Question: Exercise 7-06 Presented below is information from Tamarisk Computers Incorporated. July 1 10 17 30 Sold $18,000 of computers to Robertson Company with terms 3/15,

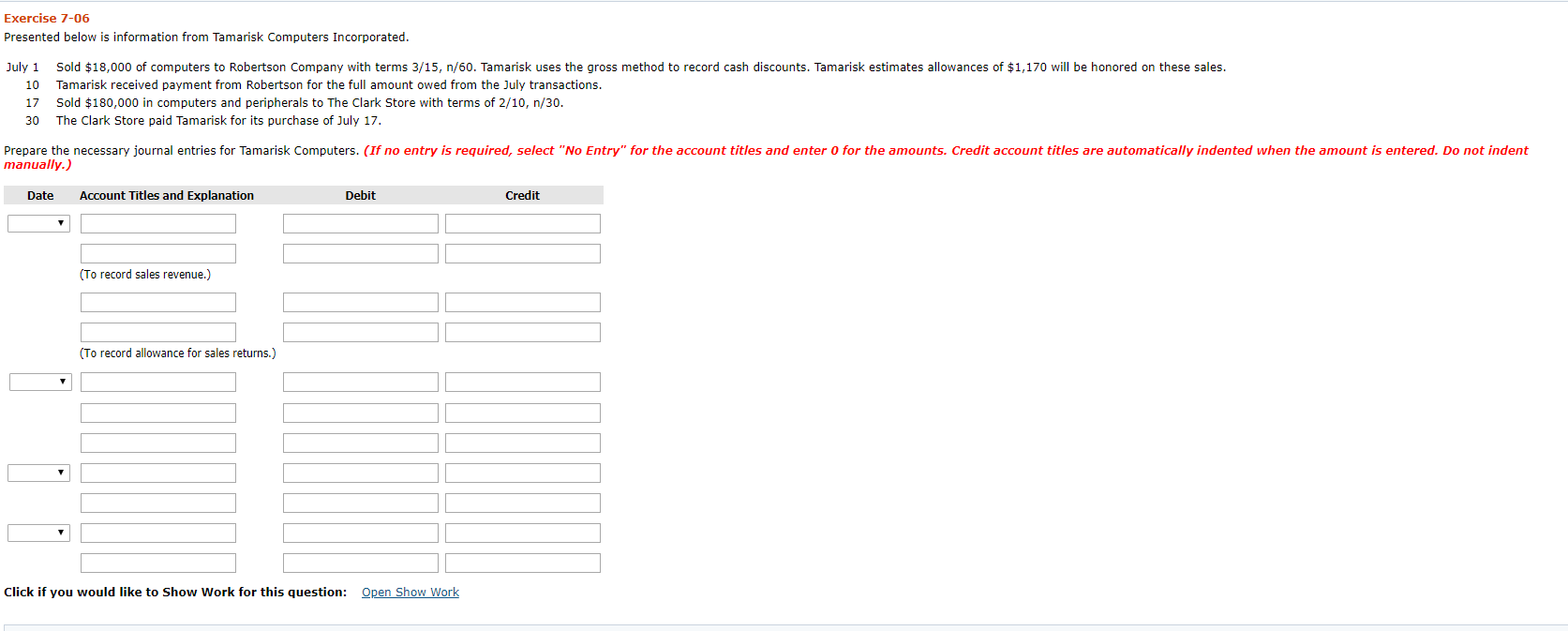

Exercise 7-06 Presented below is information from Tamarisk Computers Incorporated. July 1 10 17 30 Sold $18,000 of computers to Robertson Company with terms 3/15, n/60. Tamarisk uses the gross method to record cash discounts. Tamarisk estimates allowances of $1,170 will be honored on these sales. Tamarisk received payment from Robertson for the full amount owed from the July transactions. Sold $180,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30. The Clark Store paid Tamarisk for its purchase of July 17. Prepare the necessary journal entries for Tamarisk Computers. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit (To record sales revenue.) (To record allowance for sales returns.) Click if you would like to show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts