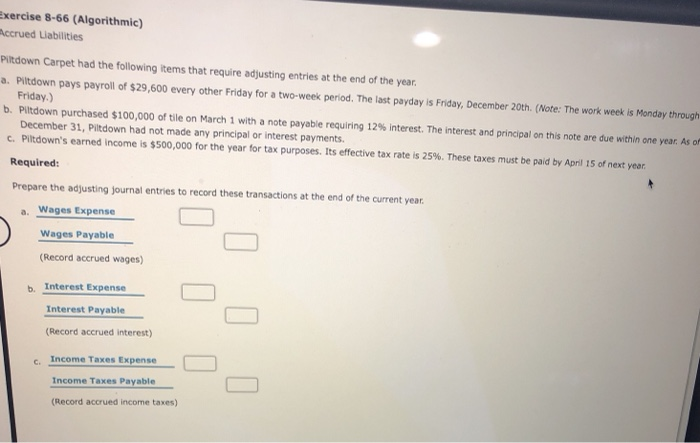

Question: Exercise 8-66 (Algorithmic) Accrued abilities Piltdown Carpet had the following items that require adjusting entries at the end of the year. a. Pultdown pays payroll

Exercise 8-66 (Algorithmic) Accrued abilities Piltdown Carpet had the following items that require adjusting entries at the end of the year. a. Pultdown pays payroll of $29,600 every other Friday for a two-week period. The last payday is Friday, December 20th. (Note: The work week is Monday through Friday.) b. Piltdown purchased $100,000 of tile on March 1 with a note payable requiring 12% interest. The interest and principal on this note are due within one year. As or December 31, Piltdown had not made any principal or interest payments. c. Piltdown's earned Income is $500,000 for the year for tax purposes. Its effective tax rate is 25%. These taxes must be paid by April 15 of next year. Required: Prepare the adjusting journal entries to record these transactions at the end of the current year. a. Wages Expense Wages Payable (Record accrued wages) b. Interest Expense Interest Payable (Record accrued interest) C. Income Taxes Expense Income Taxes Payable (Record accrued income taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts