Question: Exercise 7. The market consensus is that Advanced Micro Devices (AMD) has an ROE = 9%, a beta of 1.25, and plans to maintain indefinitely

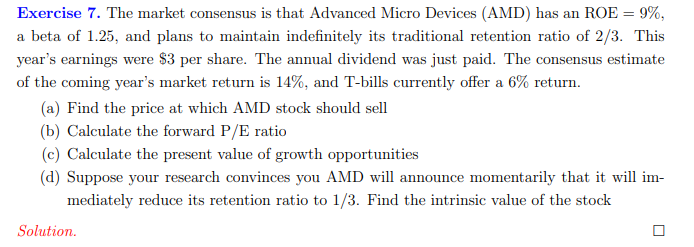

Exercise 7. The market consensus is that Advanced Micro Devices (AMD) has an ROE = 9%, a beta of 1.25, and plans to maintain indefinitely its traditional retention ratio of 2/3. This year's earnings were $3 per share. The annual dividend was just paid. The consensus estimate of the coming year's market return is 14%, and T-bills currently offer a 6% return. (a) Find the price at which AMD stock should sell (b) Calculate the forward P/E ratio (c) Calculate the present value of growth opportunities (d) Suppose your research convinces you AMD will announce momentarily that it will im- mediately reduce its retention ratio to 1/3. Find the intrinsic value of the stock Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts