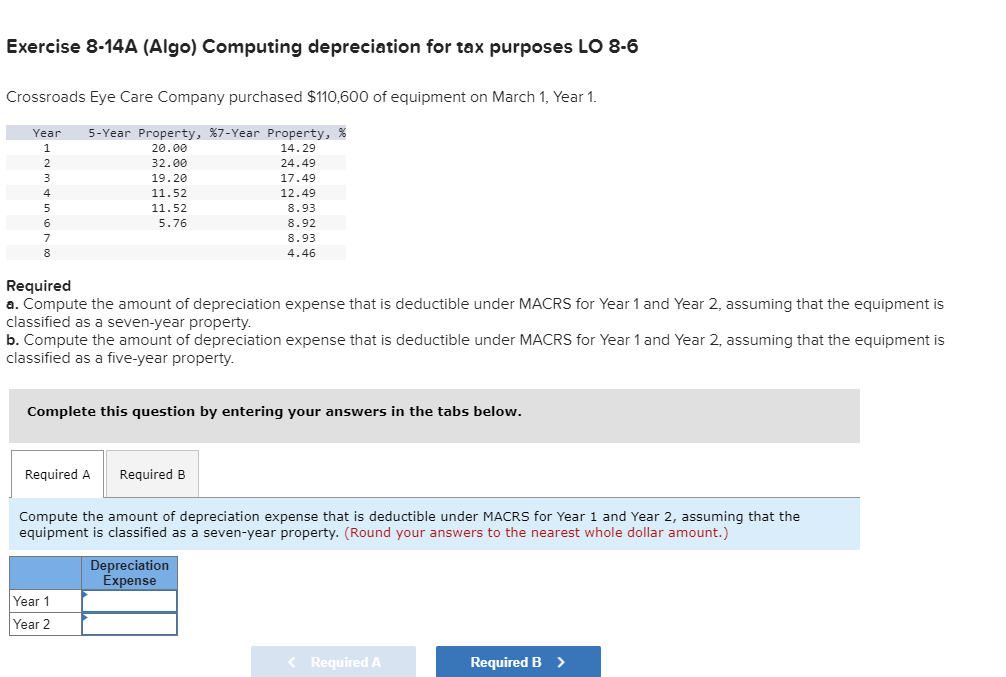

Question: Exercise 8 - 1 4 A ( Algo ) Computing depreciation for tax purposes LO 8 - 6 Crossroads Eye Care Company purchased $ 1

Exercise A Algo Computing depreciation for tax purposes LO

Crossroads Eye Care Company purchased $ of equipment on March Year

Required

a Compute the amount of depreciation expense that is deductible under MACRS for Year and Year assuming that the equipment is

classified as a sevenyear property.

b Compute the amount of depreciation expense that is deductible under MACRS for Year and Year assuming that the equipment is

classified as a fiveyear property.

Complete this question by entering your answers in the tabs below.

Required

Compute the amount of depreciation expense that is deductible under MACRS for Year and Year assuming that the

equipment is classified as a sevenyear property. Round your answers to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock