Question: File Edit View History Bookmarks Tools Help X M Inbox - eta123958@gmail.com - x CengageNOWv2 Registration In X CengageNOWv2 | Online teachi X + O

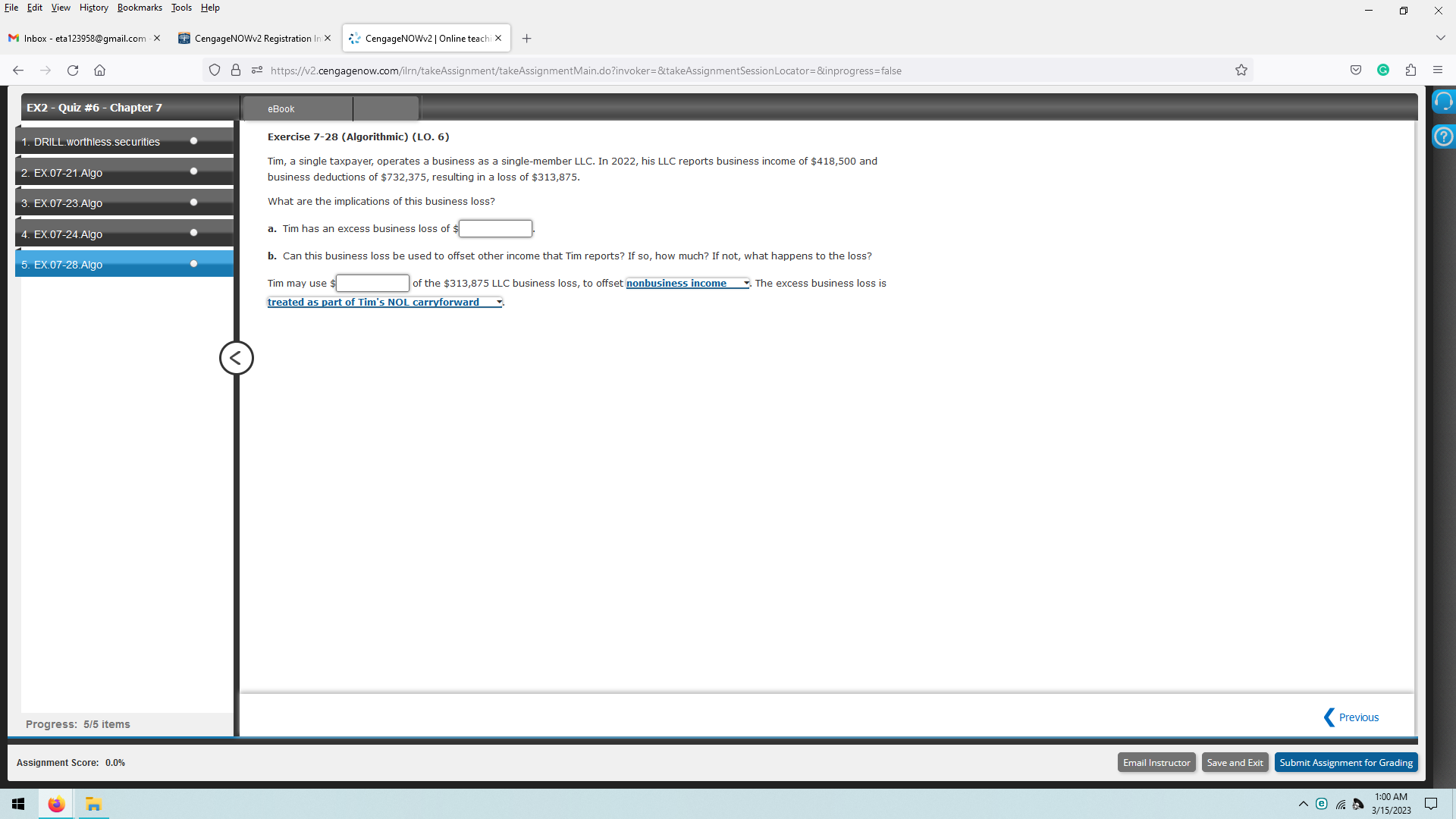

File Edit View History Bookmarks Tools Help X M Inbox - eta123958@gmail.com - x CengageNOWv2 Registration In X CengageNOWv2 | Online teachi X + O 8 . https://v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false G S E EX2 - Quiz #6 - Chapter 7 eBook 1. DRILL.worthless.securities Exercise 7-28 (Algorithmic) (LO. 6) Tim, a single taxpayer, operates a business as a single-member LLC. In 2022, his LLC reports business income of $418,500 and 2. EX.07-21.Algo business deductions of $732,375, resulting in a loss of $313,875. 3. EX.07-23.Algo What are the implications of this business loss? 4. EX.07-24.Algo a. Tim has an excess business loss of $ b. Can this business loss be used to offset other income that Tim reports? If so, how much? If not, what happens to the loss? 5. EX.07-28.Algo Tim may use $ of the $313,875 LLC business loss, to offset nonbusiness income . The excess business loss is treated as part of Tim's NOL carryforward Progress: 5/5 items Previous Assignment Score: 0.0% Email Instructor Save and Exit Submit Assignment for Grading 1:00 AM 3/15/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts