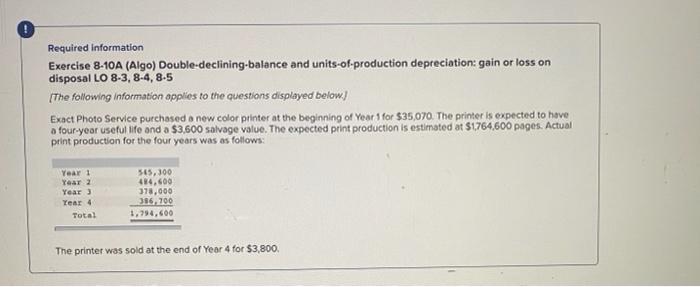

Question: Required information Exercise 8-10A (Algo) Double-declining balance and units-of-production depreciation: gain or loss on disposal LO 8-3, 8-4, 8.5 [The following information applies to the

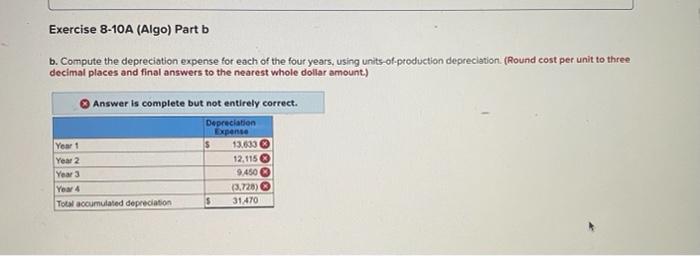

Required information Exercise 8-10A (Algo) Double-declining balance and units-of-production depreciation: gain or loss on disposal LO 8-3, 8-4, 8.5 [The following information applies to the questions displayed below) Exact Photo Service purchased a new color printer at the beginning of Year 4 for $35,070. The printer is expected to have a four-year useful life and a $3,600 salvage value. The expected print production is estimated at $1764,600 pages. Actual print production for the four years was as follows: Year 1 Year 2 Year) Year 4 Total 545,300 484.600 378,000 386.700 1.794.600 The printer was sold at the end of Year 4 for $3,800 Exercise 8-10A (Algo) Part b b. Compute the depreciation expense for each of the four years, using units of production depreciation (Round cost per unit to three decimal places and final answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Depreciation Expense Yeart 13.000 Year 2 12,115 Year 9.450 Year 4 (3.728) Total accumulated depreciation 31.470 OOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts