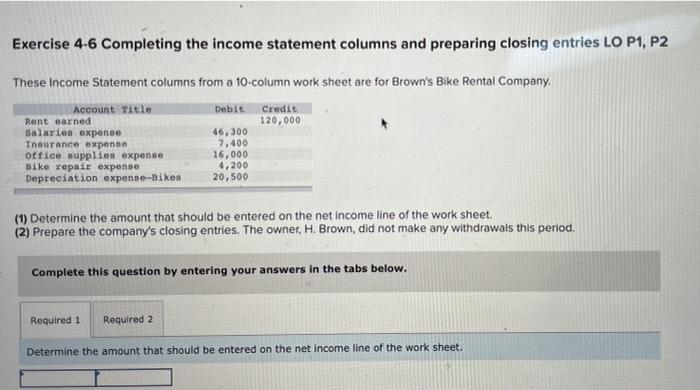

Question: Exercise 4-6 Completing the income statement columns and preparing closing entries LO P1, P2 These Income Statement columns from a 10-column work sheet are for

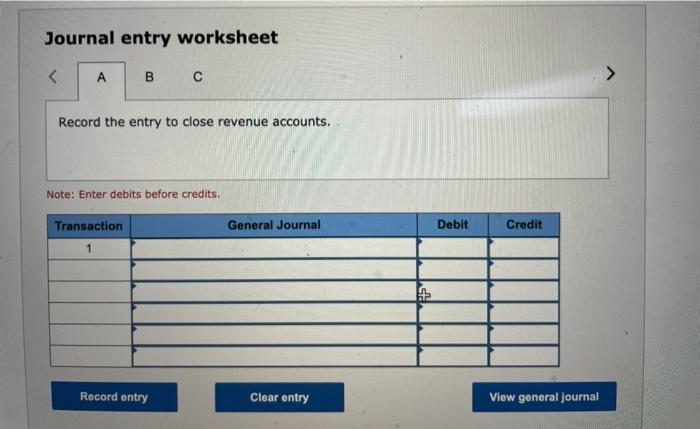

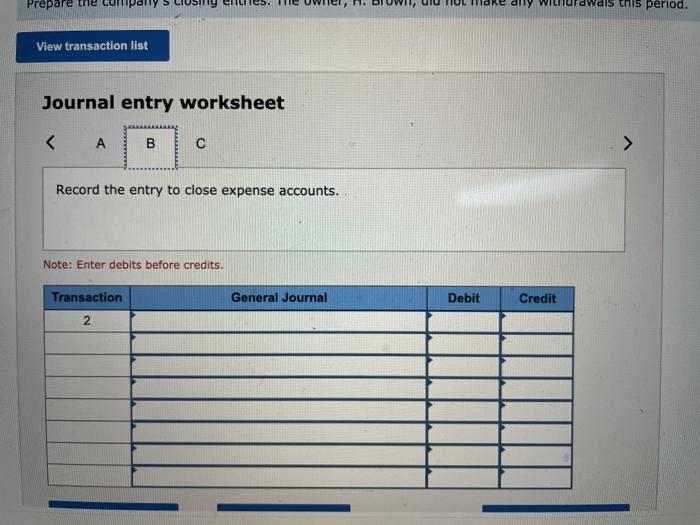

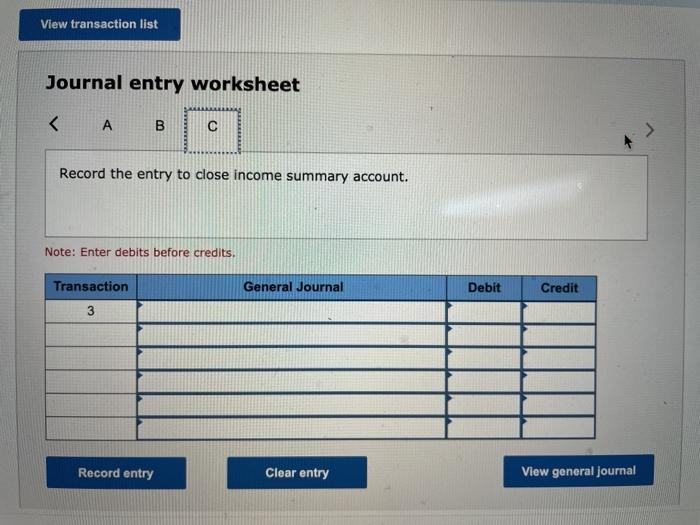

Exercise 4-6 Completing the income statement columns and preparing closing entries LO P1, P2 These Income Statement columns from a 10-column work sheet are for Brown's Bike Rental Company Account Title Debit Credit Rent earned 120,000 Salaries expense 46,300 Insurance expense 7.400 office supplies expense 16,000 alke repair expense 4,200 Depreciation expense-Bikes 20,500 (1) Determine the amount that should be entered on the net income line of the work sheet. (2) Prepare the company's closing entries. The owner, H. Brown, did not make any withdrawals this period. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the amount that should be entered on the net income line of the work sheet. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts