Question: EXERCISE ON TOPIC 10 : PROSPECTIVE ANALYSIS 1. Describe the steps in forecasting the income statement. 2. Describe the two-step process of forecasting the balance

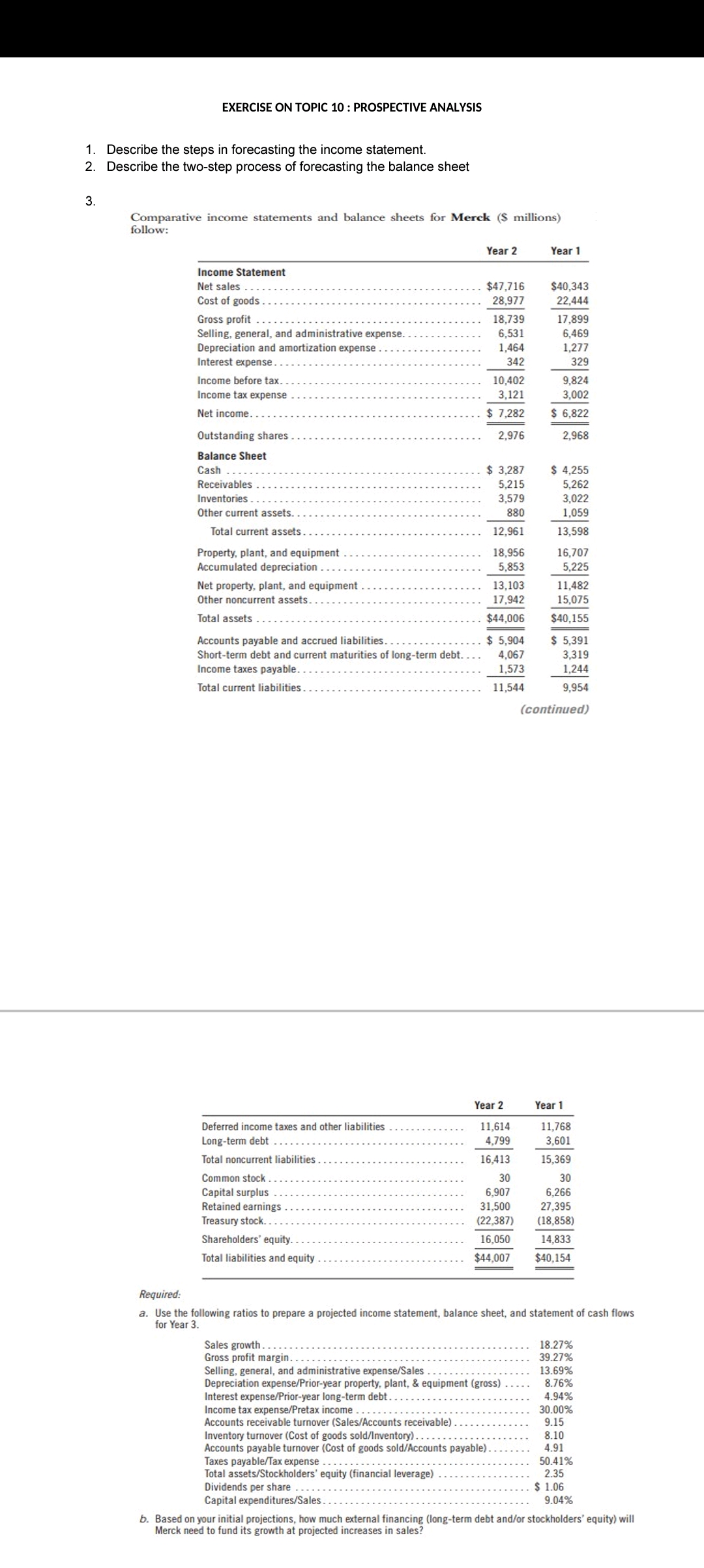

EXERCISE ON TOPIC 10 : PROSPECTIVE ANALYSIS 1. Describe the steps in forecasting the income statement. 2. Describe the two-step process of forecasting the balance sheet 3. Comparative income statements and balance sheets for Merck ( $ millions) follow: Required: a. Use the following ratios to prepare a projected income statement, balance sheet, and statement of cash flow for Year 3. Sales growth. Gross profit margin. Selling, general, and administrative expense/Sales ........... 13.69\% Depreciation expense/Prior-year property, plant, \& equipment (gross) .... 8.76% Interest expense/Prior-year long-term debt. ............... 4.94% Income tax expense/Pretax income. Accounts receivable turnover (Sales/Accounts receivable) . . . . . . . . . . . . 9.15 Inventory turnover (Cost of goods sold/lmventor) Accounts payable turnover (Cost of goods sold/Accol Accounts payable turnover (Cost of goods sold/Accounts payable) . . . . . . . 4.91 Total assets/Stockholders' equity (financial leverage) Dividends per share b. Based on your initial projections, how much external financing (long-term debt and/or stockholders' equity) wi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts