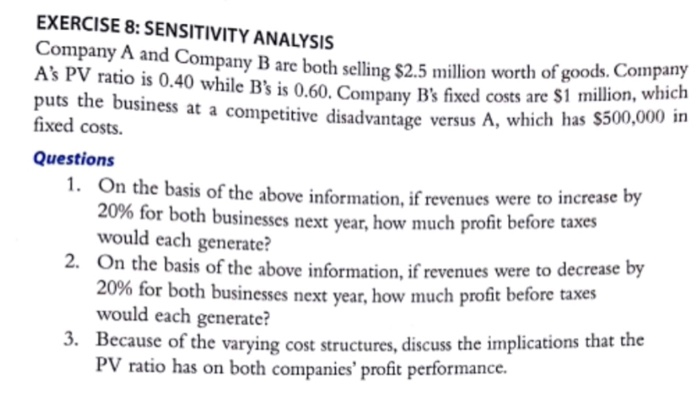

Question: EXERCISE 8: SENSITIVITY ANALYSIS Company A and Compa As PV ratio is 0.40 while B's is 0.60. Company B's fixed costs are $1 million, whic

EXERCISE 8: SENSITIVITY ANALYSIS Company A and Compa As PV ratio is 0.40 while B's is 0.60. Company B's fixed costs are $1 million, whic puts the business at a competitive disadvantage versus A, which has S5 fixed costs ny B are both selling $2.5illorth of goods. Company 00,000 in Questions 1. On the basis of the above information, if revenues were to increase by 20% for both businesse would each generate? On the basis of the above information, if revenues were to decrease by s next year, how much profit before taxes 2. 20% f would each generate? or both businesses next year, how much profit before taxes . Because of the varying cost structures, discuss the implications that the PV ratio has on both companies' profit performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts