Question: Exercise 6-15 Required: Using Exhibit 6A-5 as a guide, prepare an action analysis report for Interstate Trucking similar to those prepared for products. EXERCISE 6A-4

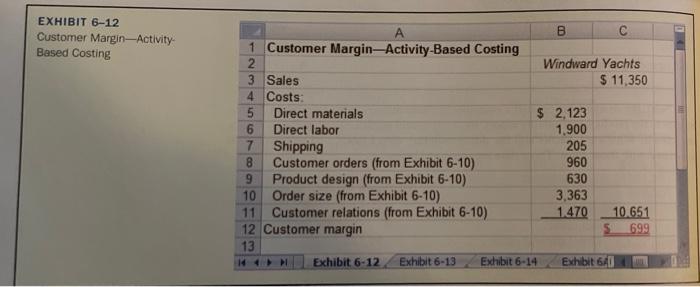

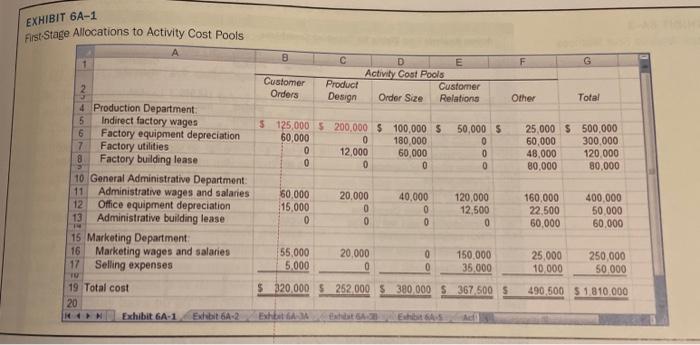

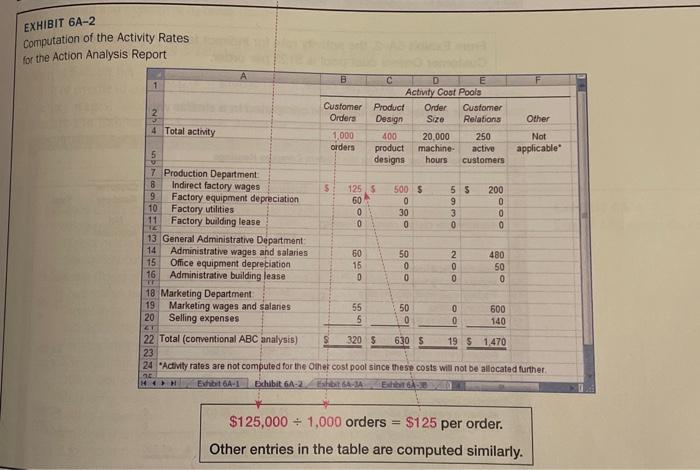

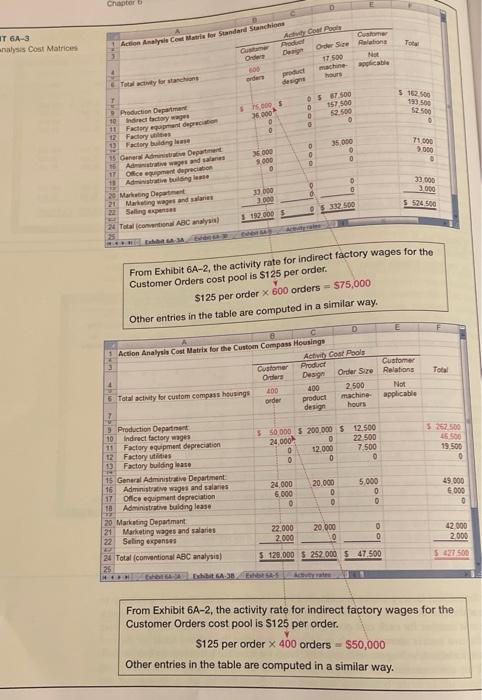

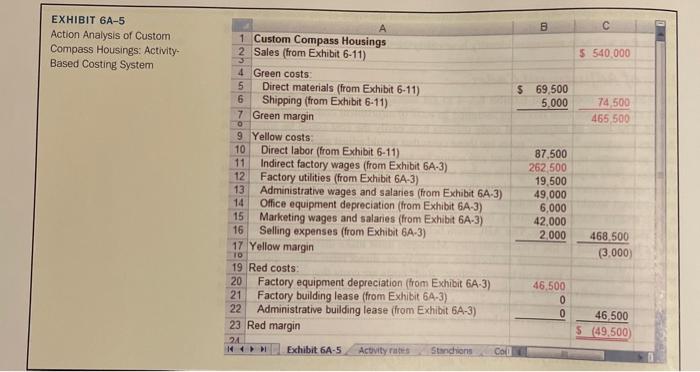

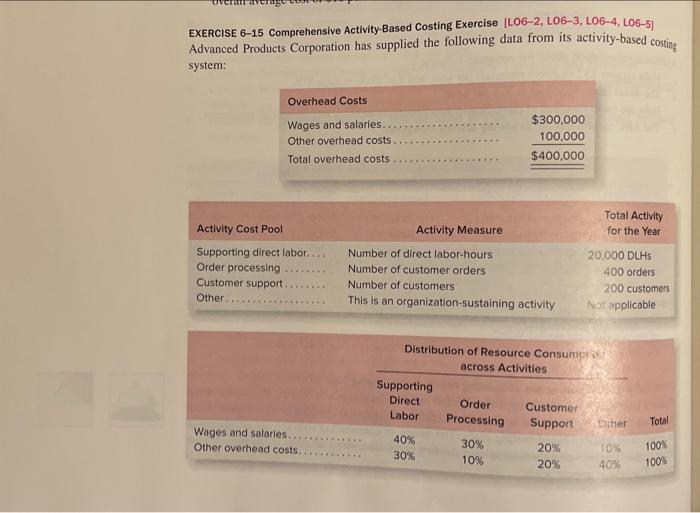

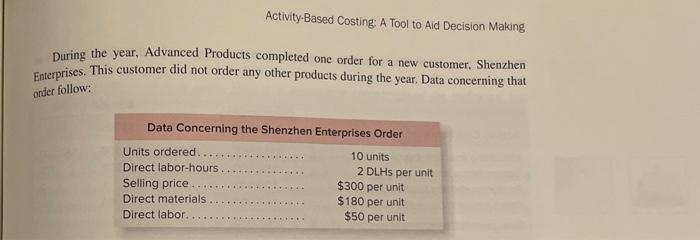

Required: Using Exhibit 6A-5 as a guide, prepare an action analysis report for Interstate Trucking similar to those prepared for products. EXERCISE 6A-4 Comprehensive Activity-Based Costing Exercise (L06-2. L06-3, L06-4, 106-6) Refer to the data for Advanced Products Corporation in Exercise 6-15. Required: 1. Using Exhibit 6A-1 as a guide, prepare a report showing the first-stage allocations of over head costs to the activity cost pools. 2. Using Exhibit 6A-2 as a guide, compute the activity rates for the activity cost pools. 3. Using Exhibit 6A-3 as a guide, prepare a report showing the overhead costs for the order from Shenzhen Enterprises including customer support costs. 4. Using Exhibit 6-12 as a guide, prepare a report showing the customer margin for Sherizhen Enterprises 5. Using Exhibit 6A-5 as a guide, prepare an action analysis report showing the customer mar- gin for Shenzhen Enterprises. Direct materials should be coded as a Green cost, direct labor and wages and salaries as Yellow costs, and other overhead costs as a Red cost. 6. What action, if any, do you recommend as a result of the above analyses? a EXHIBIT 6-12 Customer Margin-Activity Based Costing B 1 Customer Margin-Activity-Based Costing 2 Windward Yachts 3 Sales $ 11,350 4 Costs: 5 Direct materials $ 2,123 6 Direct labor 1.900 7 Shipping 205 8 Customer orders (from Exhibit 6-10) 960 9 Product design (from Exhibit 6-10) 630 10 Order size (from Exhibit 6-10) 3,363 11 Customer relations (from Exhibit 6-10) 1470 10.651 12 Customer margin 13 Exhibit 6-12 Exhibit 6-13 Exhibit 6-14 Exhibit 6.0 699 EXHIBIT 6A-1 First Stage Allocations to Activity Cost Pools A C F G Customer Orders Product Design D E Activity Cost Pools Customer Order Size Relations Other Tota! $ 125,000 $200,000 $100,000 $ 60,000 0 180,000 0 12.000 60,000 0 0 0 50,000 $ 0 0 0 25,000 $ 500,000 60,000 300.000 48.000 120.000 80,000 80,000 4 Production Department 5 Indirect factory wages G Factory equipment depreciation 7 Factory utilities 8 Factory building lease 10 General Administrative Department: 11 Administrative wages and salaries 12 Office equipment depreciation 13 Administrative building lease 15 Marketing Department 16 Marketing wages and salaries 17 Selling expenses TO 19 Total cost 20 Exhibit 6A-1 Exhibit 6A-2 60,000 15.000 0 20.000 0 0 40,000 0 0 120,000 12,500 0 160,000 22.500 60,000 400.000 50,000 60.000 55,000 5.000 20,000 0 0 0 150.000 35.000 25,000 10 000 250,000 50.000 $ 320,000 5 252,000 $380 000 S 367,500 5 490 500 51810.000 INN Ex- Exhibit AS A EXHIBIT 6A-2 Computation of the Activity Rates for the Action Analysis Report Order Size -- mo ca. B D E F 1 Activity Cost Pools Customer Product Customer Orders Design Relations Other 4 Total activity 1,000 400 20,000 250 Not orders product machine active applicable 5 designs hours customers 7 Production Department 8 Indirect factory wages 5 125 5 500 $ 5 $ 200 9 Factory equipment depreciation 60 0 9 0 10 Factory utilities 0 30 3 0 11 Factory building lease 0 12 13 General Administrative Department 14 Administrative wages and salaries 60 50 2 480 15 Office equipment depreciation 15 0 50 16 Administrative building lease 0 0 0 18 Marketing Department 19 Marketing wages and salanes 55 50 600 20 Selling expenses 5 0 0 140 22 Total (conventional ABC analysis) 320 $ 630 S 19 $ 1.470 23 24 Activity rates are not computed for the other cost pool since these costs will not be allocated further 20 MH Exhibit A-1 Echibit 6A-2 ETARIA EGA ood OON 0 in $125,000 + 1,000 orders $125 per order. Other entries in the table are computed similarly. Chapter D Customer IT 6A-3 analysis Cost Matrices Acron Ana Carrie der Standard Stand Total G O Ae Care Pedia Day 17 500 pro designs O Sirene Net licable Ti Hy ly stantiati 5000 O5T 500 157.500 12.500 10250 193.500 52 500 36.000 35 000 T1000 3.000 6.000 000 0 15 Production Department Indirect biayage 11 Factory and precio Factory Factory buildinglese Ganer Ade Department Adres and sales Office depreciation Admitetullesse 20 Marketing Department 21 Manages and sanes Selling en 24 Total con ABC analy) D 0 o 000 3000 1192.000 33.000 2009 5 $24.500 22 22.500 Y From Exhibit 6A-2, the activity rate for indirect factory wages for the Customer Orders cost pool is $125 per order. $125 per order x 600 orders S75,000 Other entries in the table are computed in a similar way. Total 5 25.500 16500 19.500 D Action Analysis Cost Matrix for the Custom Compass Housing A Cool Pools Customer Product Customer O Design Order Size Relations 100 400 3 Total activity for custom compass housings Not 2.500 order product machine applicable design hours Production Department 10 Indirect factory wages 550.000 200.000 $12.500 11 Factory equipment depreciation 24.000 22 500 12 Factory was 0 12.000 7.500 Factory building was 0 0 15 General Administre Department 16 Administratie wages and sales 24 000 20.000 5,000 17 Ofice equipment depreciation 6 000 0 0 ta Administrative building lease 0 20 Marketing Department 21 Marketing wages and salaries 22.000 20.000 0 22 Seling expenses 2.000 24 Total conventional ABC analysis) $ 120.000 $ 252 000 $ 47,500 25 HOTEL A30 49.000 6000 0 Q 42.000 2000 SEXT500 From Exhibit 6A-2, the activity rate for indirect factory wages for the Customer Orders cost pool is $125 per order. $125 per order x 400 orders - $50,000 Other entries in the table are computed in a similar way. EXHIBIT 6A-5 Action Analysis of Custom Compass Housings: Activity Based Costing System 5 540 000 74,500 465 500 0 B 1 Custom Compass Housings 2 Sales (from Exhibit 6-11) 4 Green costs 5 Direct materials (from Exhibit 6-11) $ 69,500 6 Shipping (from Exhibit 6-11) 5.000 7 Green margin 9 Yellow costs 10 Direct labor (from Exhibit 6-11) 87,500 11 Indirect factory wages (from Exhibit 6A-3) 262 500 12 Factory utilities (from Exhibit 6A-3) 19.500 13 Administrative wages and salaries (from Exhibit 6A-3) 49,000 14 Office equipment depreciation (from Exhibit 6A-3) 6,000 15 Marketing wages and salaries (from Exhibit 6A-3) 42.000 16 Selling expenses (from Exhibit 6A-3) 2.000 17 Yellow margin 10 19 Red costs 20 Factory equipment depreciation (from Exhibit 6A-3) 46.500 21 Factory building lease (from Exhibit 6A-3) 0 22 Administrative building lease (from Exhibit 6A-3) 0 23 Red margin 24 Exhibit 6A-5 Activity is Stacions Cold 468,500 (3.000) 46,500 5 (49,500 EXERCISE 6-15 Comprehensive Activity-Based Costing Exercise (L06-2, L06-3, L06-4, L06-5) Advanced Products Corporation has supplied the following data from its activity-based costing system: Overhead Costs Wages and salaries.. Other overhead costs Total overhead costs $300,000 100,000 $400,000 Total Activity for the Year Activity Measure Activity Cost Pool Supporting direct labor.... Order processing Customer support.. Other.. Number of direct labor-hours Number of customer orders Number of customers This is an organization-sustaining activity 20.000 DLHS 400 orders 200 customers Not applicable Distribution of Resource Consump across Activities Supporting Direct Order Customer Labor Processing Support 40% 30% 20% 30% 10% 20% ther Total Wages and salaries Other overhead costs 10% 40% 100% 100% Activity-Based Costing: A Tool to Aid Decision Making During the year, Advanced Products completed one order for a new customer, Shenzhen Enterprises. This customer did not order any other products during the year. Data concerning that order follow: Data Concerning the Shenzhen Enterprises Order Units ordered Direct labor-hours Selling price Direct materials Direct labor. 10 units 2 DLHS per unit $300 per unit $180 per unit $50 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts