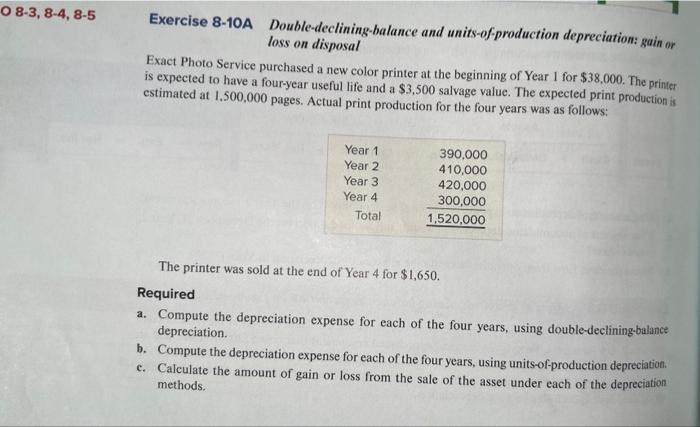

Question: Exercise 8-10A Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of

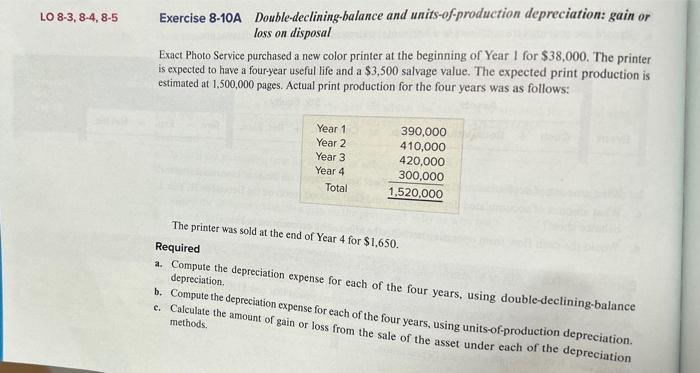

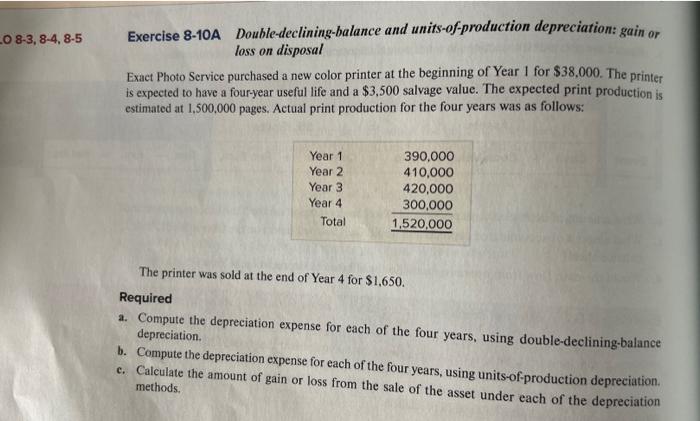

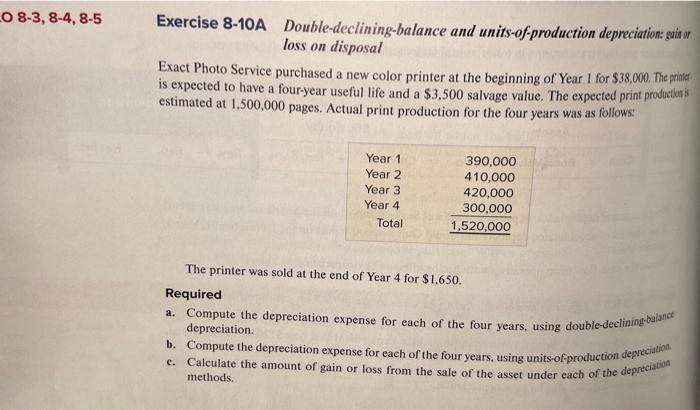

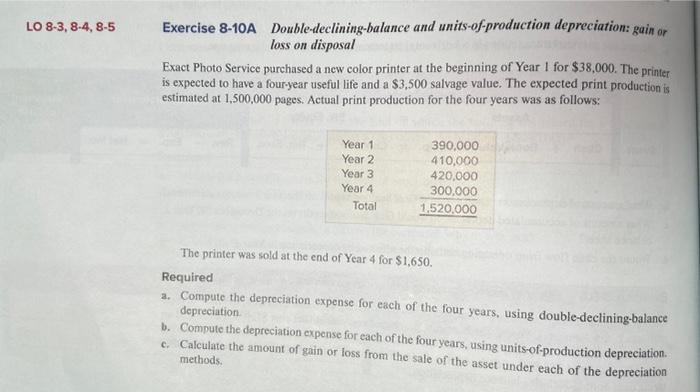

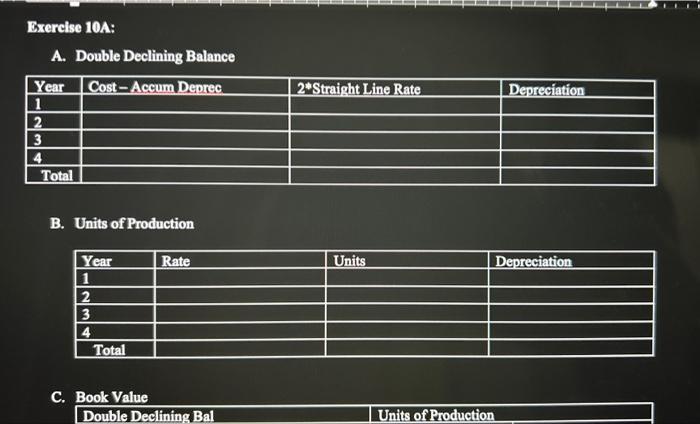

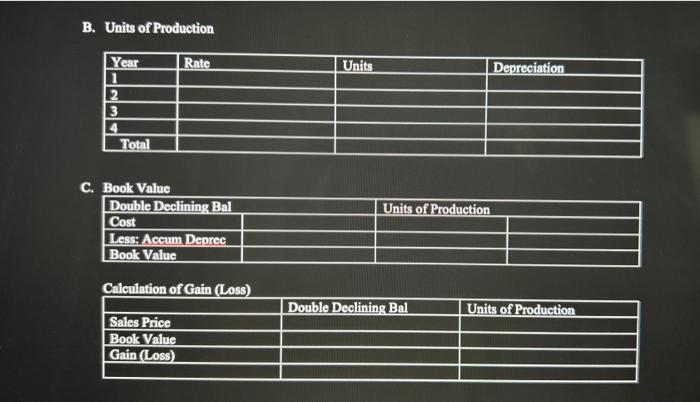

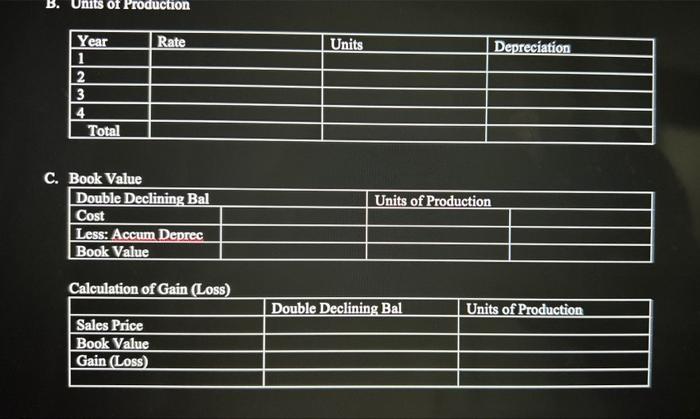

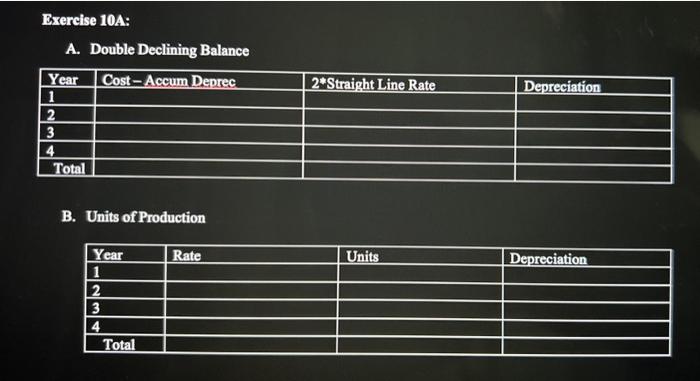

Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year I for $38,000. The printer is expected to have a fouryear useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. Exercise 8-10A Double-declining-balance and units-of-production depreciation: giin or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The pritte is expected to have a four-year useful life and a $3,500 salvage value. The expected print production i estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-ofproduction depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciatiof methods. Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printet is expected to have a fouryear useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: The printer was sold at the end of Year 4 for $1,650. Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. A. Double Declining Balance B. Units of Production B. Units of Production \begin{tabular}{|l|l|l|l|} \hline Year & Rate & Units & Depreciation \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline Total & & & \\ \hline \end{tabular} C. Book Value \begin{tabular}{|l|l|l|l|} \hline Double Declining Bal & \multicolumn{2}{|l|}{ Units of Production } \\ \hline Cost & & & \\ \hline Less: Accum Deprec & & & \\ \hline Book Value & & & \\ \hline \end{tabular} Calculation of Gain (Loss) \begin{tabular}{|l|l|l|} \hline & Double Declining Bal & Units of Production \\ \hline Sales Price & & \\ \hline Book Value & & \\ \hline Gain(Loss) & & \\ \hline & & \\ \hline \end{tabular} A. Double Declining Balance B. Units of Production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts