Question: Exercise 6-33 (Algorithmic) (LO. 4) On January 7, 2022, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction

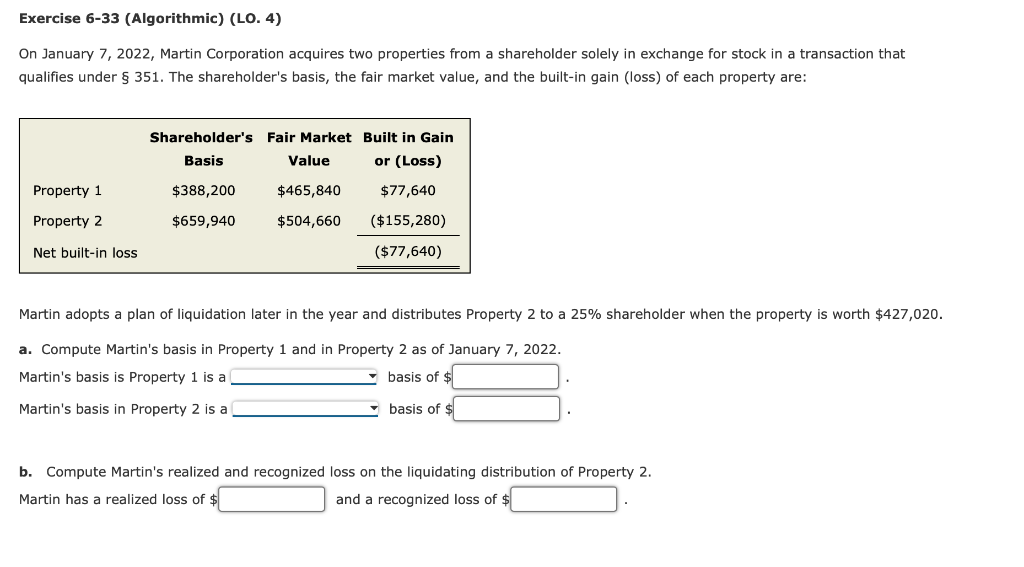

Exercise 6-33 (Algorithmic) (LO. 4) On January 7, 2022, Martin Corporation acquires two properties from a shareholder solely in exchange for stock in a transaction that qualifies under 351. The shareholder's basis, the fair market value, and the built-in gain (loss) of each property are: Martin adopts a plan of liquidation later in the year and distributes Property 2 to a 25% shareholder when the property is worth $427,020. a. Compute Martin's basis in Property 1 and in Property 2 as of January 7, 2022. Martin's basis is Property 1 is a basis of $ Martin's basis in Property 2 is a basis of $ b. Compute Martin's realized and recognized loss on the liquidating distribution of Property 2. Martin has a realized loss of and a recognized loss of $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts