Question: = Exercise 7.1 Consider the standard Black-Scholes model and a T-claim X of the form X = O(S(T)). Denote the corresponding arbitrage free price process

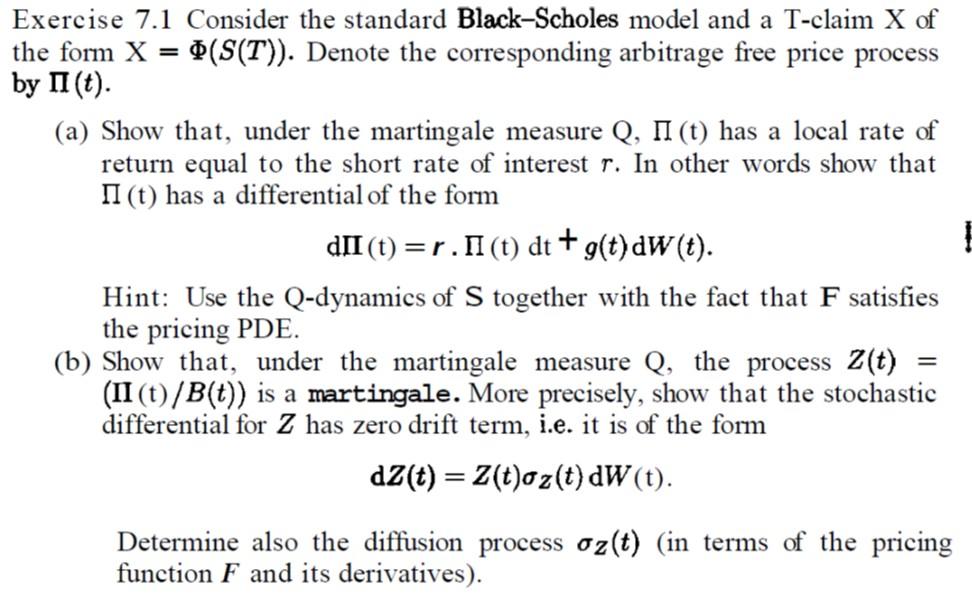

= Exercise 7.1 Consider the standard Black-Scholes model and a T-claim X of the form X = O(S(T)). Denote the corresponding arbitrage free price process by II(t). (a) Show that, under the martingale measure Q, II (t) has a local rate of return equal to the short rate of interest r. In other words show that II (t) has a differential of the form dII (t)=r. II (t) dt + g(t)dW(t). Hint: Use the Q-dynamics of S together with the fact that F satisfies the pricing PDE. (b) Show that, under the martingale measure Q, the process Z(t) (II (t)/B(t)) is a martingale. More precisely, show that the stochastic differential for Z has zero drift term, i.e. it is of the form dz(t) = 2(t)oz(t) dW(t). r. Determine also the diffusion process oz(t) (in terms of the pricing function F and its derivatives). = Exercise 7.1 Consider the standard Black-Scholes model and a T-claim X of the form X = O(S(T)). Denote the corresponding arbitrage free price process by II(t). (a) Show that, under the martingale measure Q, II (t) has a local rate of return equal to the short rate of interest r. In other words show that II (t) has a differential of the form dII (t)=r. II (t) dt + g(t)dW(t). Hint: Use the Q-dynamics of S together with the fact that F satisfies the pricing PDE. (b) Show that, under the martingale measure Q, the process Z(t) (II (t)/B(t)) is a martingale. More precisely, show that the stochastic differential for Z has zero drift term, i.e. it is of the form dz(t) = 2(t)oz(t) dW(t). r. Determine also the diffusion process oz(t) (in terms of the pricing function F and its derivatives)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts