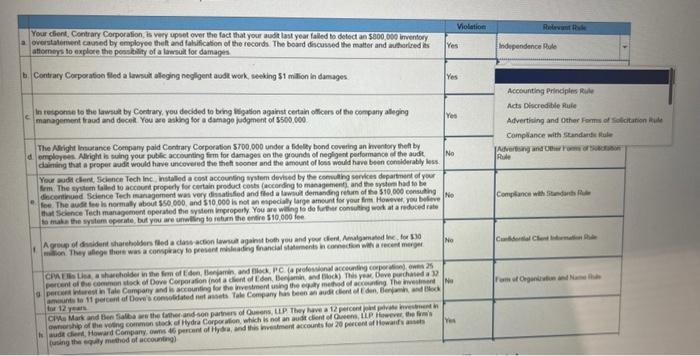

Question: please choose the relevent rule for each case from dropdown list that is shown in these two pictures 9 percent irterest in Tale Compeny and

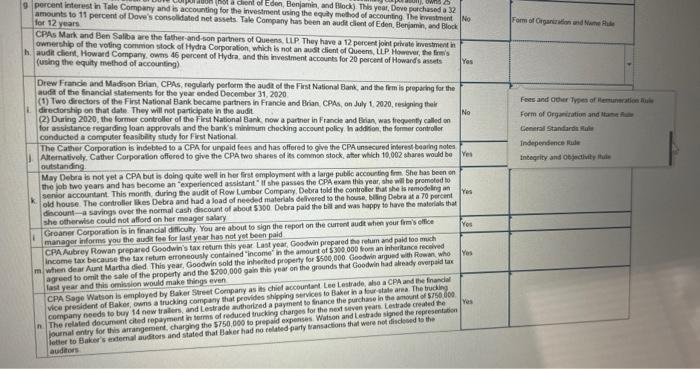

9 percent irterest in Tale Compeny and is accounting for the invor Eden, Benjarmia, and Block). Thes year, Oove perchasod a 32 amounts to 11 percent of Dove's consolldated net assets. Tale Company has been equ mehod of accounting Ihe inontinet No. for 12 years. CPAs Mark and Ben Salba are the father-and son parthers of Queens. LIP. They hwe a 12 percent joint petiote imestment in ownerchip of the voling coenmen stock of Hydra Corporation, which is not an aust cient of Queens, UP Howner, the frims. h. audit cliein, Howard Compary. Owns 45 percent of Hydra, and this investment accounts for 20 peroerl of Howands assets (using the equity method of accounting) Drew Francie and Madison Brian, CPAs, regularty perfoem the audit ef the Fist National Bank, and the frm is peparing for the aud of the finandal statements lor the year ended Docember 31,2020 (1) Two directors of the First National Bank became partrers in Frandie and Brian, CPAs, on July 1, 2020, resigniog thair i. directorship on that date. They will not partichate in the audi. (2) During 2020, the former controller of the First National Bank now a partner in Franck and Evian was trequenty called on Form of Oigerizition aid Nuan file for assistance regarding loan approvals and the bank's minhimum checking account policy h addition, the former controler conducted a computer feasibiliy stucy for First National. The Cather Carporation is indebled to a CPA for urpaid fees and has offered to give the CPA unsecured inlerest beaing notes Fees and Gour Tyses of lemunstion alium 1. Alematively. Cather Carporation offered to give the CPA two shares of tis comenoo stock, ather which 10,002 thares woild be outstanding. May Debra is not yet a CPA but is doing pute well in her frst employmert wht a largu public accoucting frem she has been on the job two years and has becone an "experienced ass bstant" If she passies the CPA exam thi yeat, ahe will be promoted to senior accountant. This month during the audit of Row Lumber Company, Debra told the controlor that se is numoseling an disoount - a savings over the nocmal cash dincount of atse Groaner Comporation is in financial difiliculiy. You are about to sign the report on the carment audt ehen yeur frmis elfice managor informs you the audi fee for last year has not yot boen paid CPAAubrey Rowan prepared Geodwin's tax return this year Last year, Goodwin prepared toe retum and paid too much income tax because the tax retum erroneously contained "income 'in the arsount of 5300000 from an intentance recelved CPA Sage Watson is employed by flaker Stret Company as is chict accourtant Leet Bake ha a bur tale area The buding vice president of Bakes, owns a trucking compacy that provides shipring servos finance the purchase in tha ancent of 515000 . n. audears: 9 percent irterest in Tale Compeny and is accounting for the invor Eden, Benjarmia, and Block). Thes year, Oove perchasod a 32 amounts to 11 percent of Dove's consolldated net assets. Tale Company has been equ mehod of accounting Ihe inontinet No. for 12 years. CPAs Mark and Ben Salba are the father-and son parthers of Queens. LIP. They hwe a 12 percent joint petiote imestment in ownerchip of the voling coenmen stock of Hydra Corporation, which is not an aust cient of Queens, UP Howner, the frims. h. audit cliein, Howard Compary. Owns 45 percent of Hydra, and this investment accounts for 20 peroerl of Howands assets (using the equity method of accounting) Drew Francie and Madison Brian, CPAs, regularty perfoem the audit ef the Fist National Bank, and the frm is peparing for the aud of the finandal statements lor the year ended Docember 31,2020 (1) Two directors of the First National Bank became partrers in Frandie and Brian, CPAs, on July 1, 2020, resigniog thair i. directorship on that date. They will not partichate in the audi. (2) During 2020, the former controller of the First National Bank now a partner in Franck and Evian was trequenty called on Form of Oigerizition aid Nuan file for assistance regarding loan approvals and the bank's minhimum checking account policy h addition, the former controler conducted a computer feasibiliy stucy for First National. The Cather Carporation is indebled to a CPA for urpaid fees and has offered to give the CPA unsecured inlerest beaing notes Fees and Gour Tyses of lemunstion alium 1. Alematively. Cather Carporation offered to give the CPA two shares of tis comenoo stock, ather which 10,002 thares woild be outstanding. May Debra is not yet a CPA but is doing pute well in her frst employmert wht a largu public accoucting frem she has been on the job two years and has becone an "experienced ass bstant" If she passies the CPA exam thi yeat, ahe will be promoted to senior accountant. This month during the audit of Row Lumber Company, Debra told the controlor that se is numoseling an disoount - a savings over the nocmal cash dincount of atse Groaner Comporation is in financial difiliculiy. You are about to sign the report on the carment audt ehen yeur frmis elfice managor informs you the audi fee for last year has not yot boen paid CPAAubrey Rowan prepared Geodwin's tax return this year Last year, Goodwin prepared toe retum and paid too much income tax because the tax retum erroneously contained "income 'in the arsount of 5300000 from an intentance recelved CPA Sage Watson is employed by flaker Stret Company as is chict accourtant Leet Bake ha a bur tale area The buding vice president of Bakes, owns a trucking compacy that provides shipring servos finance the purchase in tha ancent of 515000 . n. audears

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts