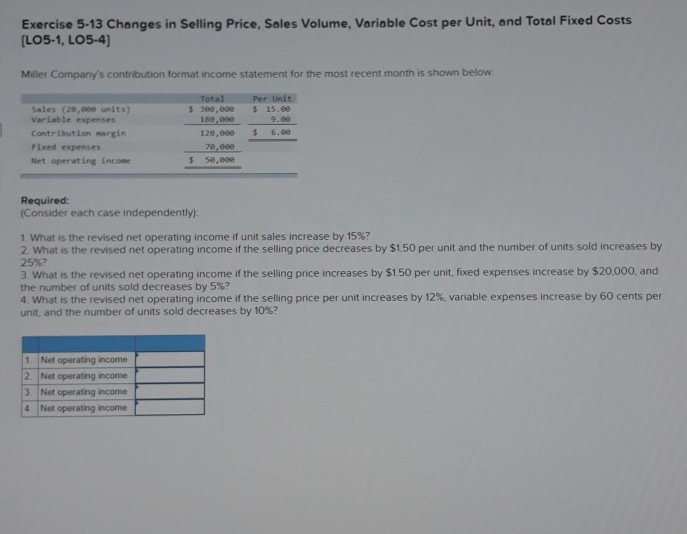

Question: Exercise 5-13 Changes in Selling Price, Soles Volume, Variable Cost per Unit, and Total Fixed Costs (LO5-1, LO5-4) Miller Company's contribution format income statement for

Exercise 5-13 Changes in Selling Price, Soles Volume, Variable Cost per Unit, and Total Fixed Costs (LO5-1, LO5-4) Miller Company's contribution format income statement for the most recent month is shown below Per Unit 15.00 9.00 Sales (20,000 units) Variable expenses Contribution margin Fixed expenses Net operating Income Total $ 300,000 180,000 120,000 70,000 $ 50,000 Required: (Consider each case independently): 1 What is the revised net operating income if unit sales increase by 15%? 2 What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 25%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $20.000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 12%, variable expenses increase by 60 cents per unit, and the number of units sold decreases by 10%? 1. Net operating income 2 Net operating income 3. Net operating income 4 Net operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts