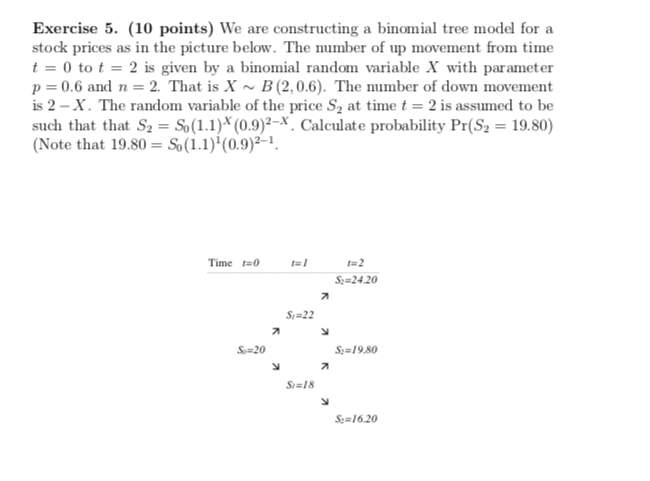

Question: Exercise 5. (10 points) We are constructing a binomial tree model for a stock prices as in the picture below. The number of up movement

Exercise 5. (10 points) We are constructing a binomial tree model for a stock prices as in the picture below. The number of up movement from time t = 0 to t = 2 is given by a binomial random variable X with parameter p = 0.6 and n = 2. That is X ~ B (2, 0.6). The number of down movement is 2 - X. The random variable of the price S, at time t = 2 is assumed to be such that that S2 = So(1.1)(0.9)3-*. Calculate probability Pr($2 = 19.80) (Note that 19.80 = So (1.1)'(0.9)2-1. Time 1=0 1=2 $1=24.20 SI=22 S=20 $1=19.80 y A S=18 5=16.20Exercise 6. (10 points). Suppose we have a pool of 100 bonds issued by different corporations. By experience or empirical evidence, we may know that each quarter of a year the expected number to default is two; that is, A = 2. Moreover, from prior research, we can approximate the distribution of Nquarter by the Poisson distribution with parameter A = 2. What is the expected number of bonds to default within the next year, that is what is E [Nyear ] = E [Na quarters]?Exercise 6. (10 points). Suppose we have a pool of 200 bonds issued by different corporations. By experience or empirical evidence, we ma)r know that each quarter of a year the expected number to default is 10. Moreover, from prior research, we know that we can approximate the distribution of Nmm, by the Poisson distribution. (1) What is the correct parameter A of the Poisson distribution that we should use? (2) What is the expected number of bonds to default within the next semester, that is what is E [N,,,,,,,,,,,,,,,..] = E [N2 gnaw]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts