Question: Exercise 9.4 Depreciation Methods (LO9-3) On January 2, 2018, Jatson Corporation acquired a new machine with an estimated useful life of five years. The cost

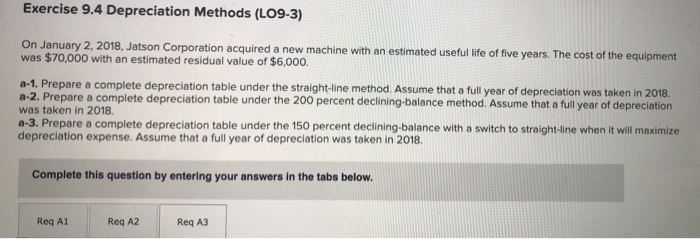

Exercise 9.4 Depreciation Methods (LO9-3) On January 2, 2018, Jatson Corporation acquired a new machine with an estimated useful life of five years. The cost of the equipment was $70,000 with an estimated residual value of $6,000. a-1. Prepare a complete depreciation table under the straight-line method. Assume that a full year of depreciation was taken in 2018. -2. Prepare a complete depreciation table under the 200 percent declining balance method. Assume that a full year of depreciation was taken in 2018. a-3. Prepare a complete depreciation table under the 150 percent declining balance with a switch to straight-line when it will maximize depreciation expense. Assume that a full year of depreciation was taken in 2018. Complete this question by entering your answers in the tabs below. Req Al Req A2 Req A3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts