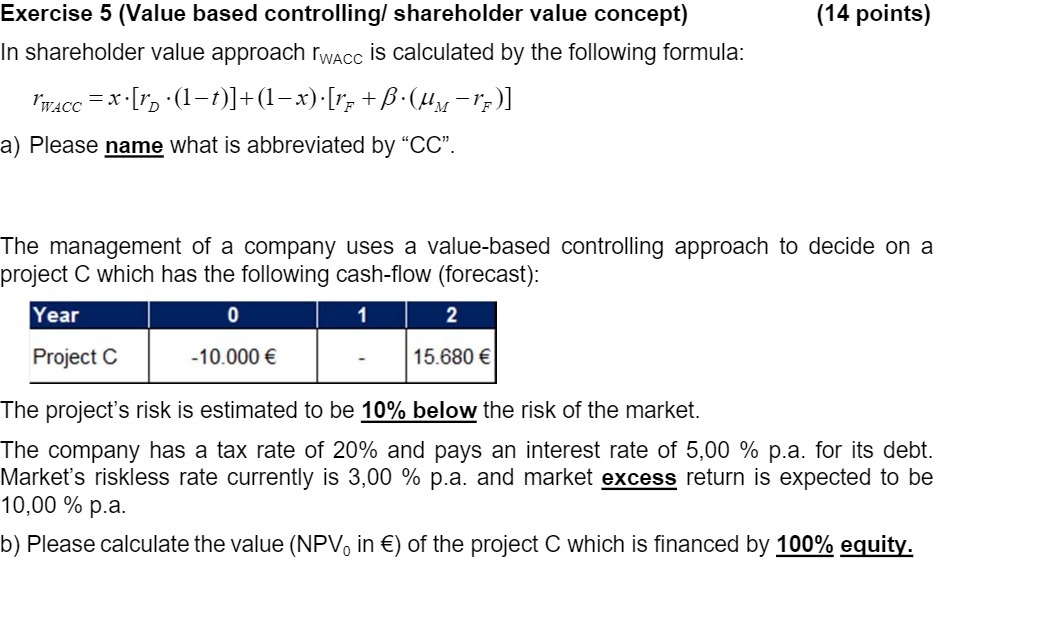

Question: Exercise 5 (Value based controlling! shareholder value concept) (14 points) In shareholder value approach rmCC is calculated by the following formula: r Home :x'lro '(1_I)l+(1_x)'[rp

Exercise 5 (Value based controlling! shareholder value concept) (14 points) In shareholder value approach rmCC is calculated by the following formula: r Home :x'lro '(1_I)l+(1_x)'[rp +16'(2uM _ F)] a) Please name what is abbreviated by "CC\". The management of a company uses a value-based controlling approach to decide on a project C which has the following cash-ow (forecast): The project's risk is estimated to be 10% below the risk of the market. The company has a tax rate of 20% and pays an interest rate of 5,00 % pa. for its debt. Market's riskless rate currently is 3,00 % pa. and market excess return is expected to be 10,00 % pa. b) Please calculate the value (NPVO in E) of the project C which is nanced by 100% eguiy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts