Question: Exercise 7 - 2 5 Manufacturing; Using CVP Analysis ( LO 7 - 1 , 7 - 4 ) Rosario Company, which is located in

Exercise Manufacturing; Using CVP Analysis LO

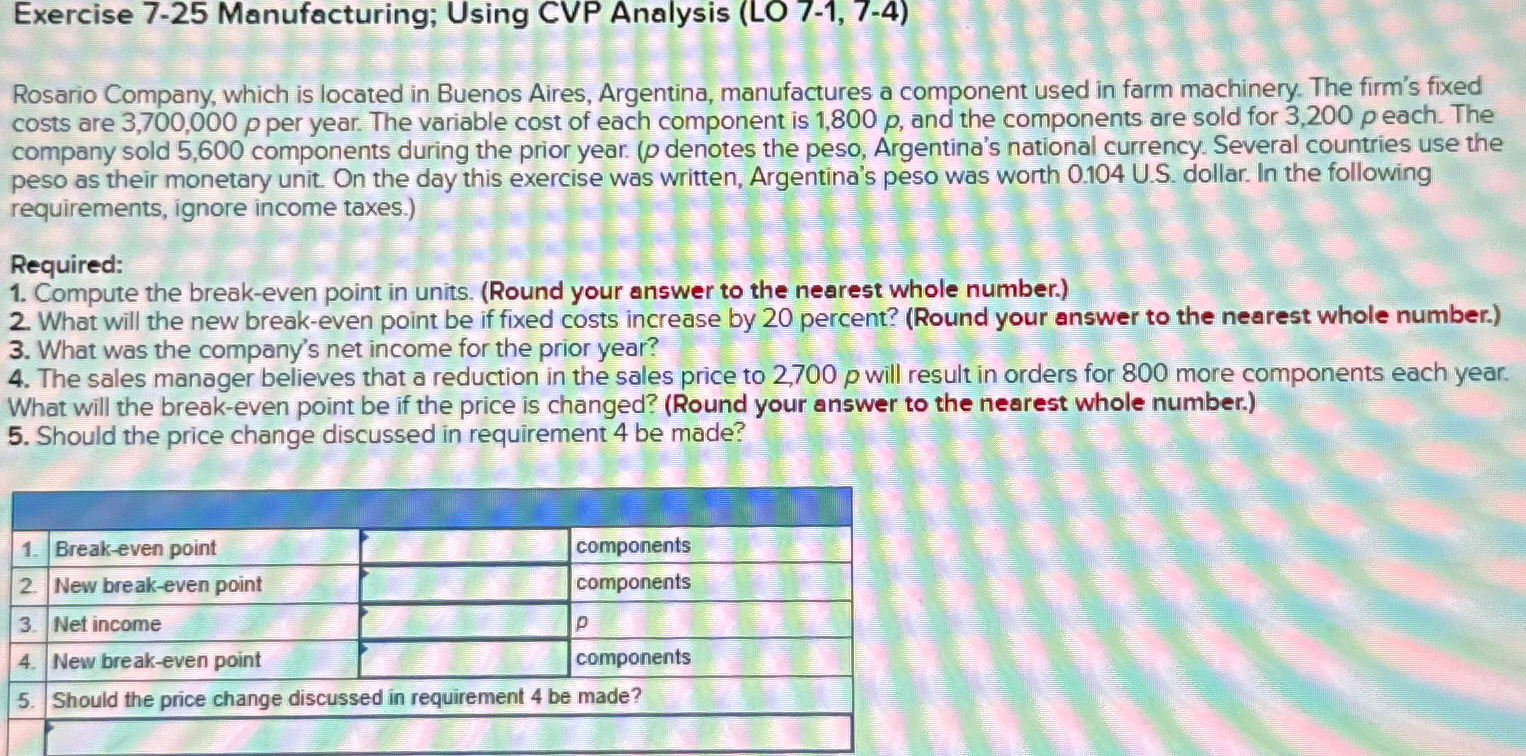

Rosario Company, which is located in Buenos Aires, Argentina, manufactures a component used in farm machinery. The firm's fixed costs are per year. The variable cost of each component is and the components are sold for each. The company sold components during the prior year. denotes the peso, Argentina's national currency. Several countries use the peso as their monetary unit. On the day this exercise was written, Argentina's peso was worth US dollar. In the following requirements, ignore income taxes.

Required:

Compute the breakeven point in units. Round your answer to the nearest whole number.

What will the new breakeven point be if fixed costs increase by percent? Round your answer to the nearest whole number.

What was the company's net income for the prior year?

The sales manager believes that a reduction in the sales price to will result in orders for more components each year. What will the breakeven point be if the price is changed? Round your answer to the nearest whole number.

Should the price change discussed in requirement be made?

tableBreakeven point,componentsNew breakeven point,componentsNet income,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock