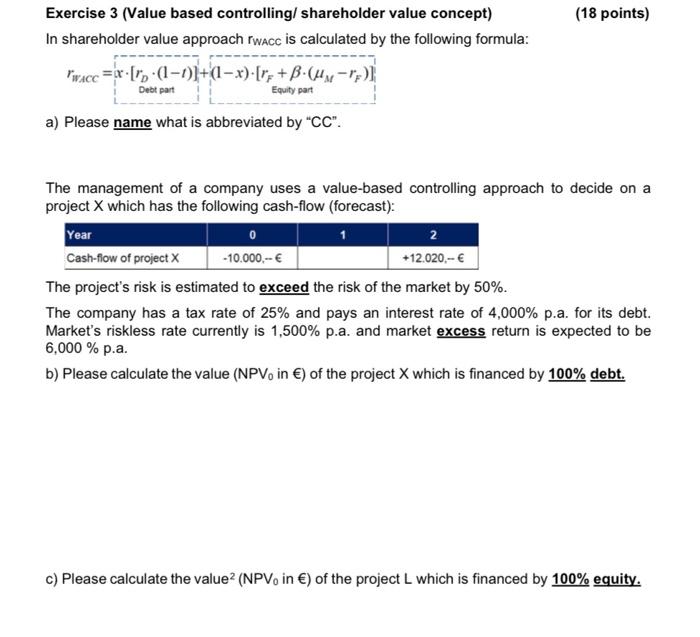

Question: Value based controlling (18 points) Exercise 3 (Value based controlling/ shareholder value concept) In shareholder value approach rwacc is calculated by the following formula: Piracc=x[r,

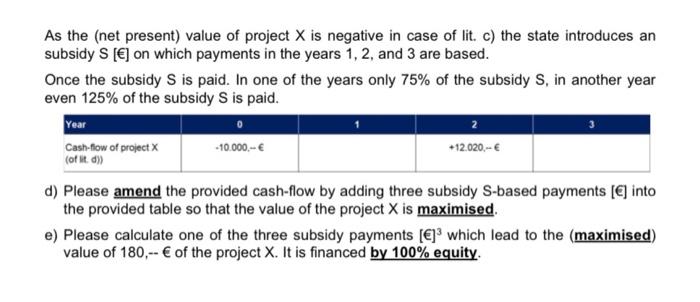

(18 points) Exercise 3 (Value based controlling/ shareholder value concept) In shareholder value approach rwacc is calculated by the following formula: Piracc=x[r, (1-0))+ (1 - x)-[r:+B(4-ro) Debt part Equity part a) Please name what is abbreviated by "CC". 0 The management of a company uses a value-based controlling approach to decide on a project X which has the following cash-flow (forecast): Year 2 Cash-flow of project X -10.000,- +12.020,- The project's risk is estimated to exceed the risk of the market by 50%. The company has a tax rate of 25% and pays an interest rate of 4,000% p.a. for its debt. Market's riskless rate currently is 1,500% p.a. and market excess return is expected to be 6,000 % p.a. b) Please calculate the value (NPV, in ) of the project X which is financed by 100% debt. c) Please calculate the value? (NPV, in ) of the project L which is financed by 100% equity. As the (net present) value of project X is negative in case of lit. c) the state introduces an subsidy S [] on which payments in the years 1, 2, and 3 are based. Once the subsidy S is paid. In one of the years only 75% of the subsidy S, in another year even 125% of the subsidy S is paid. Year Cash-flow of project X (of it. d) +10.000.- +12.020.- d) Please amend the provided cash-flow by adding three subsidy S-based payments () into the provided table so that the value of the project X is maximised. e) Please calculate one of the three subsidy payments [] which lead to the (maximised) value of 180,-- of the project X. It is financed by 100% equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts