Question: Exercise 8-49 (Static) Prepare a Production Cost Report: FIFO Method (LO 8-2, 4, 5) Terminal Industries (TI) produces a product using three departments: Mixing, Processing,

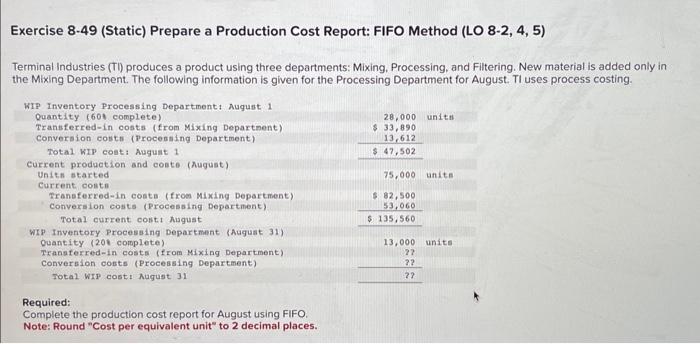

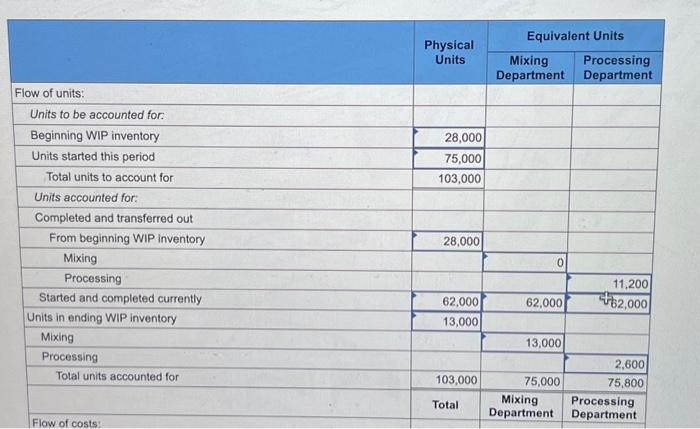

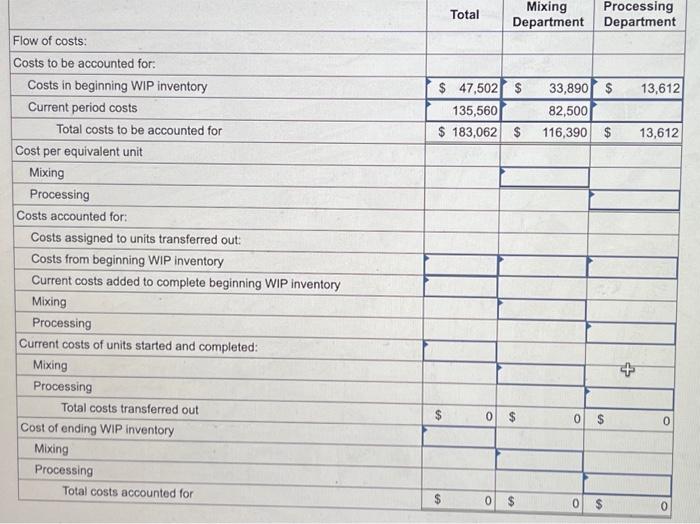

Exercise 8-49 (Static) Prepare a Production Cost Report: FIFO Method (LO 8-2, 4, 5) Terminal Industries (TI) produces a product using three departments: Mixing, Processing, and Filtering. New material is added only in the Mixing Department. The following information is given for the Processing Department for August. TI uses process costing. Required: Complete the production cost report for August using FIFO. Note: Round "Cost per equivalent unit" to 2 decimal places. \begin{tabular}{|c|c|c|c|} \hline & \multirow{2}{*}{\begin{tabular}{c} Physical \\ Units \end{tabular}} & \multicolumn{2}{|c|}{ Equivalent Units } \\ \hline & & \begin{tabular}{c} Mixing \\ Department \end{tabular} & \begin{tabular}{l} Processing \\ Department \end{tabular} \\ \hline \multicolumn{4}{|l|}{ Flow of units: } \\ \hline \multicolumn{4}{|l|}{ Units to be accounted for: } \\ \hline Beginning WIP inventory & 28,000 & & \\ \hline Units started this period & 75,000 & & \\ \hline Total units to account for & 103,000 & & \\ \hline \multicolumn{4}{|l|}{ Units accounted for: } \\ \hline Completed and transferred out & & & \\ \hline From beginning WIP inventory & 28,000 & & \\ \hline Mixing & & 0 & \\ \hline Processing & & & 11,200 \\ \hline Started and completed currently & 62,000 & 62,000 & \( 4 \longdiv { 6 2 , 0 0 0 } \) \\ \hline Units in ending WIP inventory & 13,000 & & \\ \hline Mixing & & 13,000 & \\ \hline Processing & & & 2,600 \\ \hline \multirow[t]{2}{*}{ Total units accounted for } & 103,000 & 75,000 & 75,800 \\ \hline & Total & \begin{tabular}{l} Mixing \\ Department \end{tabular} & \begin{tabular}{l} Processing \\ Department \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Flow of costs: } & Total & \multicolumn{2}{|c|}{\begin{tabular}{c} Mixing \\ Department \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{l} Processing \\ Department \end{tabular}} \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{ Costs to be accounted for: } \\ \hline Costs in beginning WIP inventory & $47,502 & $ & 33,890 & $ & 13,612 \\ \hline Current period costs & 135,560 & & 82,500 & & \\ \hline Total costs to be accounted for & $183,062 & $ & 116,390 & $ & 13,612 \\ \hline \multicolumn{6}{|l|}{ Cost per equivalent unit } \\ \hline \multicolumn{6}{|l|}{ Mixing } \\ \hline \multicolumn{6}{|l|}{ Processing } \\ \hline \multicolumn{6}{|l|}{ Costs accounted for: } \\ \hline \multicolumn{6}{|l|}{ Costs assigned to units transferred out: } \\ \hline \multicolumn{6}{|l|}{ Costs from beginning WIP inventory } \\ \hline \multicolumn{6}{|l|}{ Current costs added to complete beginning WIP inventory } \\ \hline \multicolumn{6}{|l|}{ Mixing } \\ \hline \multicolumn{6}{|l|}{ Processing } \\ \hline \multicolumn{6}{|l|}{ Current costs of units started and completed: } \\ \hline Mixing & & 5 & & & r \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} Processing \\ Total costs transferred \end{tabular}} \\ \hline Total costs transferred out & 0 & $ & 0 & $ & 0 \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} Cost of ending WIP inventory \\ Mixing \end{tabular}} \\ \hline Mixing & & & & & \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} Processing \\ Total costs accounted for \end{tabular}} \\ \hline Total costs accounted for & 0 & $ & 0 & $ & 0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts