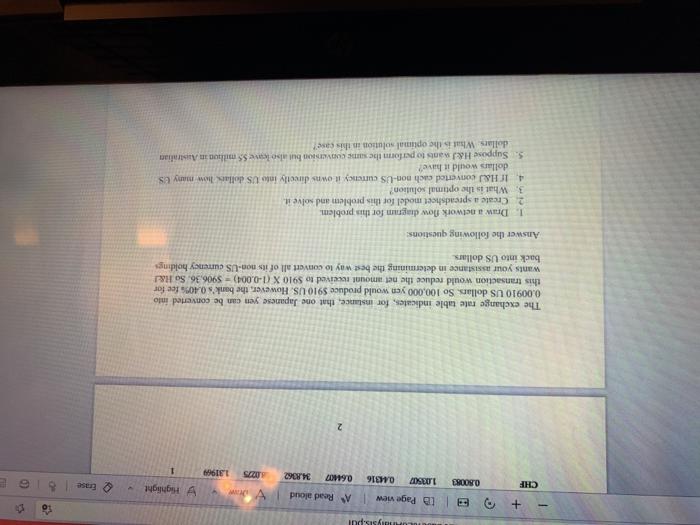

+ ID Page view A Read aloud V Draw Highlight Erase Case 1 Hamilton & Jacobs (H&J) is a global investment company, providing start-up cap to promising new ventures around the world. Due to the nature of its business, H&J holds funds in a variety of countries and converts between currencies as needs arise in different parts of the world. Several months ago, the company moved $16 million into Japanese yen (JPY) when one U.S. dollar (USD) was worth 75 yen. Since that time, the value of the dollar has fallen sharply, where it now requires almost 110 yen to purchase 1 dollar. Besides its holdings of yen, H&J also currently owns 6 million European EUROs and 30 million Swiss Franc (CHF). H&J's chief economic forecaster is predicting that all of the currencies it is presently holding will continue to gain strength against the dollar for the rest of the year. As a result, the company would like to convert all its surplus currency holdings back to U.S. dollars until the economic picture improves. The bank H&J uses for currency conversions charges different transaction fees for converting between various currencies. The following table summarizes the transaction fees (expressed as a percentage of the amount converted) for US dollars (USD), Australian dollars (AUD), British pounds (GBP), European Euros (EURO), Indian Rupee (INR). Japanese yen (JPY), Singapore dollars (SGD), and Swiss Franc (CHF). USD FROM TO USD AUD AUD 0.10% GBP 0.50% 0.70 CHE 0.50 75 GBP JPY 0.40% 0.30 0.407 0.10% 0.20% 0.10 0.5% 0.40. 0.40% 0.40 0.25% 0.50% Transaction Fee Table EUR INR 0.40% 0.40% 0.50 0.30% 0.706 0.70% 0.09% 0.05% OTOR 0.2% 0.10% 0.10 0.10% 0.10% 0.70 050% 0.30% 0.30% 0.75 0.75 EUR INR JPY SGD CHF SGD 0.25% 0.75% 0,45% 0.10% 0.10% 0.05% 0.70% 0.70% 040 0.45 0.50 0.50% 0.10% 0.10% 0.50% 050 0.05% 0.50% Because it costs differing amounts to convert between various currencies. H&J determined that converting existing holdings directly into US dollars may not be the best strategy. Instead, it might be less expensive to convert existing holdings to an intermediate currency before converting the result back to US dollars. The following table summarizes the current exchange rates for converting from one currency to another Highlight Frase O File | C:/Usersileg/Downloads/Midterm%20Case%20Analysis.pdf E ID Page view A Read aloud V Draw Exchange Rate Tolle From Te USD AUD GBP EUR INR SGD USD 1 1.29249 0.56337 0.80425 43.5000 109.920 1.64790 AUD 0.77370 1 0.42815 0.675 33.6560 85.0451 1.27498 GBP 1.80710 233566 1 1.45835 78.6088 198.636 2.97792 EUR 1.24340 1.60708 0.68806 1 54.0679 136.675 204900 INR 0.02299 0.02971 0.01272 0.01849 1 2.5269 0.03788 JPY 0.00910 0.01176 0.00503 0.00732 0.39574 1 0.01499 SGD 0.60683 0.78433 033581 0.48804 26.3972 66 7031 1 CHF 0.80083 1.03507 0.44316 0.64407 34.8362 88.0275 1 31969 CHF 1.24870 0.96612 225652 1.59263 0.02871 0.01136 0.75775 1 The exchange rate table indicates, for instance, that one Japanese yen can be converted into 0.00910 US dollars. So 100,000 yen would produce S910 US. However, the bank's 0.40%. fee for this transaction would reduce the net amount received to S910 X (1-0.004) - 5906.36. So H&J wants your assistance in determining the best way to convert all of its non-US currency holdings back into US dollars. Answer the following questions 1. Draw a network flow diagram for this problem 2. Create a spreadsheet model for this problem and solve il 3. What is the optimal solution? 1 ICHS consented cashmanS UITSIS dinsly into US dollar how mans Oy Sis.pl - + E D Page view O.R.ORG 1.MSI 04316 A Read aloud CHE Highlight Erase 0 064617 34.8362 0275 1.319 1 2 The exchange rate table indicates, for instance, that one Japanese yen can be converted into 0.00910 US dollars. So 100,000 yen would produce 5910 US. However, the banks 0.40%. fee for this transaction would reduce the net amount received to S910 X (1-0.004)5906,36. So H& wants your assistance in determining the best way to convert all of its non-US currency holdings back into US dollars Answer the following questions: 1. Draw a network flow diagram for this problem. 2. Create a spreadsheet model for this problem and solve it 3. What is the optimal solution? 4 Ir H converted coch non-US currency it owns directly into US dollars. w many US dollars would it have? 5. Suppose H&J wants to perform the same conversion but also leave 55 milho in Australian dollars. What is the optimal solution in this case + ID Page view A Read aloud V Draw Highlight Erase Case 1 Hamilton & Jacobs (H&J) is a global investment company, providing start-up cap to promising new ventures around the world. Due to the nature of its business, H&J holds funds in a variety of countries and converts between currencies as needs arise in different parts of the world. Several months ago, the company moved $16 million into Japanese yen (JPY) when one U.S. dollar (USD) was worth 75 yen. Since that time, the value of the dollar has fallen sharply, where it now requires almost 110 yen to purchase 1 dollar. Besides its holdings of yen, H&J also currently owns 6 million European EUROs and 30 million Swiss Franc (CHF). H&J's chief economic forecaster is predicting that all of the currencies it is presently holding will continue to gain strength against the dollar for the rest of the year. As a result, the company would like to convert all its surplus currency holdings back to U.S. dollars until the economic picture improves. The bank H&J uses for currency conversions charges different transaction fees for converting between various currencies. The following table summarizes the transaction fees (expressed as a percentage of the amount converted) for US dollars (USD), Australian dollars (AUD), British pounds (GBP), European Euros (EURO), Indian Rupee (INR). Japanese yen (JPY), Singapore dollars (SGD), and Swiss Franc (CHF). USD FROM TO USD AUD AUD 0.10% GBP 0.50% 0.70 CHE 0.50 75 GBP JPY 0.40% 0.30 0.407 0.10% 0.20% 0.10 0.5% 0.40. 0.40% 0.40 0.25% 0.50% Transaction Fee Table EUR INR 0.40% 0.40% 0.50 0.30% 0.706 0.70% 0.09% 0.05% OTOR 0.2% 0.10% 0.10 0.10% 0.10% 0.70 050% 0.30% 0.30% 0.75 0.75 EUR INR JPY SGD CHF SGD 0.25% 0.75% 0,45% 0.10% 0.10% 0.05% 0.70% 0.70% 040 0.45 0.50 0.50% 0.10% 0.10% 0.50% 050 0.05% 0.50% Because it costs differing amounts to convert between various currencies. H&J determined that converting existing holdings directly into US dollars may not be the best strategy. Instead, it might be less expensive to convert existing holdings to an intermediate currency before converting the result back to US dollars. The following table summarizes the current exchange rates for converting from one currency to another Highlight Frase O File | C:/Usersileg/Downloads/Midterm%20Case%20Analysis.pdf E ID Page view A Read aloud V Draw Exchange Rate Tolle From Te USD AUD GBP EUR INR SGD USD 1 1.29249 0.56337 0.80425 43.5000 109.920 1.64790 AUD 0.77370 1 0.42815 0.675 33.6560 85.0451 1.27498 GBP 1.80710 233566 1 1.45835 78.6088 198.636 2.97792 EUR 1.24340 1.60708 0.68806 1 54.0679 136.675 204900 INR 0.02299 0.02971 0.01272 0.01849 1 2.5269 0.03788 JPY 0.00910 0.01176 0.00503 0.00732 0.39574 1 0.01499 SGD 0.60683 0.78433 033581 0.48804 26.3972 66 7031 1 CHF 0.80083 1.03507 0.44316 0.64407 34.8362 88.0275 1 31969 CHF 1.24870 0.96612 225652 1.59263 0.02871 0.01136 0.75775 1 The exchange rate table indicates, for instance, that one Japanese yen can be converted into 0.00910 US dollars. So 100,000 yen would produce S910 US. However, the bank's 0.40%. fee for this transaction would reduce the net amount received to S910 X (1-0.004) - 5906.36. So H&J wants your assistance in determining the best way to convert all of its non-US currency holdings back into US dollars. Answer the following questions 1. Draw a network flow diagram for this problem 2. Create a spreadsheet model for this problem and solve il 3. What is the optimal solution? 1 ICHS consented cashmanS UITSIS dinsly into US dollar how mans Oy Sis.pl - + E D Page view O.R.ORG 1.MSI 04316 A Read aloud CHE Highlight Erase 0 064617 34.8362 0275 1.319 1 2 The exchange rate table indicates, for instance, that one Japanese yen can be converted into 0.00910 US dollars. So 100,000 yen would produce 5910 US. However, the banks 0.40%. fee for this transaction would reduce the net amount received to S910 X (1-0.004)5906,36. So H& wants your assistance in determining the best way to convert all of its non-US currency holdings back into US dollars Answer the following questions: 1. Draw a network flow diagram for this problem. 2. Create a spreadsheet model for this problem and solve it 3. What is the optimal solution? 4 Ir H converted coch non-US currency it owns directly into US dollars. w many US dollars would it have? 5. Suppose H&J wants to perform the same conversion but also leave 55 milho in Australian dollars. What is the optimal solution in this case