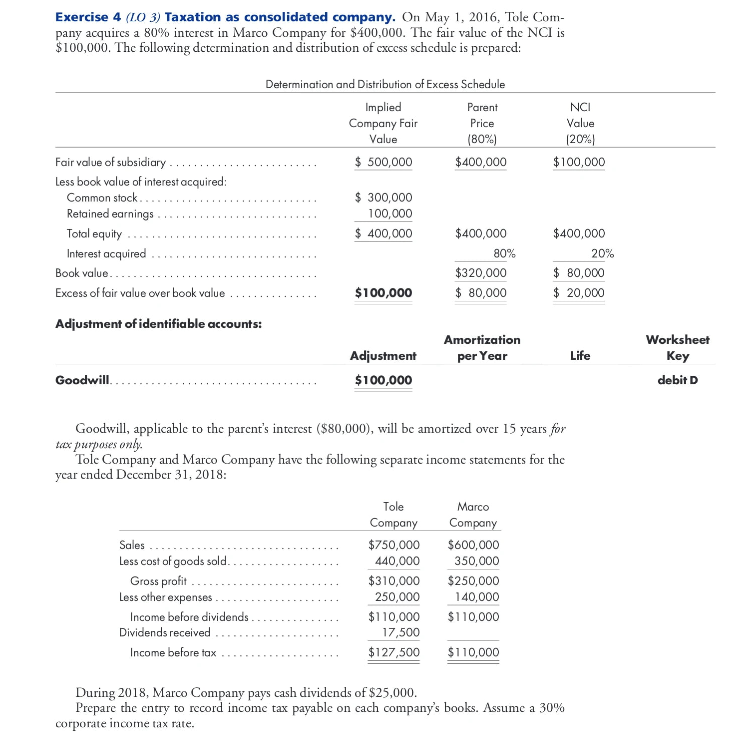

Question: Exercise 4 ( L . O 3 ) Taxation as consolidated company. On May 1 , 2 0 1 6 , Tole Com - pany

Exercise LO Taxation as consolidated company. On May Tole Com

pany acquircs a interest in Marco Company for $ The fair valuc of the NCI is

$ The following detcrmination and distribution of excess schedule is prepared:

Determination and Distribution of Excess Schedule

Goodwill, applicable to the parent's interest $ will be amortized over years for

taxpurposes only.

Tole Company and Marco Company have the following separate income statements for the

year ended December :

During Marco Company pays cash dividends of $

Prepare the entry to record income tax payable on cach company's books. Assume a

corporate income tax rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock