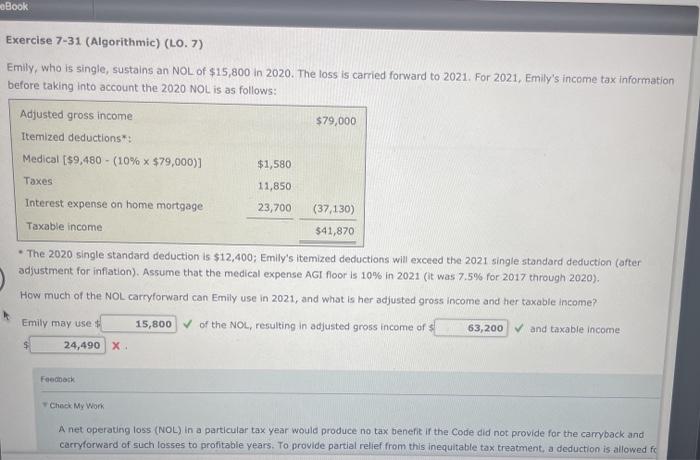

Question: Book Exercise 7-31 (Algorithmic) (LO. 7) Emily, who is single, sustains an NOL of $15,800 in 2020. The loss is carried forward to 2021. For

Book Exercise 7-31 (Algorithmic) (LO. 7) Emily, who is single, sustains an NOL of $15,800 in 2020. The loss is carried forward to 2021. For 2021, Emily's income tax information before taking into account the 2020 NOL is as follows: Adjusted gross income $79,000 Itemized deductions Medical ($9,480 - (10% x $79,000)] $1,580 Taxes 11,850 Interest expense on home mortgage 23,700 (37,130) Taxable income $41,870 The 2020 single standard deduction is $12,400; Emily's itemized deductions will exceed the 2021 single standard deduction (after adjustment for inflation). Assume that the medical expense AGI floor is 10% in 2021 (it was 7.5% for 2017 through 2020). How much of the NOL carryforward can Emily use in 2021, and what is her adjusted gross income and her taxable income? Emily may use 15,800 of the NOL, resulting in adjusted gross income of 63,200 and taxable income 24,490 X Feedback Check My Work A net operating loss (NOL) in a particular tax year would produce no tax benefit in the Code did not provide for the carryback and carryforward of such losses to profitable years. To provide partial relief from this inequitable tax treatment, a deduction is allowed fc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts