Question: Exercise D-3 Record equity investments using the fair value method (LO D-2) 5 Mr. T's Fashions, once a direct competitor to Italian Stallion's clothing line,

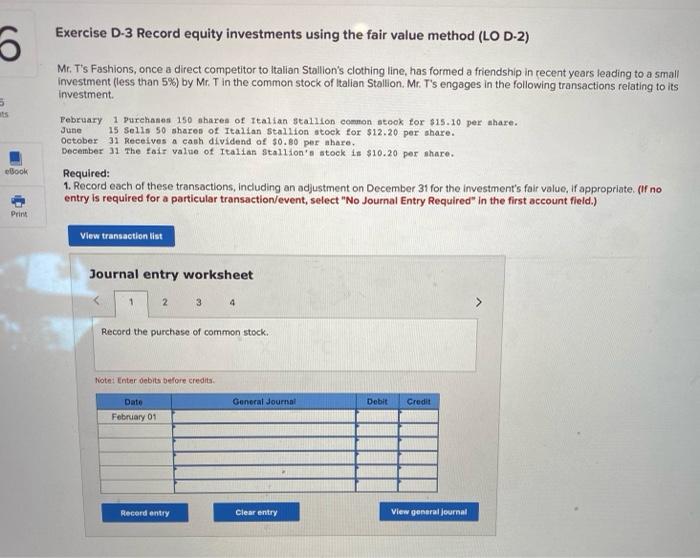

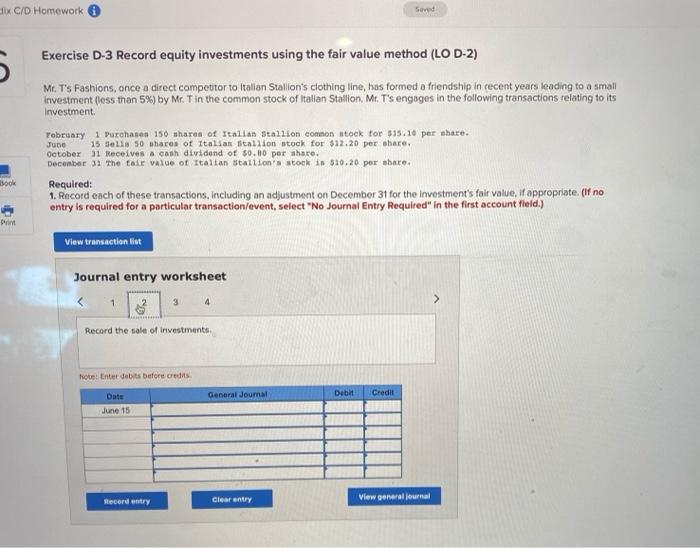

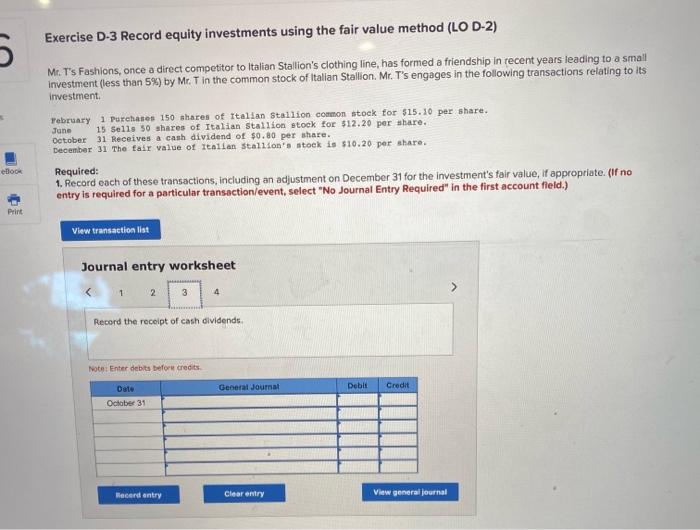

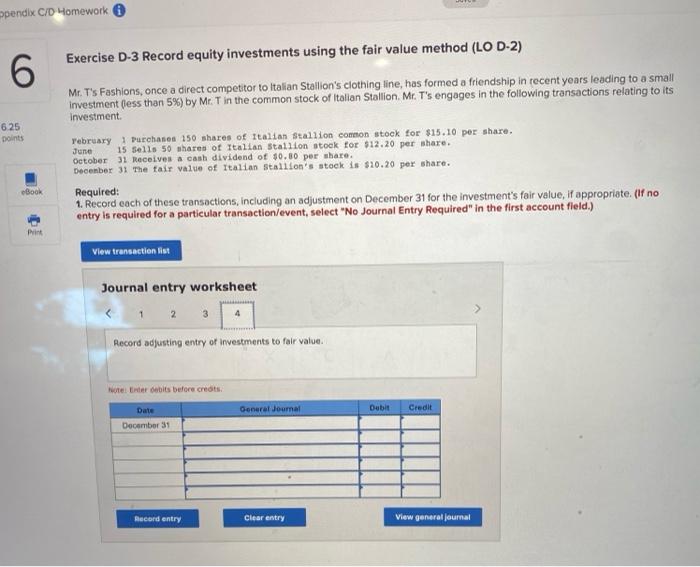

Exercise D-3 Record equity investments using the fair value method (LO D-2) 5 Mr. T's Fashions, once a direct competitor to Italian Stallion's clothing line, has formed a friendship in recent years leading to a small investment (less than 5%) by Mr. T in the common stock of Italian Stallion, Mr. T's engages in the following transactions relating to its Investment February 1 Purchases 150 shares of Italian Stallion common stock for $15.10 per share. June 15 Sells 50 shares of Italian Stallion stock for $12.20 per share. October 31 Receives a cash dividend of $0.80 per share. December 31 The tair value of Italian Stallion's stock is $10.20 por share. Required: 1. Record each of these transactions, including an adjustment on December 31 for the investment's fair value, If appropriate. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Book Print View transaction list Journal entry worksheet 4 Record the purchase of common stock. Note: Enter debits before credits General Journal Debit Credit Date February 01 Record entry Clear entry View general Journal Homework 0 Seved 5. Exercise D-3 Record equity investments using the fair value method (LO D-2) June Mr. T's Fashions, once a direct competitor to Italian Stallion's clothing line, has formed a friendship in recent years leading to a small Investment (less than 5%) by Mr. Tin the common stock of Italian Stallion Mt. T's engages in the following transactions relating to its Investment February 1 Purchase 150 shares of Italian Stallion common took for $15.10 per share. 15 311 50 shares of Italian Stallion stock for $12.20 per share. October 31 Receives a cash dividend of $0.00 per share. December 31 The fair value of Italian Stallion's stock is 510,20 per bare Required: 1. Record each of these transactions, including an adjustment on December 31 for the investment's fair value, if appropriate. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Book Print View transaction lit Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts