Question: please help with 2 tax accounting problems. Thank you so much! Exercise 4-22 (Algorithmic) (LO. 3) Simba and Zola are married but file separate returns.

please help with 2 tax accounting problems. Thank you so much!

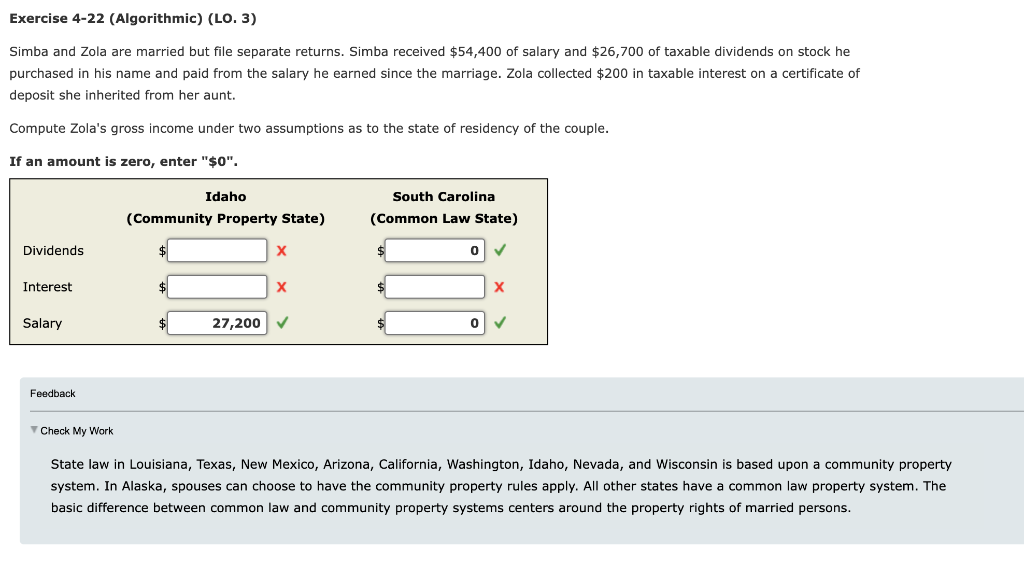

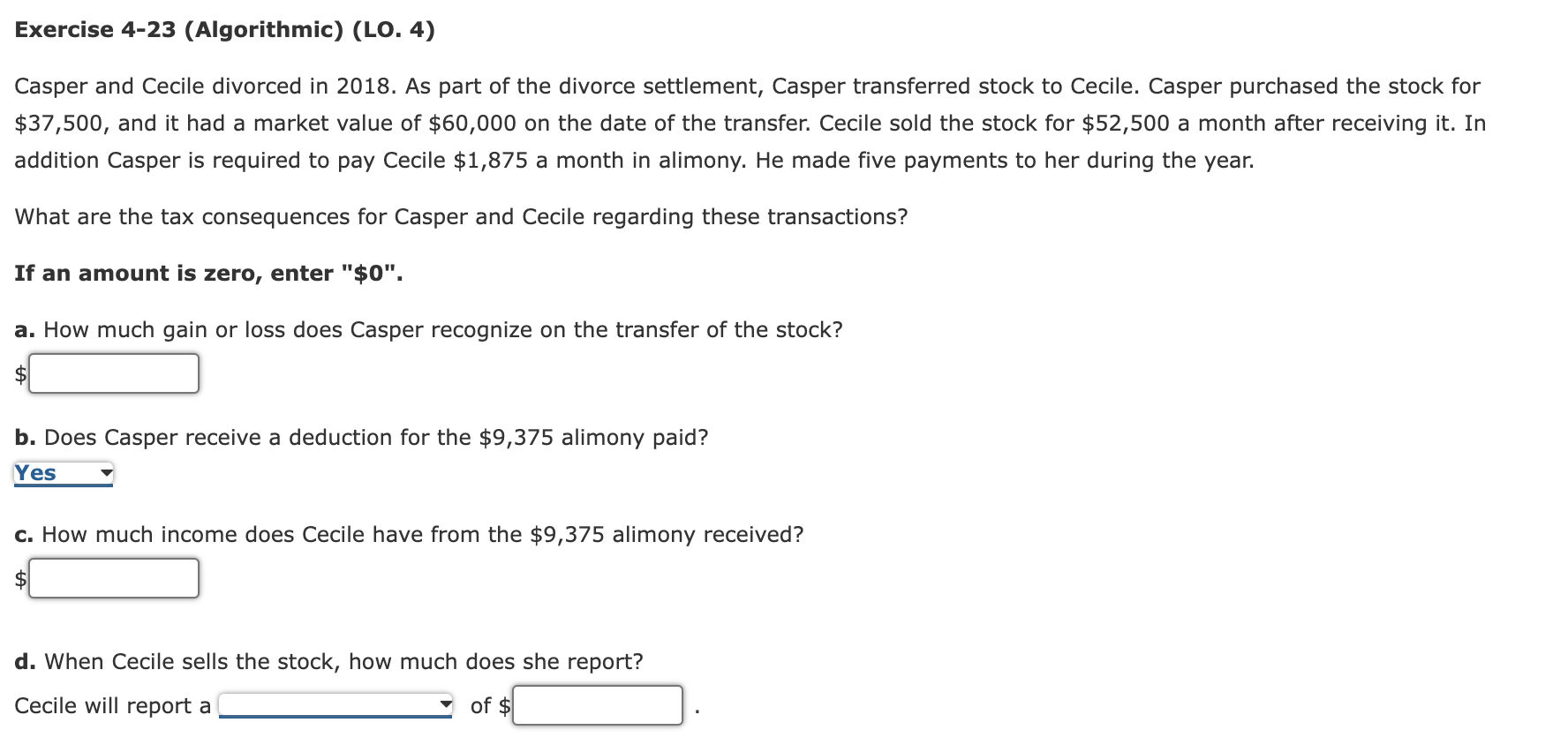

Exercise 4-22 (Algorithmic) (LO. 3) Simba and Zola are married but file separate returns. Simba received $54,400 of salary and $26,700 of taxable dividends on stock he purchased in his name and paid from the salary he earned since the marriage. Zola collected $200 in taxable interest on a certificate of deposit she inherited from her aunt. Compute Zola's gross income under two assumptions as to the state of residency of the couple. If an amount is zero, enter "$0". Idaho (Community Property State) South Carolina (Common Law State) Dividends $ 0 Interest $ Salary 27,200 $ 0 Feedback Check My Work State law in Louisiana, Texas, New Mexico, Arizona, California, Washington, Idaho, Nevada, and Wisconsin is based upon a community property system. In Alaska, spouses can choose to have the community property rules apply. All other states have a common law property system. The basic difference between common law and community property systems centers around the property rights of married persons. Exercise 4-23 (Algorithmic) (LO. 4) Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for $37,500, and it had a market value of $60,000 on the date of the transfer. Cecile sold the stock for $52,500 a month after receiving it. In addition Casper is required to pay Cecile $1,875 a month in alimony. He made five payments to her during the year. What are the tax consequences for Casper and Cecile regarding these transactions? If an amount is zero, enter "$0". a. How much gain or loss does Casper recognize on the transfer of the stock? $ b. Does Casper receive a deduction for the $9,375 alimony paid? Yes c. How much income does Cecile have from the $9,375 alimony received? d. When Cecile sells the stock, how much does she report? Cecile will report a of $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts