Question: only need 5 and 6 Exercise 9-67 (Algorithmic) Bond Premium and Discount Markway Inc. is contemplating selling bonds. The issue is to be composed of

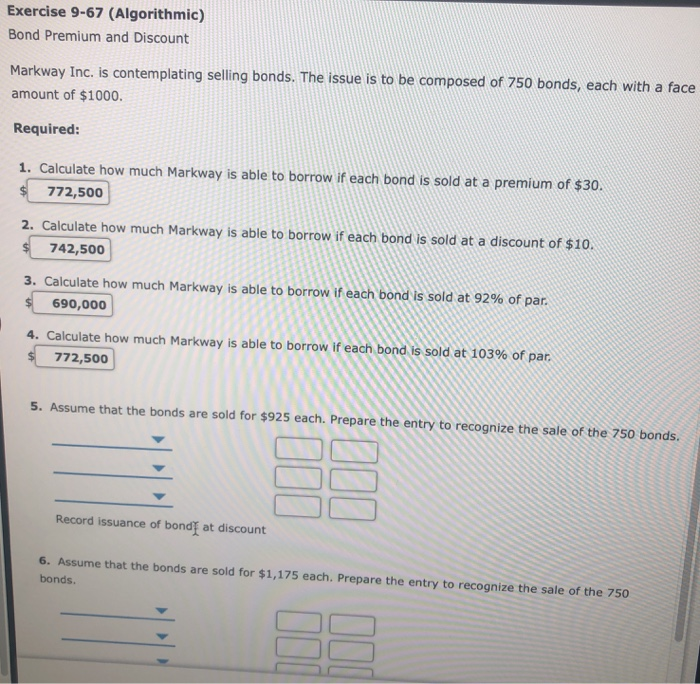

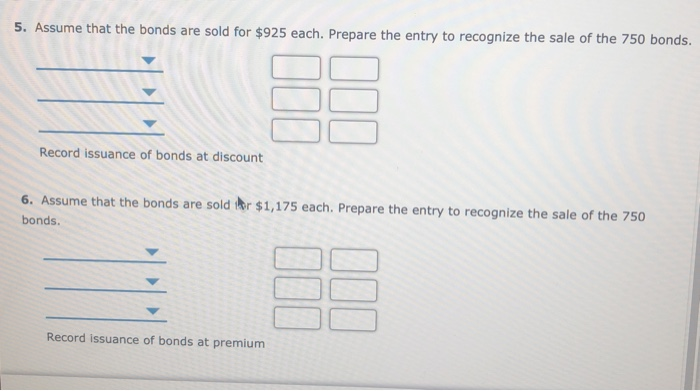

Exercise 9-67 (Algorithmic) Bond Premium and Discount Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a face amount of $1000 Required: 1. Calculate how much Markway is able to borrow if each bond is sold at a premium of $30. 772,500 2. Calculate how much Markway is able to borrow if each bond is sold at a discount of $10. 742,500 3. Calculate how much Markway is able to borrow if each bond is sold at 92% of par. 690,000 4. Calculate how much Markway is able to borrow if each bond is sold at 103% of par. 772,500 5. Assume that the bonds are sold for $925 each. Prepare the entry to recognize the sale of the 750 bonds. Record issuance of bond at discount 6. Assume that the bonds are sold for $1,175 each. Prepare the entry to recognize the sale of the 750 bonds. DOD 5. Assume that the bonds are sold for $925 each. Prepare the entry to recognize the sale of the 750 bonds. Record issuance of bonds at discount 6. Assume that the bonds are sold for $1,175 each. Prepare the entry to recognize the sale of the 750 bonds. Record issuance of bonds at premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts