Question: EXERCISE 8-5 Variable Costing Unit Product Cost and Income Statement; Break-Even [L01, LO2] Exercise 8-5: Help Me Solve It Tutorial Click here to view a

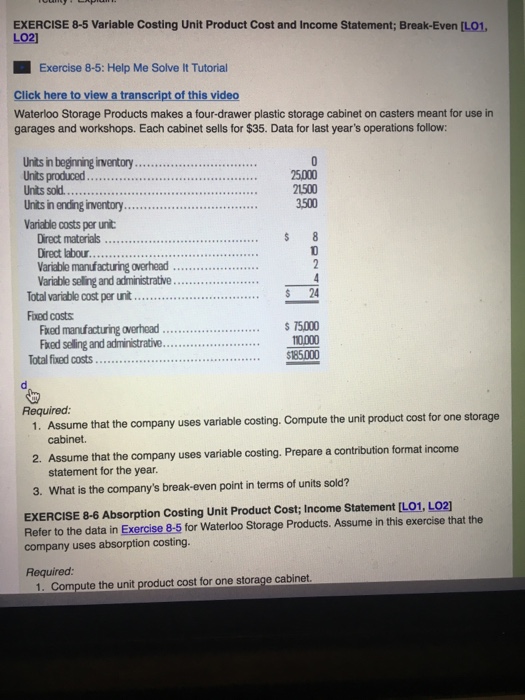

EXERCISE 8-5 Variable Costing Unit Product Cost and Income Statement; Break-Even [L01, LO2] Exercise 8-5: Help Me Solve It Tutorial Click here to view a transcript of this video Waterloo Storage Products makes a four-drawer plastic storage cabinet on casters meant for use in garages and workshops. Each cabinet sells for $35. Data for last year's operations follow: Units in beginning inventory 25000 21500 3500 Units in ending inventory. ariable costs per unt Direct materials Variable manufacturing overhead.. . . ariable selling and administrative $ 24 Total variable cost per unit .. Fixed costs Fxed manufacturing overhead5000 Fixed selling and administrative $185000 otal fixed costs. Required 1. Assume that the company uses variable costing. Compute the unit product cost for one storage cabinet. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for the year 3. What is the company's break-even point in terms of units sold? EXERCISE 8-6 Absorption Costing Unit Product Cost; Income Statement [LO1, LO2) Refer to the data in Exercise 8-5 for Waterloo Storage Products. Assume in this exercise that the company uses absorption costing. Required: uct cost for one storage cabir

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts