Question: Exercise 5 - 1 9 A ( Algo ) Effect of inventory cost flow ( FIFO , LIFO, and weighted average ) on gross margin

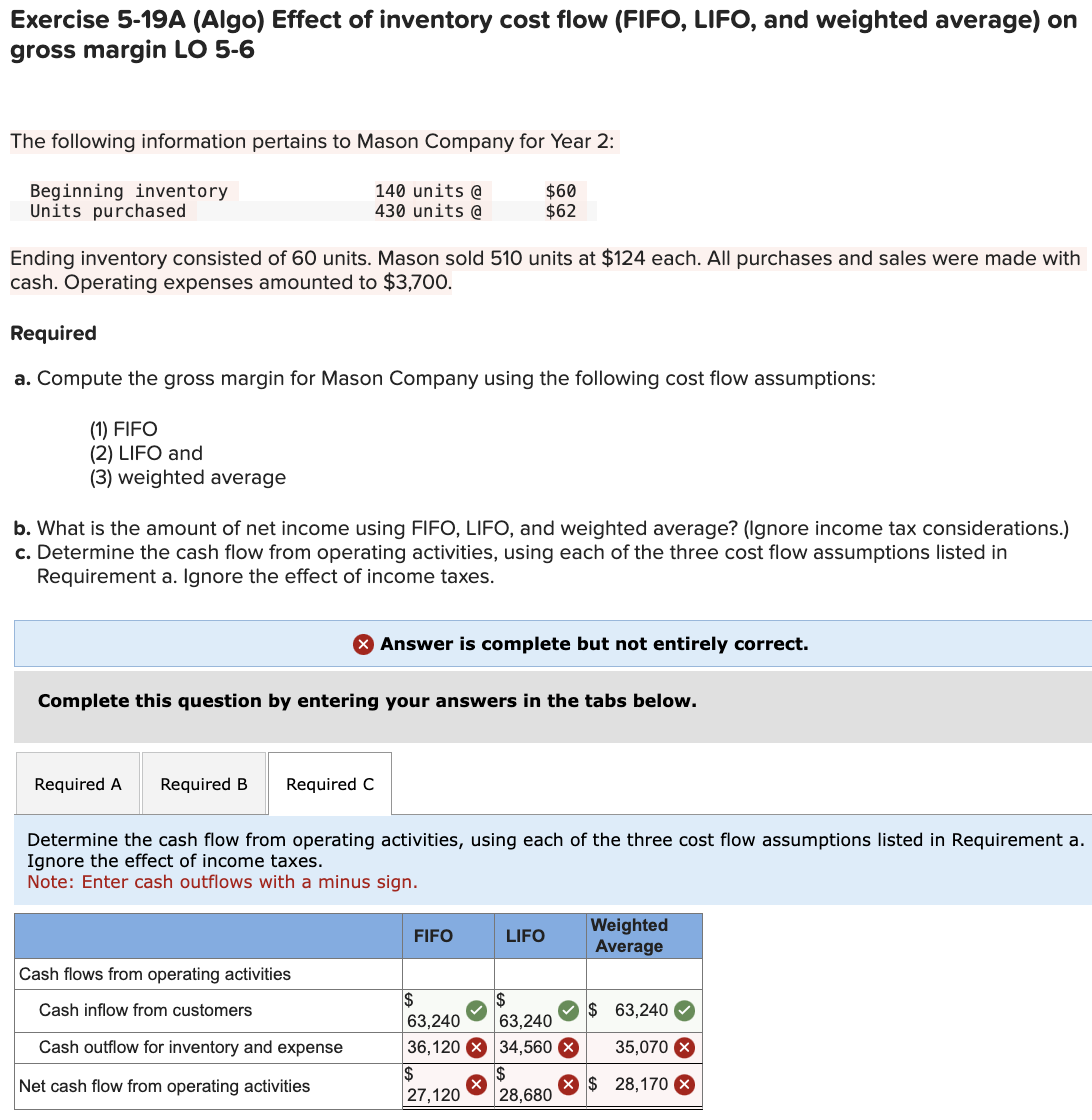

Exercise A Algo Effect of inventory cost flow FIFO LIFO, and weighted average on

gross margin LO

The following information pertains to Mason Company for Year :

Beginning inventory

Units purchased

Ending inventory consisted of units. Mason sold units at $ each. All purchases and sales were made with

cash. Operating expenses amounted to $

Required

a Compute the gross margin for Mason Company using the following cost flow assumptions:

FIFO

LIFO and

weighted average

b What is the amount of net income using FIFO, LIFO, and weighted average? Ignore income tax considerations.

c Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in

Requirement a Ignore the effect of income taxes.

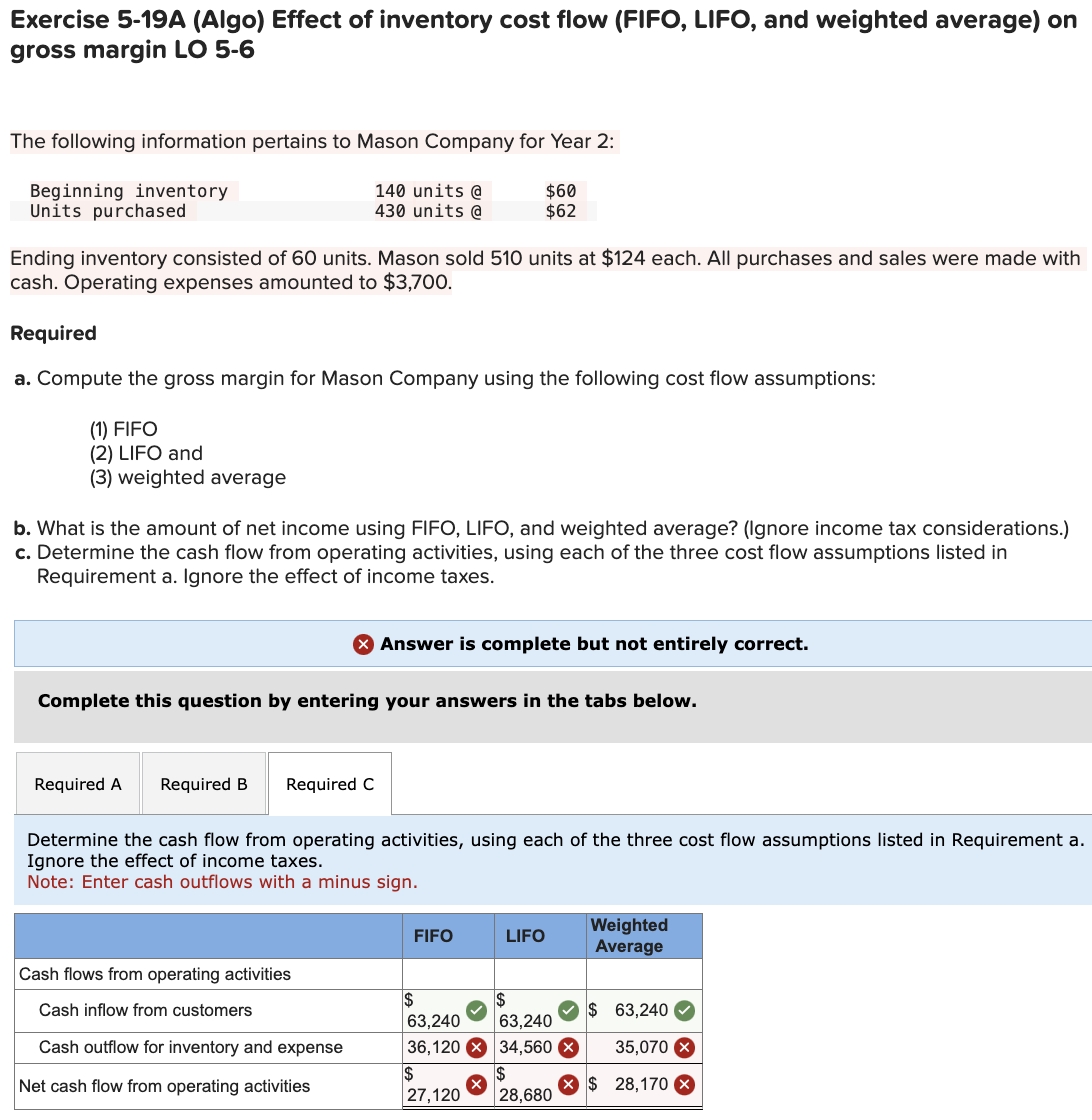

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Requirement a

Ignore the effect of income taxes.

Note: Enter cash outflows with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock