Question: Exercise 9 - 4 1 ( Algo ) Activity - Based versus Traditional Costing ( LO 9 - 4 , 5 , 6 ) Asbury

Exercise Algo ActivityBased versus Traditional Costing LO

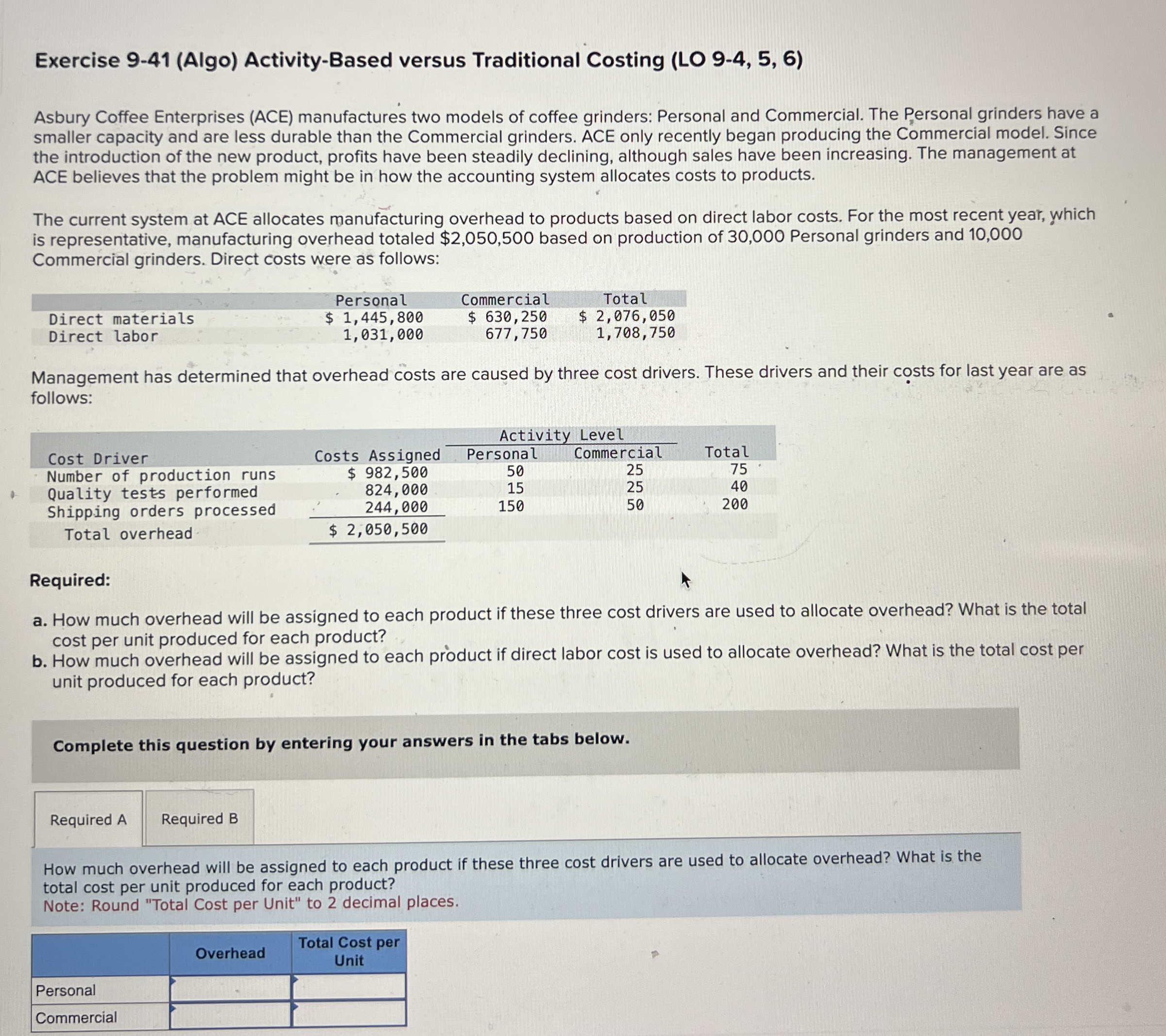

Asbury Coffee Enterprises ACE manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE believes that the problem might be in how the accounting system allocates costs to products.

The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which is representative, manufacturing overhead totaled $ based on production of Personal grinders and Commercial grinders. Direct costs were as follows:

tablePersonal,Commercial,TotalDirect materials,$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock