Question: Exercise 7 - Financial Analysis Use the financial statements in Chapter 6 of the Zietlow textbook for the Sacred Heart Community Service to complete the

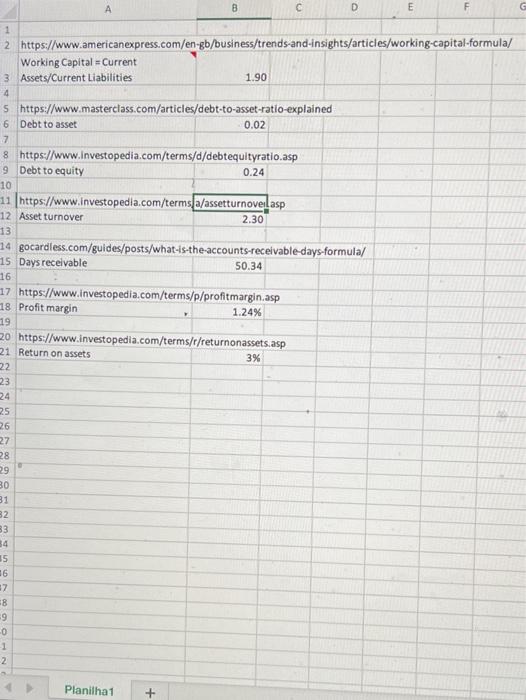

Exercise 7 - Financial Analysis Use the financial statements in Chapter 6 of the Zietlow textbook for the Sacred Heart Community Service to complete the following questions: 1. Complete the following ratios in Excel for FY 14: current, working capital, quick, debt-to-asset, debt-to-equity, asset-turnover, days-receivable, profit margin, return-on-assets, common size, and contributions. For each, write a sentence reporting the results and briefly describing what it means. 2. Write 2-3 paragraphs in Word that explains the financial condition of the nonprofit organization, including any "red flags" that you identify Your submission will be graded as a ythole according to the grading scale found in the syllabus, NOTE: All submitted assignments MUST include the Excel calculations, the answer summaries, and the summary paragraphs A c D m F G 1 2 https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/working-capital-formula/ Working Capital - Current 3 Assets/Current Liabilities 1.90 4 5 https://www.masterclass.com/articles/debt-to-asset-ratio-explained 6 Debt to asset 0.02 7 8 https://www.investopedia.com/terms/d/debtequityratio.asp 9 Debt to equity 0.24 10 11 https://www.investopedia.com/terms a/assetturnovelasp 12 Asset turnover 2.30 13 14 gocardless.com/guides/posts/what-is-the-accounts-receivable-days-formula/ 15 Days receivable 50.34 16 17 https://www.investopedia.com/terms/p/profitmargin.asp 18 Profit margin 1.24% 19 20 https://www.investopedia.com/terms/t/returnonassets.asp 21 Return on assets 3% 22 23 24 25 26 27 28 29 30 31 32 33 34 15 16 97 8 -9 -0 1 2 Planilha1 + Exercise 7 - Financial Analysis Use the financial statements in Chapter 6 of the Zietlow textbook for the Sacred Heart Community Service to complete the following questions: 1. Complete the following ratios in Excel for FY 14: current, working capital, quick, debt-to-asset, debt-to-equity, asset-turnover, days-receivable, profit margin, return-on-assets, common size, and contributions. For each, write a sentence reporting the results and briefly describing what it means. 2. Write 2-3 paragraphs in Word that explains the financial condition of the nonprofit organization, including any "red flags" that you identify Your submission will be graded as a ythole according to the grading scale found in the syllabus, NOTE: All submitted assignments MUST include the Excel calculations, the answer summaries, and the summary paragraphs A c D m F G 1 2 https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/working-capital-formula/ Working Capital - Current 3 Assets/Current Liabilities 1.90 4 5 https://www.masterclass.com/articles/debt-to-asset-ratio-explained 6 Debt to asset 0.02 7 8 https://www.investopedia.com/terms/d/debtequityratio.asp 9 Debt to equity 0.24 10 11 https://www.investopedia.com/terms a/assetturnovelasp 12 Asset turnover 2.30 13 14 gocardless.com/guides/posts/what-is-the-accounts-receivable-days-formula/ 15 Days receivable 50.34 16 17 https://www.investopedia.com/terms/p/profitmargin.asp 18 Profit margin 1.24% 19 20 https://www.investopedia.com/terms/t/returnonassets.asp 21 Return on assets 3% 22 23 24 25 26 27 28 29 30 31 32 33 34 15 16 97 8 -9 -0 1 2 Planilha1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts