Question: This is all one question. Project Y requires a $319,500 investment for new machinery with a six-year life and no salvage value. The project yields

This is all one question.

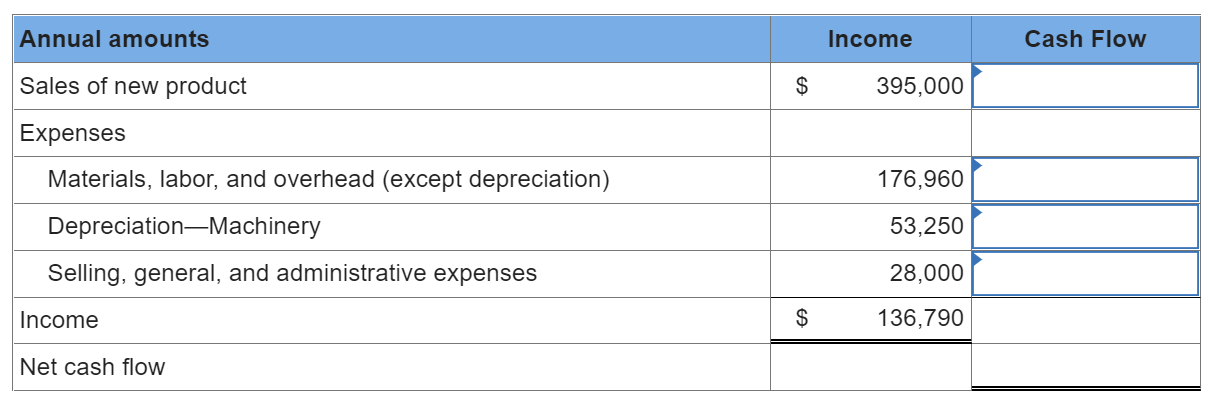

Project Y requires a $319,500 investment for new machinery with a six-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Annual Amounts | Project Y |

|---|---|

| Sales of new product | $ 395,000 |

| Expenses | |

| Materials, labor, and overhead (except depreciation) | 176,960 |

| DepreciationMachinery | 53,250 |

| Selling, general, and administrative expenses | 28,000 |

| Income $ 136,790 |

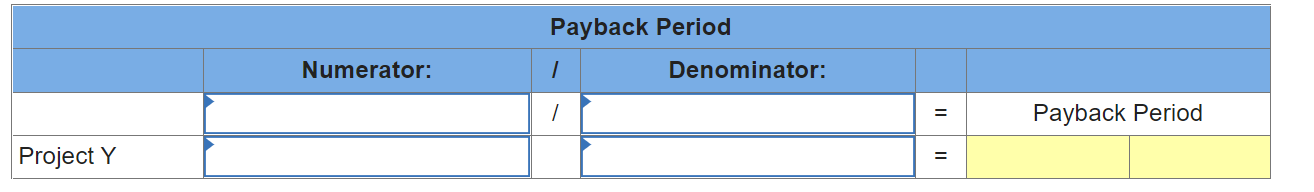

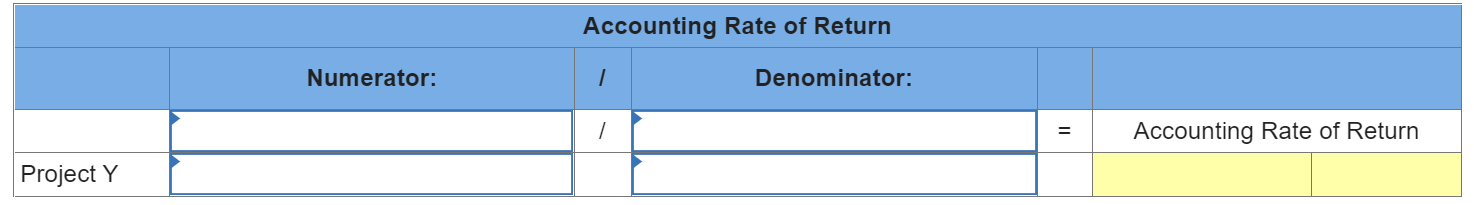

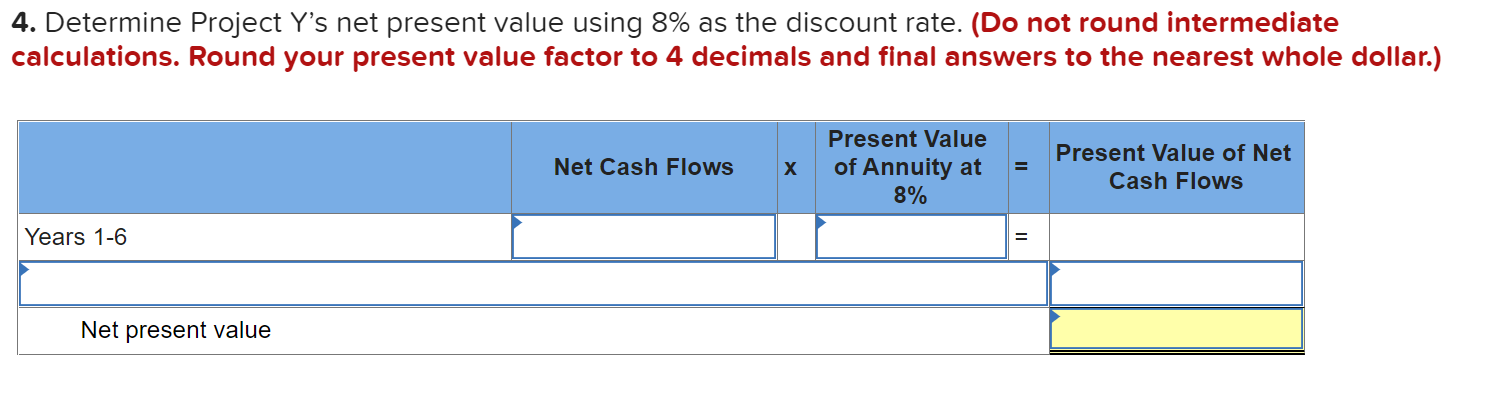

Annual amounts Income Cash Flow Sales of new product $ 395,000 Expenses Materials, labor, and overhead (except depreciation) DepreciationMachinery 176,960 53,250 Selling, general, and administrative expenses 28,000 Income $ 136,790 Net cash flow Payback Period Numerator: / Denominator: / = Payback Period 11 Project Y Accounting Rate of Return Numerator: 1 Denominator: / Accounting Rate of Return Project Y 4. Determine Project Y's net present value using 8% as the discount rate. (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Net Cash Flows Present Value of Annuity at 8% = Present Value of Net Cash Flows Years 1-6 = Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts