Question: Exercise 7-31 (Algorithmic) (LO. 7) Emily, who is single, sustains an NOL of $13,720 in 2019. The loss is carried forward to 2020. For 2020,

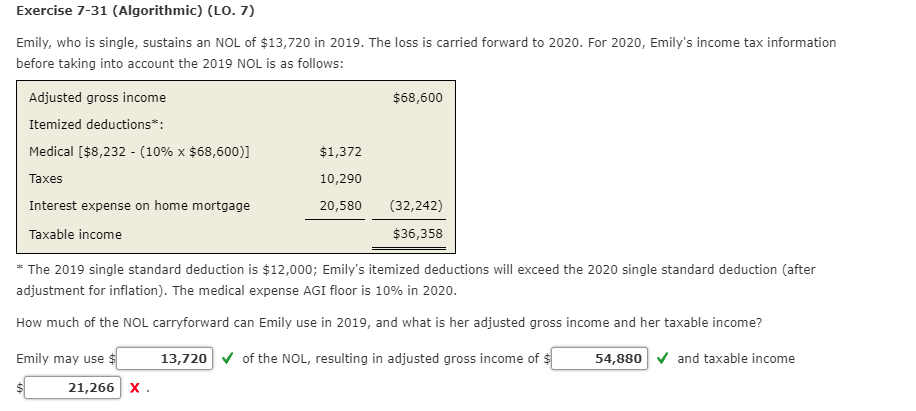

Exercise 7-31 (Algorithmic) (LO. 7) Emily, who is single, sustains an NOL of $13,720 in 2019. The loss is carried forward to 2020. For 2020, Emily's income tax information before taking into account the 2019 NOL is as follows: Adjusted gross income $68,600 Itemized deductions*: Medical ($8,232 - (10% x $68,600)] $1,372 Taxes 10,290 20,580 Interest expense on home mortgage Taxable income (32,242) $36,358 * The 2019 single standard deduction is $12,000; Emily's itemized deductions will exceed the 2020 single standard deduction (after adjustment for inflation). The medical expense AGI floor is 10% in 2020. How much of the NOL carryforward can Emily use in 2019, and what is her adjusted gross income and her taxable income? Emily may use $ 13,720 of the NOL, resulting in adjusted gross income of $ 54,880 and taxable income 21,266 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts