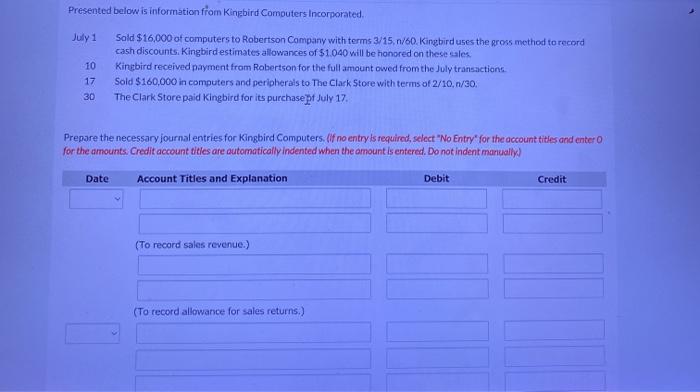

Question: Presented below is information from Kingbird Computers Incorporated, July 1 10 17 30 Sold $16,000 of computers to Robertson Company with terms 3/15./60. Kingbird uses

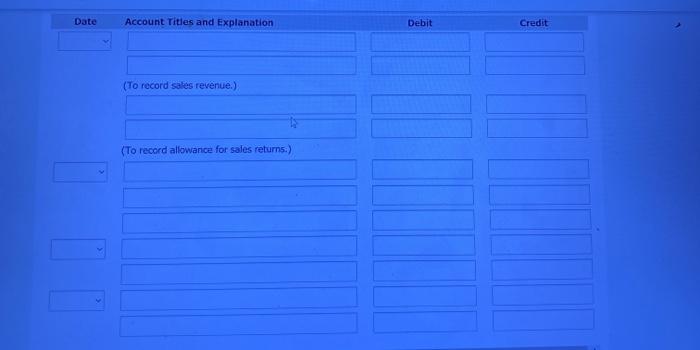

Presented below is information from Kingbird Computers Incorporated, July 1 10 17 30 Sold $16,000 of computers to Robertson Company with terms 3/15./60. Kingbird uses the gross method to record cash discounts, Kingbird estimates allowances of $1.040 will be honored on these sales Kingbird received payment from Robertson for the full amount owed from the July transactions Sold $160,000 in computers and peripherals to The Clark Store with terms of 2/10,n/30. The Clark Store paid Kingbird for its purchase pr July 17. Prepare the necessary Journal entries for Kingbird Computers. If no entry is required, select "No Entry for the account titles and entero for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Credit Debit (To record sales revenue.) (To record allowance for sales returns.) Date Account Titles and Explanation Debit Credit (To record sales revenue.) (To record allowance for sales returns.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts