Question: EXERCISE 8-9A Exercise 8-9A Computing and recording straight-line versus double-declining-balance depreciation At the beginning of Year 1. Copeland Drugstore purchased a new computer system for

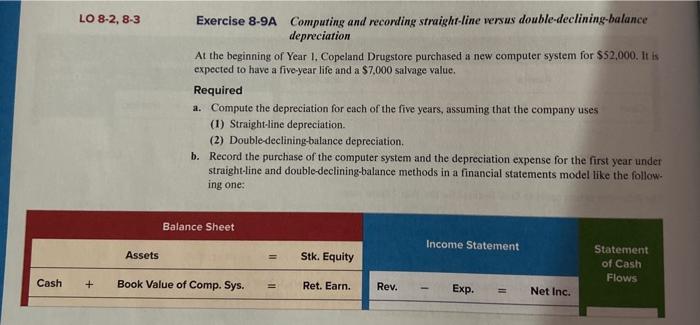

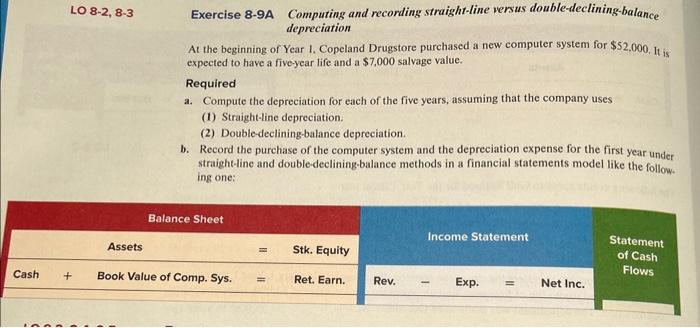

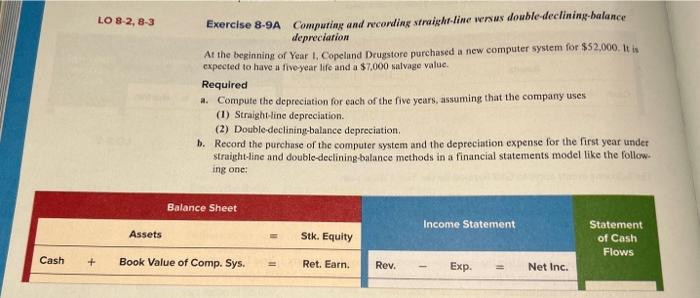

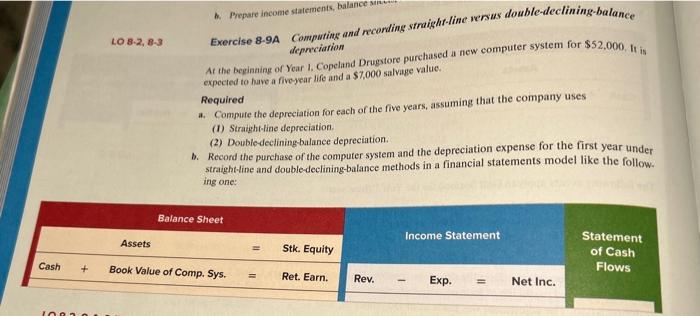

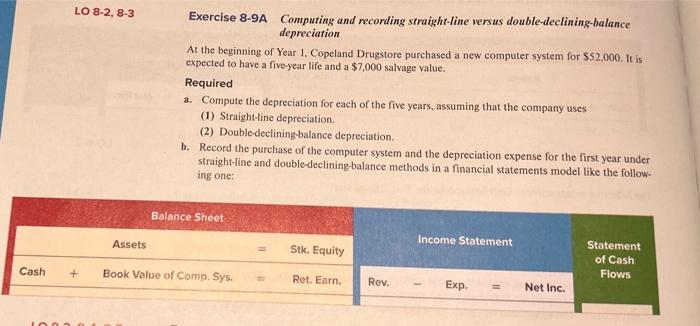

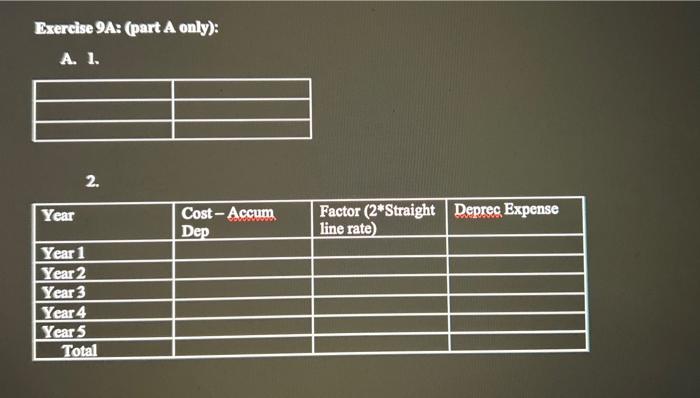

Exercise 8-9A Computing and recording straight-line versus double-declining-balance depreciation At the beginning of Year 1. Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a fiveyear life and a $7,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Doubledeclining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-declining-balance methods in a financial statements model like the following one: Exercise 8-9A Computing and recording straight-line versus double-declining-balance depreciation At the beginning of Year 1. Copeland Drugstore purchased a new computer system for $52.000, It is expected to have a five-year life and a $7,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-declining-balance methods in a financial statements model like the follow. ing one: Exercise 8-9A Computing and reonding straight-line verus double-declining-balance depreciation At the beginning of Year I. Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a fiveyear life and a $7,000 satvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Doubledeclining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-declining balance methods in a financial statements model like the following one: Exercise 8-9A Computing and reonding straight-line versus double-declining-balance depnciation At the begianing of Year 1. Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a fiveyear life and a $7,000 salvage value. Required a. Compure the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Doubledeclining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-declining-balance methods in a financial statements model like the follow. ing one: Exercise 8-9A Computing and recording straight-line versus double-declining-balance depreciation At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-declining-balance methods in a financial statements model like the following one: Brercise 9A: (part A only): A. 1. \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} 2. \begin{tabular}{|l|l|l|l|} \hline Year & Cost-AccumDep & Factor(2*Straightlinerate) & Deprec Expense \\ \hline Year 1 & & & \\ \hline Year 2 & & & \\ \hline Year 3 & & & \\ \hline Year 4 & & & \\ \hline Year-5 & & & \\ \hline Total & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts