Question: Exercise 5-26 (Algorithmic) (LO, 3) Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in

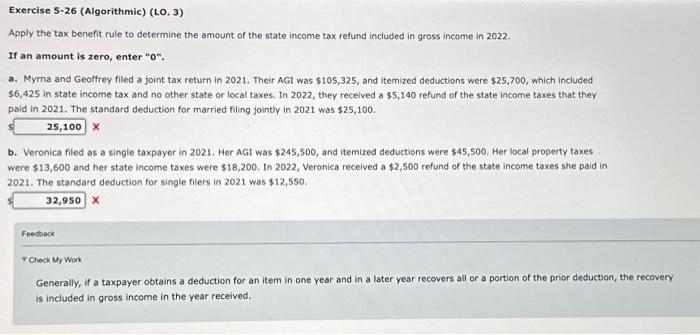

Exercise 5-26 (Algorithmic) (LO, 3) Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022. If an amount is zero, enter " 0 ". 9. Myrna and Geoffrey filed a joint tax return in 2021 . Their AGI was $105,325, and itemized deductions were $25,700, which included 56,425 in state income tax and no other state or local taxes. In 2022 , they received a $5,140 refund of the state income taxes that they paid in 2021. The standard deduction for married filing jointly in 2021 was $25,100. x . Veronica filed as a single taxpayer in 2021 . Her AGI was $245,500, and itemized deductions were $45,500. Her local property taxes vere $13,600 and her state income taxes were $18,200. In 2022 , Veronica received a $2,500 refund of the state income taxes she paid in 021 . The standard deduction for single flers in 2021 was $12,550, x Feechack r Check My Wor Generally, if a taxpayer obtains a deduction for an item in one year and in a later year recovers all or a portion of the prior deduction, the recovery is included in gross income in the year received. Exercise 5-26 (Algorithmic) (LO, 3) Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022. If an amount is zero, enter " 0 ". 9. Myrna and Geoffrey filed a joint tax return in 2021 . Their AGI was $105,325, and itemized deductions were $25,700, which included 56,425 in state income tax and no other state or local taxes. In 2022 , they received a $5,140 refund of the state income taxes that they paid in 2021. The standard deduction for married filing jointly in 2021 was $25,100. x . Veronica filed as a single taxpayer in 2021 . Her AGI was $245,500, and itemized deductions were $45,500. Her local property taxes vere $13,600 and her state income taxes were $18,200. In 2022 , Veronica received a $2,500 refund of the state income taxes she paid in 021 . The standard deduction for single flers in 2021 was $12,550, x Feechack r Check My Wor Generally, if a taxpayer obtains a deduction for an item in one year and in a later year recovers all or a portion of the prior deduction, the recovery is included in gross income in the year received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts