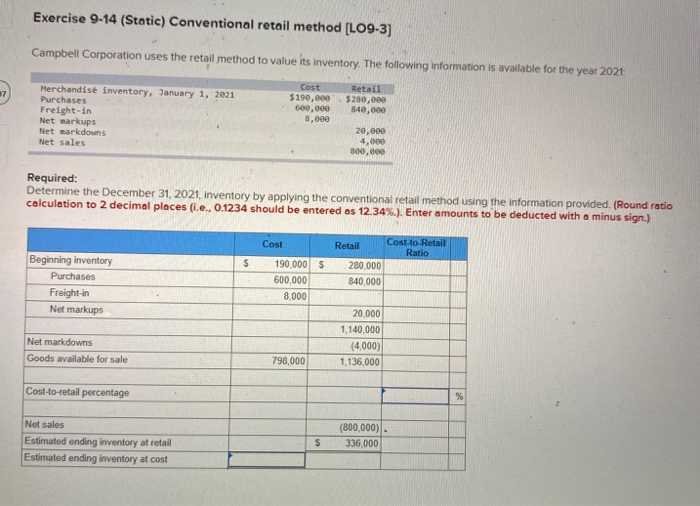

Question: Exercise 9-14 (Static) Conventional retail method [LO9-3) Campbell Corporation uses the retail method to value its inventory. The following information is available for the year

Exercise 9-14 (Static) Conventional retail method [LO9-3) Campbell Corporation uses the retail method to value its inventory. The following information is available for the year 2021 07 Merchandise inventory, January 1, 2021 Purchases Freight-in Net markups Net markdowns Net sales Cost $190,000 600,000 8,000 Retail $280,000 840,000 20,000 4,000 800,000 Required: Determine the December 31, 2021, inventory by applying the conventional retail method using the information provided. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost Retail Cost-to-Retail Ratio $ Beginning inventory Purchases Freight-in Net markups 190.000 $ 600,000 8.000 280,000 840,000 Net markdowns Goods available for sale 20.000 1.140,000 (4,000) 1,136.000 798,000 Cost-to-retail percentage % Net sales Estimated ending Inventory at retail Estimated ending inventory at cost (800,000) 336,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts