Question: Exercise 7-27 (Algorithmic) (LO. 6) Tim, a single taxpayer, operates a business as a single-member LLC. In 2020, his LLC reports business income of $380,500

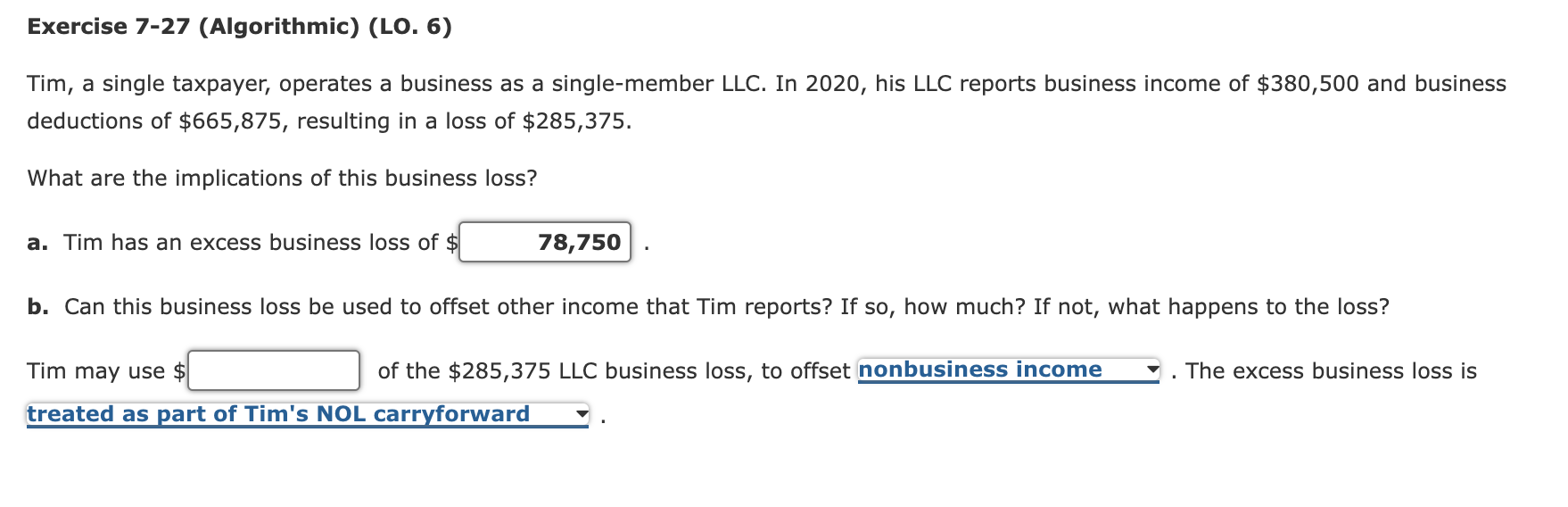

Exercise 7-27 (Algorithmic) (LO. 6) Tim, a single taxpayer, operates a business as a single-member LLC. In 2020, his LLC reports business income of $380,500 and business deductions of $665,875, resulting in a loss of $285,375. What are the implications of this business loss? a. Tim has an excess business loss of $ 78,750 b. Can this business loss be used to offset other income that Tim reports? If so, how much? If not, what happens to the loss? The excess business loss is Tim may use of the $285,375 LLC business loss, to offset nonbusiness income treated as part of Tim's NOL carryforward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts