Question: Exercise 9-67 (Algorithmic) Bond Premium and Discount Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a

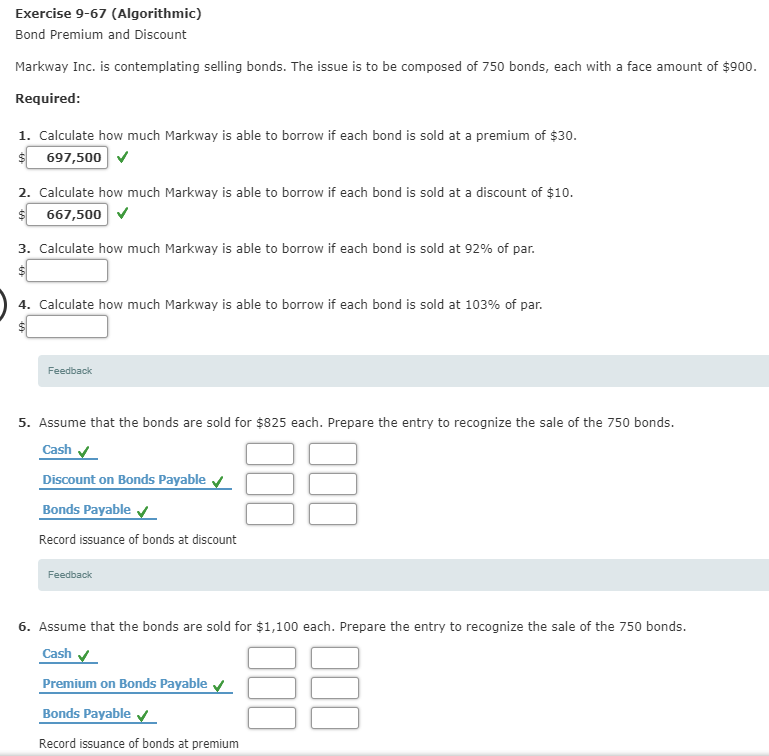

Exercise 9-67 (Algorithmic) Bond Premium and Discount Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a face amount of $900. Required: 1. Calculate how much Markway is able to borrow if each bond is sold at a premium of $30. $ 697,500 2. Calculate how much Markway is able to borrow if each bond is sold at a discount of $10. $ 667,500 3. Calculate how much Markway is able to borrow if each bond is sold at 92% of par. 4. Calculate how much Markway is able to borrow if each bond is sold at 103% of par. Feedback 5. Assume that the bonds are sold for $825 each. Prepare the entry to recognize the sale of the 750 bonds. Cash Discount on Bonds Payable Bonds Payable Record issuance of bonds at discount Feedback 6. Assume that the bonds are sold for $1,100 each. Prepare the entry to recognize the sale of the 750 bonds. Cash Premium on Bonds Payable Bonds Payable Record issuance of bonds at premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts