Question: Exercise 4-23 (Algorithmic) (10.4) Cosper and Cecile drvarced in 2018. As part of the divorce sectiement, Cosper transferred stock to Cocile. Cosper purchased the stock

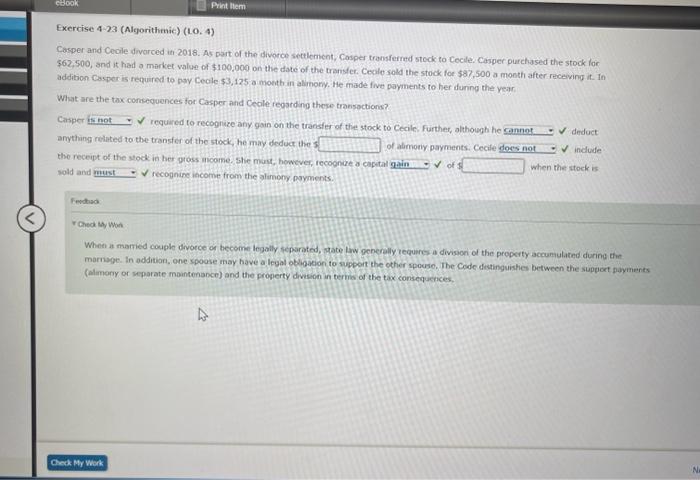

Exercise 4-23 (Algorithmic) (10.4) Cosper and Cecile drvarced in 2018. As part of the divorce sectiement, Cosper transferred stock to Cocile. Cosper purchased the stock for $62,500, and it had a market value of $100,000 on the date of the transfer. Cecilo sold the stock foe $87,500 a moeth after receving it. In addition Cosper is required to pay Cecle $3,125 a month in alimony. He made five payments to her dunng the vear. What are the tax consequences for Casper and Ceole reosrding these transoctions? Casper required to recognize any gain on the transfer of the stock to Cecilen, further, although he anything related to the transfer of the stock, he may deduct the 5 the receipt of the stock in her pross income, she munt, however, recoonce a capital sold and recognine income from the alimony payments. of abmony payments. Cecie) of 1 deduct include when the stock is Fentas: roved wh wh marnage. In additian, one spoose may have a legal obloacion to suppoit the ocher spouso, Doe Code distinguishes between the support payments (alimony or separate maintenance) and the property divsion in termo of the tax conscquences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts