Question: Exercise material and tasks Case Study: The Bell Manufacturing Company BALANCE SHEETS 2003 2004 2005 2006 CURRENT ASSETS Stock Debtors Cash / Bank FIXED ASSETS

Exercise material and tasks

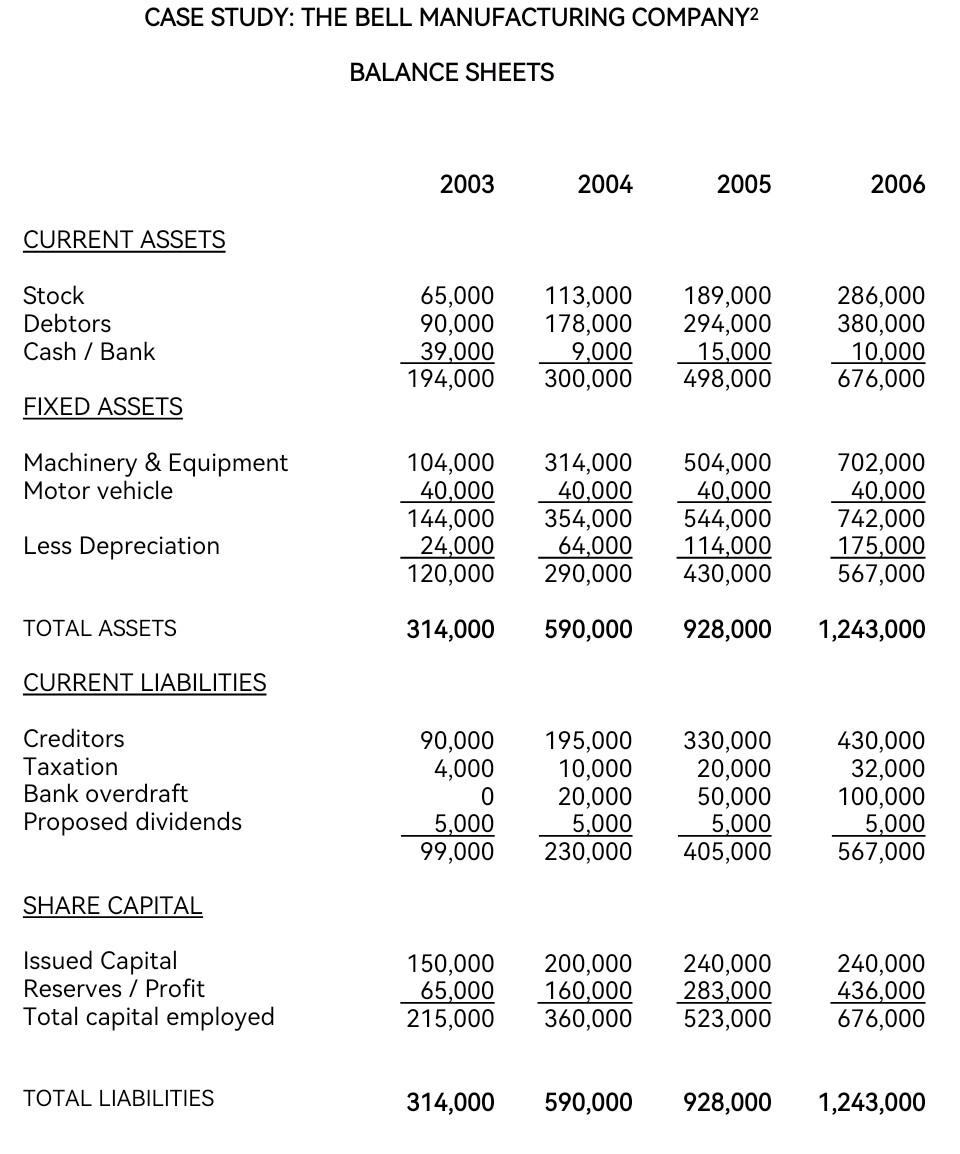

Case Study: The Bell Manufacturing Company

BALANCE SHEETS

2003

2004

2005

2006

CURRENT ASSETS

Stock Debtors Cash / Bank

FIXED ASSETS

Machinery & Equipment Motor vehicle

Less Depreciation

TOTAL ASSETS

CURRENT LIABILITIES

Creditors Taxation Bank overdraft Proposed dividends

SHARE CAPITAL

Issued Capital Reserves / Profit Total capital employed

TOTAL LIABILITIES

65,000 90,000 39,000 194,000

104,000 40,000 144,000 24,000 120,000

314,000

90,000 4,000 0 5,000 99,000

150,000 65,000 215,000

314,000

113,000 178,000 9,000 300,000

314,000 40,000 354,000 64,000 290,000

590,000

195,000 10,000 20,000 5,000 230,000

200,000 160,000 360,000

590,000

189,000 294,000 15,000 498,000

504,000 40,000 544,000 114,000 430,000

928,000

330,000 20,000 50,000 5,000 405,000

240,000 283,000 523,000

928,000

286,000 380,000 10,000 676,000

702,000 40,000 742,000 175,000 567,000

1,243,000

430,000 32,000 100,000 5,000 567,000

240,000 436,000 676,000

1,243,000

FURTHER INFORMATION

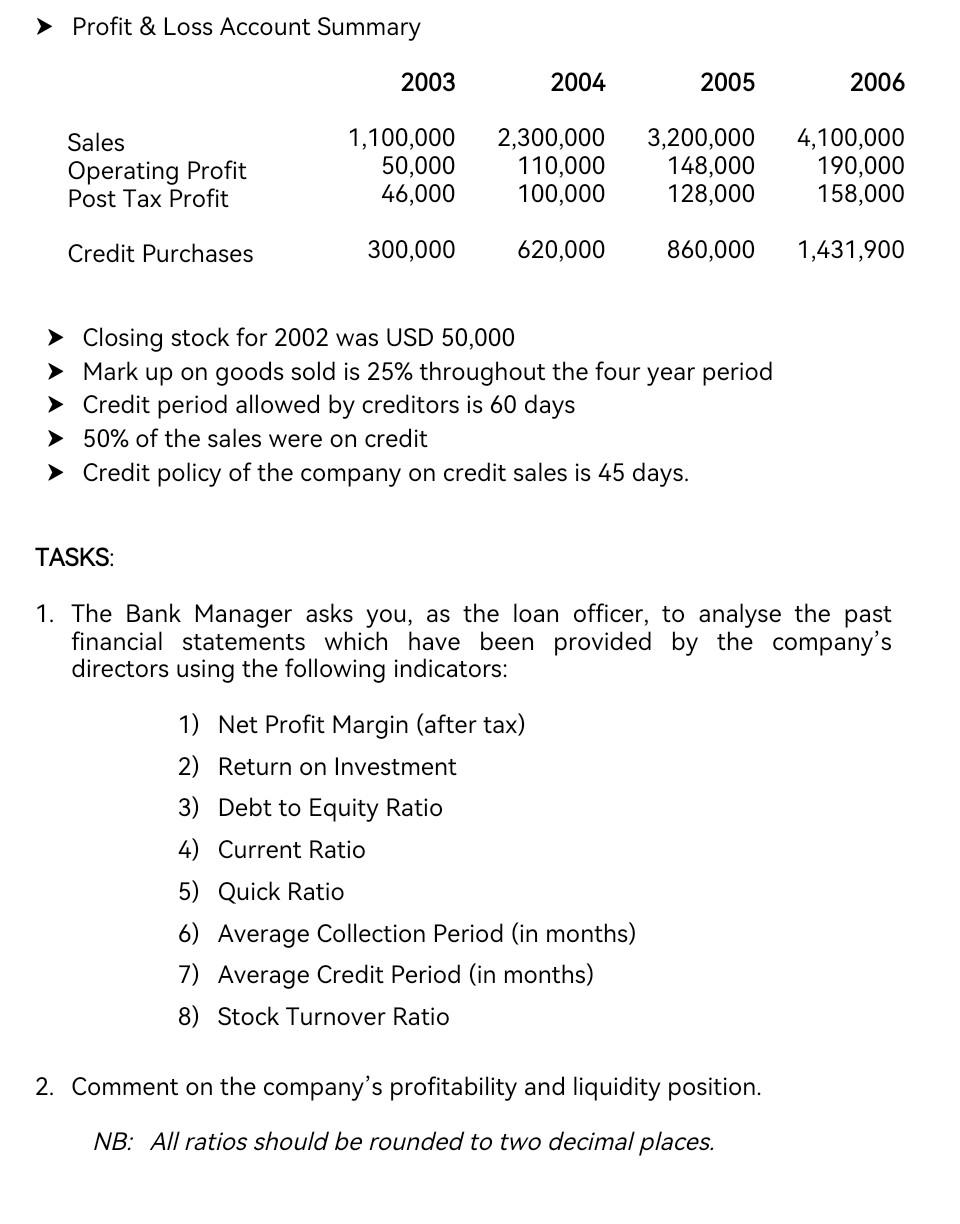

Profit & Loss Account Summary

Sales Operating Profit Post Tax Profit

Credit Purchases 2003

1,100,000 50,000 46,000

300,000 2004

2,300,000 110,000 100,000

620,000 2005

3,200,000 148,000 128,000

860,000 2006

4,100,000 190,000 158,000

1,431,900

Closing stock for 2002 was USD 50,000 Mark up on goods sold is 25% throughout the four year period Credit period allowed by creditors is 60 days 50% of the sales were on credit Credit policy of the company on credit sales is 45 days.

TASKS:

The Bank Manager asks you, as the loan officer, to analyse the past financial statements which have been provided by the companys directors using the following indicators:

Net Profit Margin (after tax) Return on Investment Debt to Equity Ratio Current Ratio Quick Ratio Average Collection Period (in months) Average Credit Period (in months) Stock Turnover Ratio

Comment on the companys profitability and liquidity position.

NB: All ratios should be rounded to two decimal places.

what is the stock turnover ratio for this problem? also calculate for its average collection period and average credit period.

CASE STUDY: THE BELL MANUFACTURING COMPANY2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts