Question: Exercise 7-29 Prorate Under- or Overapplied Overhead (LO 7- 3) Southern Rim Parts estimates its manufacturing overhead to be $380,000 and its direct labor

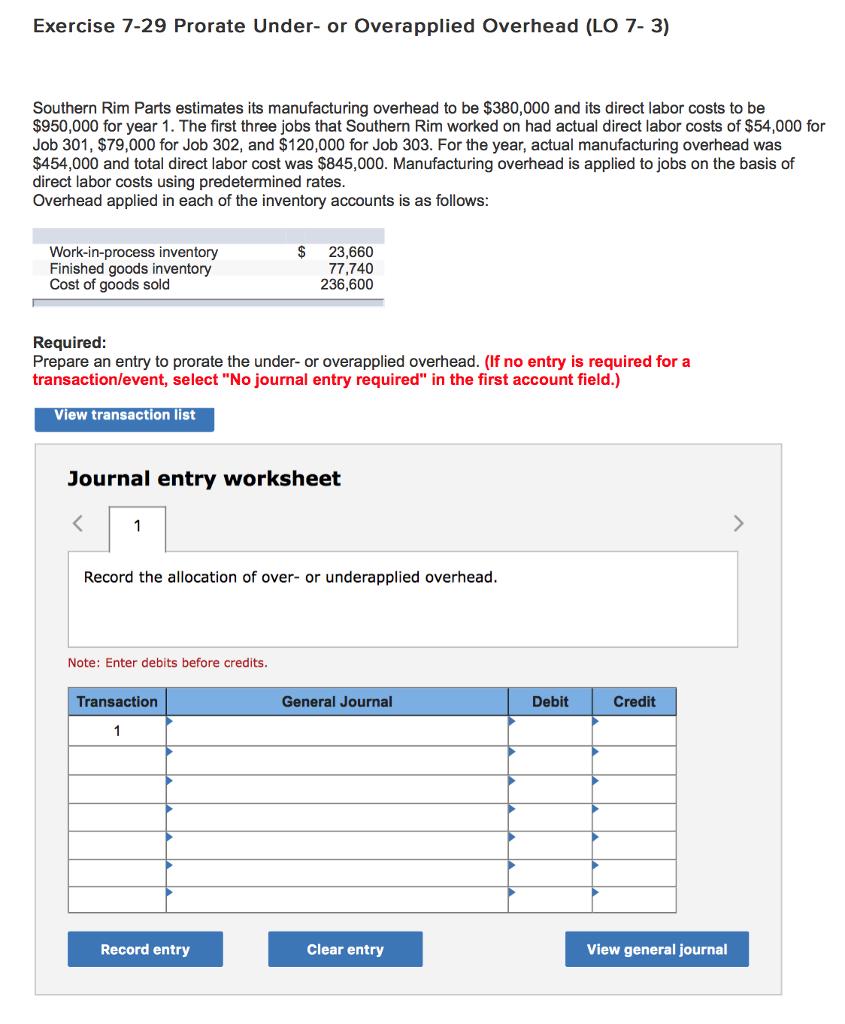

Exercise 7-29 Prorate Under- or Overapplied Overhead (LO 7- 3) Southern Rim Parts estimates its manufacturing overhead to be $380,000 and its direct labor costs to be $950,000 for year 1. The first three jobs that Southern Rim worked on had actual direct labor costs of $54,000 for Job 301, $79,000 for Job 302, and $120,000 for Job 303. For the year, actual manufacturing overhead was $454,000 and total direct labor cost was $845,000. Manufacturing overhead is applied to jobs on the basis of direct labor costs using predetermined rates. Overhead applied in each of the inventory accounts is as follows: Work-in-process inventory Finished goods inventory Cost of goods sold View transaction list Required: Prepare an entry to prorate the under- or overapplied overhead. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) < 1 Journal entry worksheet $ Note: Enter debits before credits. 23,660 77,740 236,600 Record the allocation of over- or underapplied overhead. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journal

Step by Step Solution

3.61 Rating (155 Votes )

There are 3 Steps involved in it

1 JOURNAL ENTRY Account Title Explanation Manufacturing Overheads Applied WIP Finished Goods Cost of ... View full answer

Get step-by-step solutions from verified subject matter experts