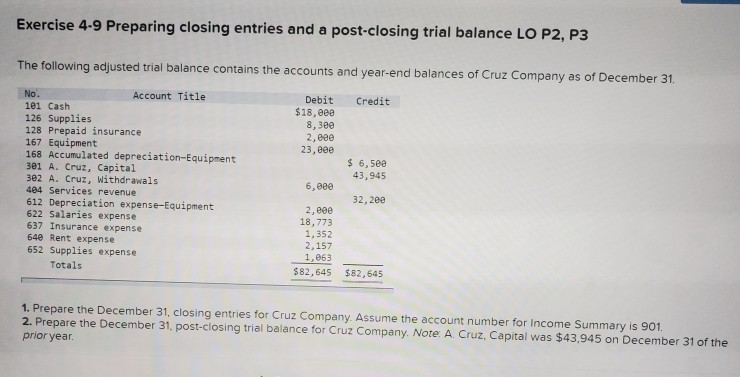

Question: Exercise 4.9 Preparing closing entries and a post-closing trial balance LO P2, P3 The following adjusted trial balance contains the accounts and year-end balances of

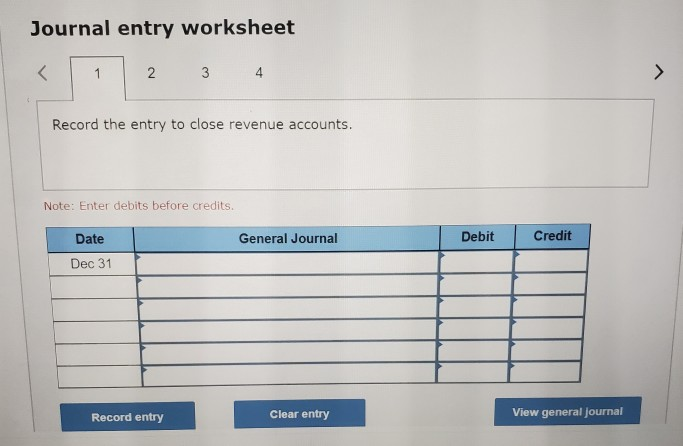

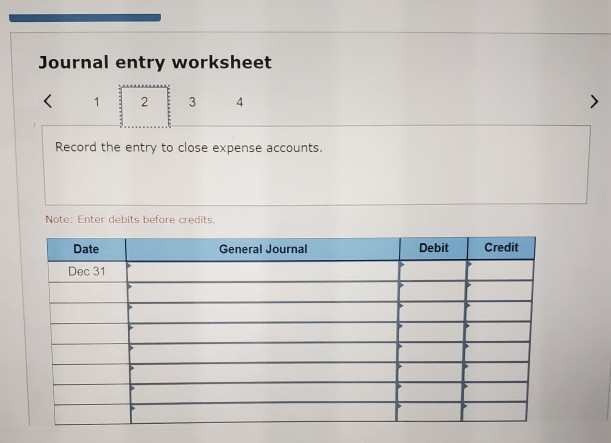

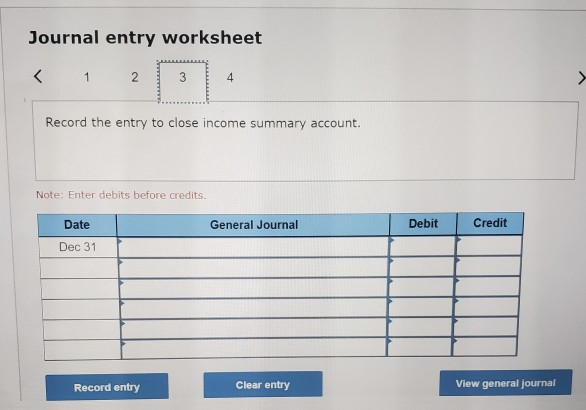

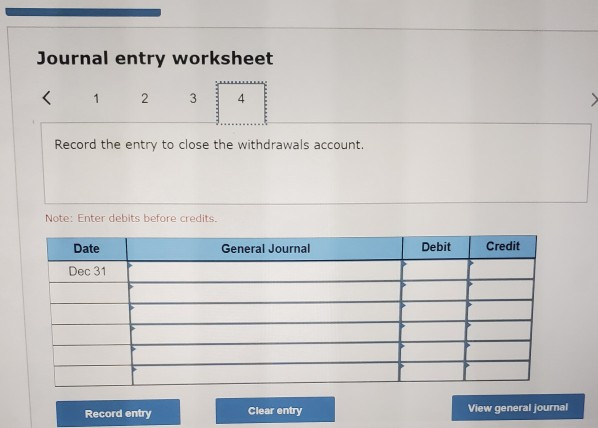

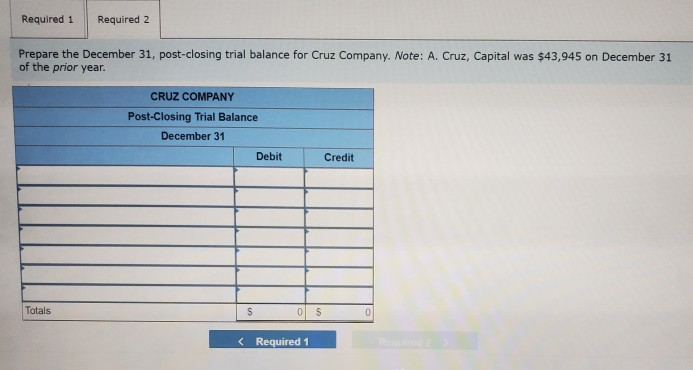

Exercise 4.9 Preparing closing entries and a post-closing trial balance LO P2, P3 The following adjusted trial balance contains the accounts and year-end balances of Cruz Company as of December 31. No. Credit Debit $18, eee 8,3ee 2,eee 23,800 $ 6,5ee 43,945 Account Title 101 Cash 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 301 A. Cruz, Capital 3e2 A. Cruz, Withdrawals 484 Services revenue 612 Depreciation expense-Equipment 622 Salaries expense 637 Insurance expense 640 Rent expense 652 Supplies expense Totals 6,000 32,269 2, eee 18,773 1,352 2.157 1.063 $82,645 $82,645 1. Prepare the December 31, closing entries for Cruz Company Assume the account number for Income Summary is 901. 2. Prepare the December 31, post-closing trial balance for Cruz Company. Note: A Cruz, Capital was $43,945 on December 31 of the prior year. Journal entry worksheet 1 2 3 4 Record the entry to close revenue accounts. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts