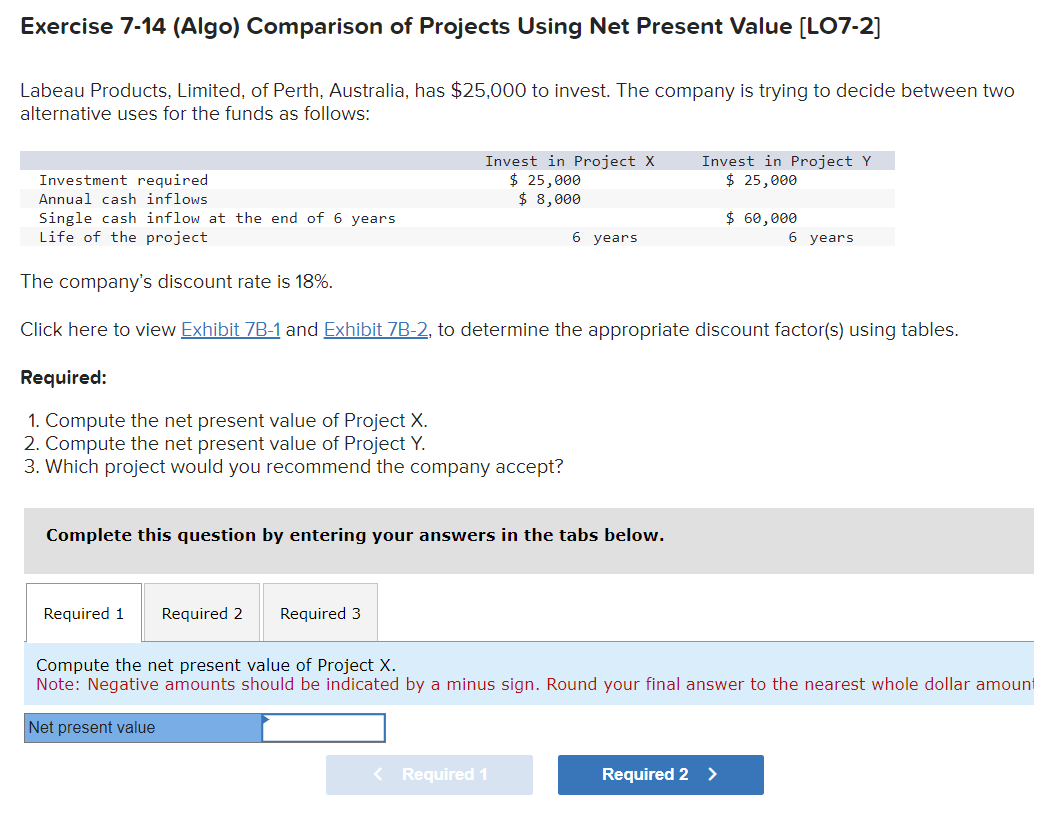

Question: Exercise 7-14 (Algo) Comparison of Projects Using Net Present Value [LO7-2] Labeau Products, Limited, of Perth, Australia, has $25,000 to invest. The company is trying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts