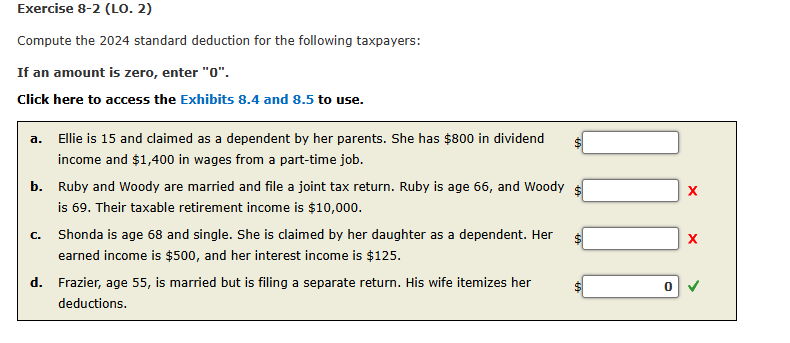

Question: Exercise 8 - 2 ( LO . 2 ) Compute the 2 0 2 4 standard deduction for the following taxpayers: If an amount is

Exercise LO Compute the standard deduction for the following taxpayers: If an amount is zero, enter Click here to access the Exhibits and to use. a Ellie is and claimed as a dependent by her parents. She has $ in dividend income and $ in wages from a parttime job. b Ruby and Woody are married and file a joint tax return. Ruby is age and Woody is Their taxable retirement income is $ c Shonda is age and single. She is claimed by her daughter as a dependent. Her earned income is $ and her interest income is $ d Frazier, age is married but is filing a separate return. His wife itemizes her deductions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock