Question: Exercise on Journalizing, Posting, and Preparing a Trial Balance On Mar. 1, 2016, Marlon Cabance, a recent medical board topnotcher, started his medical practice. During

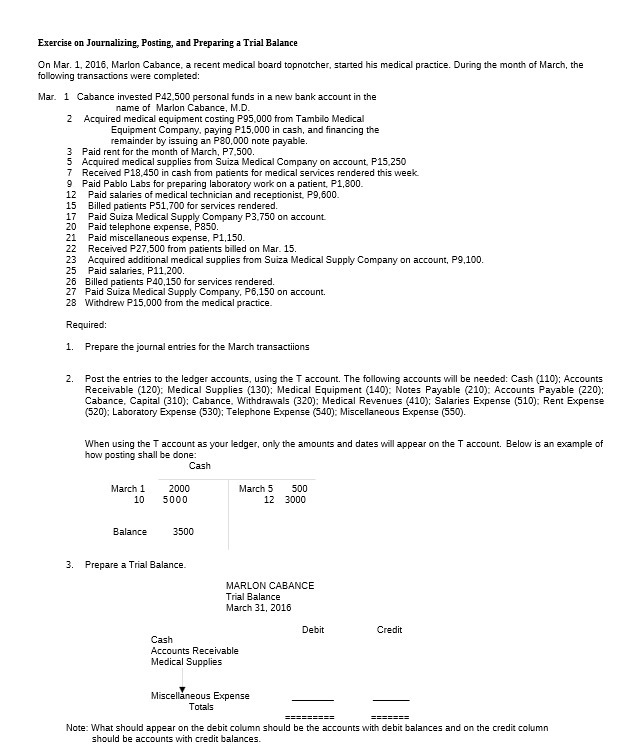

Exercise on Journalizing, Posting, and Preparing a Trial Balance On Mar. 1, 2016, Marlon Cabance, a recent medical board topnotcher, started his medical practice. During the month of March, the following transactions were completed: Mar. 1 Cabance invested P42,500 personal funds in a new bank account in the name of Marlon Cabance, M.D. 2 Acquired medical equipment costing P95.000 from Tambilo Medical Equipment Company, paying P15,000 in cash, and financing the remainder by issuing an P20,000 note payable Paid rent for the month of March, P7.500. Acquired medical supplies from Suiza Medical Company on account, P15,250 Received P18,450 in cash from patients for medical services rendered this week. Paid Pablo Labs for preparing laboratory work on a patient, P1,800. Paid salaries of medical technician and receptionist, P9,600. Billed patients P51,700 for services rendered. Paid Suiza Medical Supply Company P3.750 on account Paid telephone expense, P850. Paid miscellaneous expense, P1,150. Received P27,500 from patients billed on Mar. 15. Acquired additional medical supplies from Suiza Medical Supply Company on account, P9,100. 25 Paid salaries, P11,200 Billed patients P40,150 for services rendered. Paid Suiza Medical Supply Company, P6,150 on account. 28 Withdrew P15,000 from the medical practice. Required: 1. Prepare the journal entries for the March transactions 2. Post the entries to the ledger accounts, using the T account. The following accounts will be needed: Cash (110); Accounts Receivable (120): Medical Supplies (130); Medical Equipment (140): Notes Payable (210): Accounts Payable (220); Cabance, Capital (310); Cabance. Withdrawals (320): Medical Revenues (410); Salaries Expense (510): Rent Expense (520): Laboratory Expense (530); Telephone Expense (540): Miscellaneous Expense (550). When using the T account as your ledger, only the amounts and dates will appear on the T account. Below is an example of how posting shall be done: Cash March 1 2000 March 5 500 10 5000 12 3000 Balance 3500 3. Prepare a Trial Balance MARLON CABANCE Trial Balance March 31, 2016 Debit Credit Cash Accounts Receivable Medical Supplies Miscellaneous Expense Totals Note: What should appear on the debit column should be the accounts with debit balances and on the credit column should be accounts with credit balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts