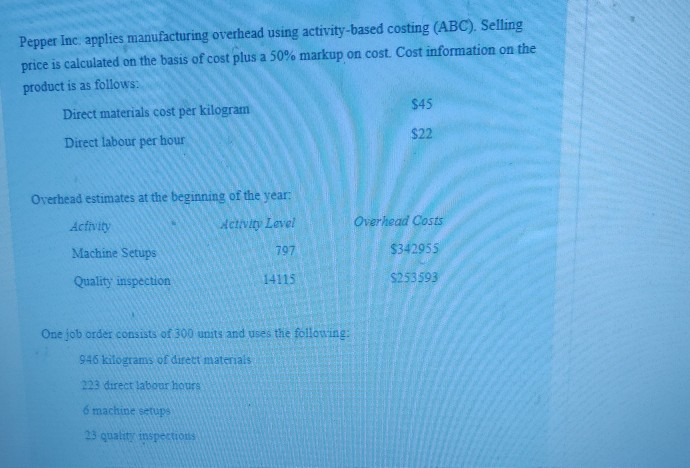

Question: Pepper Inc. applies manufacturing overhead using activity-based costing (ABC). Selling price is calculated on the basis of cost plus a 50% markup on cost. Cost

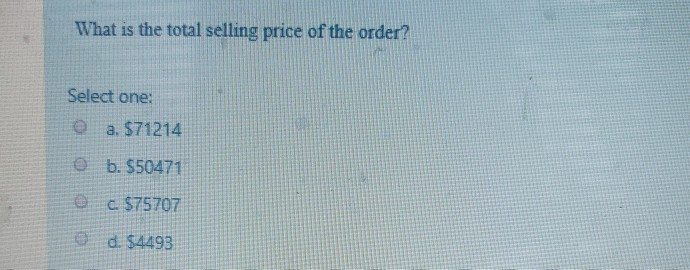

Pepper Inc. applies manufacturing overhead using activity-based costing (ABC). Selling price is calculated on the basis of cost plus a 50% markup on cost. Cost information on the product is as follows: $45 Direct materials cost per kilogram $22 Direct labour per hour Overhead estimates at the beginning of the year: Overhead Costs Actrvity Level Activity $342955 797 Machine Setups $253593 14115 Quality inspection One job order consists of 300 units and uses the following: 946 kilograms of dirett materials 223 drect labour hours 6 machine setups 23 quality inspections What is the total selling price of the order? Select one: a. $71214 O b. $50471 O C $75707 O d. $4493

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts