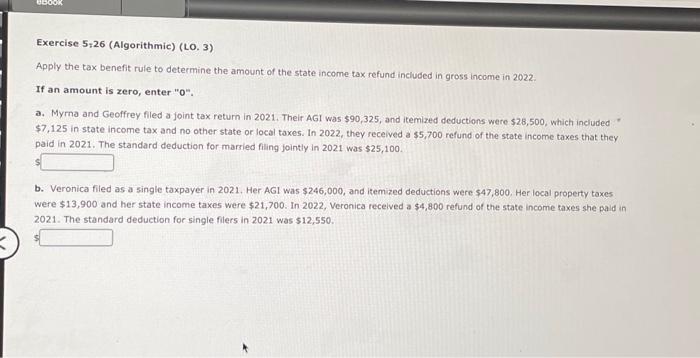

Question: Exercise 5:26 (Algorithmic) (LO. 3) Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in

Exercise 5:26 (Algorithmic) (LO. 3) Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022. If an amount is zero, enter " 0 ". a. Myrna and Geoffrey filed a joint tax return in 2021. Their AGI was $90,325, and itemized deductions were $28,500, which included $7,125 in state income tax and no other state or local taxes. In 2022, they received a $5,700 refund of the state income taxes that they paid in 2021. The standard deduction for marsied filing jointly in 2021 was $25,100. b. Veronica filed as a single taxpayer in 2021 . Her AGI was $246,000, and itemized deductions were $47,800. Her local property taxes were $13,900 and her state income taxes were $21,700. In 2022 , Veronica recelved a $4,800 refund of the state income taxes she paid in 2021. The standard deduction for single filers in 2021 was $12,550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts