Question: Exercise Problems for Chapters 1, 2, 3, 4, and 5 1. Your friend saved 12,000 SAR during his studies in KSU. He wants to invest

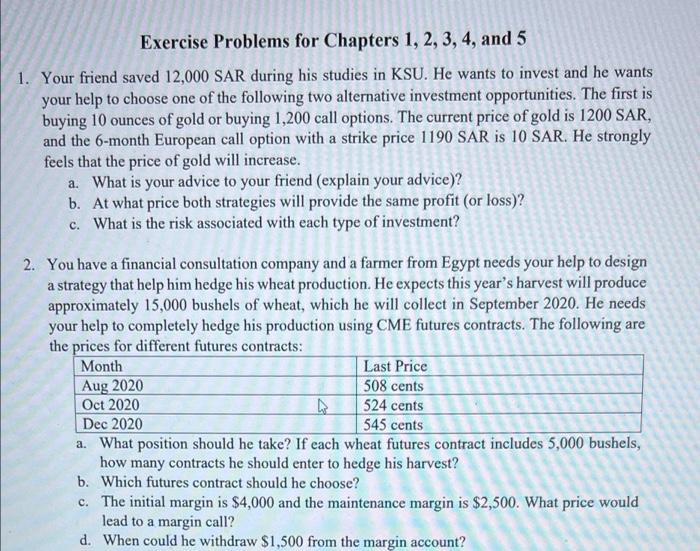

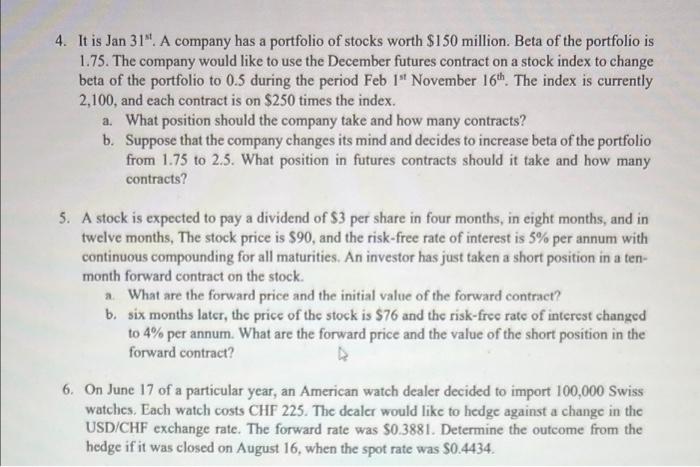

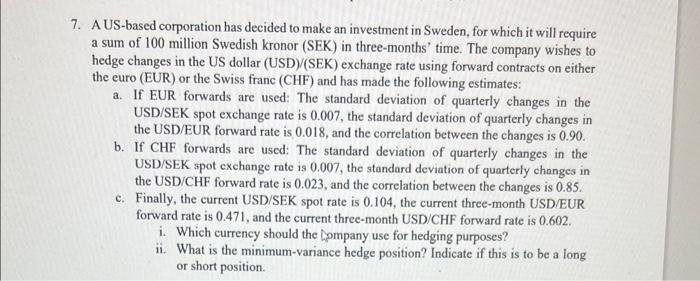

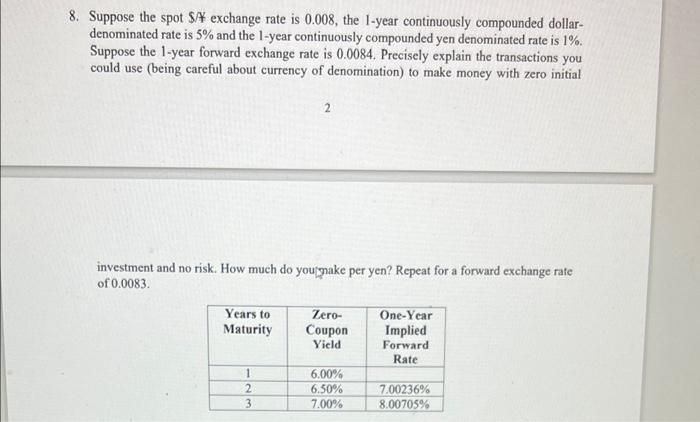

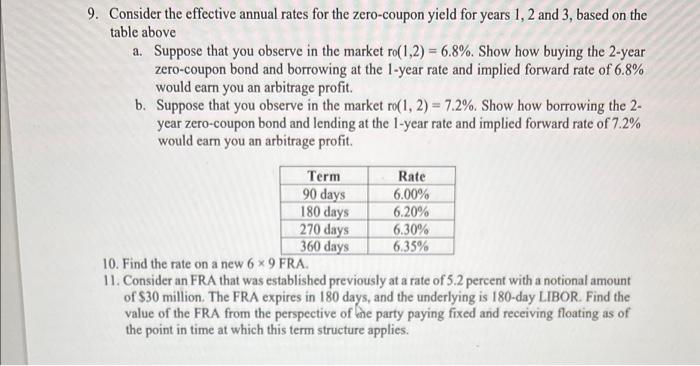

Exercise Problems for Chapters 1, 2, 3, 4, and 5 1. Your friend saved 12,000 SAR during his studies in KSU. He wants to invest and he wants your help to choose one of the following two alternative investment opportunities. The first is buying 10 ounces of gold or buying 1,200 call options. The current price of gold is 1200 SAR, and the 6-month European call option with a strike price 1190 SAR is 10 SAR. He strongly feels that the price of gold will increase. a. What is your advice to your friend (explain your advice)? b. At what price both strategies will provide the same profit (or loss)? c. What is the risk associated with each type of investment? a 2. You have a financial consultation company and a farmer from Egypt needs your help to design a strategy that help him hedge his wheat production. He expects this year's harvest will produce approximately 15,000 bushels of wheat, which he will collect in September 2020. He needs your help to completely hedge his production using CME futures contracts. The following are the prices for different futures contracts: Month Last Price Aug 2020 508 cents Oct 2020 524 cents Dec 2020 545 cents a. What position should he take? If each wheat futures contract includes 5,000 bushels, how many contracts he should enter to hedge his harvest? b. Which futures contract should he choose? c. The initial margin is $4,000 and the maintenance margin is $2,500. What price would lead to a margin call? d. When could he withdraw $1,500 from the margin account? 4. It is Jan 31". A company has a portfolio of stocks worth $150 million. Beta of the portfolio is 1.75. The company would like to use the December futures contract on a stock index to change beta of the portfolio to 0.5 during the period Feb 1" November 16th. The index is currently 2,100, and each contract is on $250 times the index. a. What position should the company take and how many contracts? b. Suppose that the company changes its mind and decides to increase beta of the portfolio from 1.75 to 2.5. What position in futures contracts should it take and how many contracts? 5. A stock is expected to pay a dividend of $3 per share in four months, in eight months, and in twelve months. The stock price is $90, and the risk-free rate of interest is 3% per annum with continuous compounding for all maturities. An investor has just taken a short position in a ten- month forward contract on the stock. 2. What are the forward price and the initial value of the forward contract? b. six months later, the price of the stock is $76 and the risk-frec rate of interest changed to 4% per annum. What are the forward price and the value of the short position in the forward contract? 6. On June 17 of a particular year, an American watch dealer decided to import 100,000 Swiss watches. Each watch costs CHF 225. The dealer would like to hedge against a change in the USD/CHF exchange rate. The forward rate was $0.3881. Determine the outcome from the hedge if it was closed on August 16, when the spot rate was $0.4434. 7. AUS-based corporation has decided to make an investment in Sweden, for which it will require a sum of 100 million Swedish kronor (SEK) in three months' time. The company wishes to hedge changes in the US dollar (USD)(SEK) exchange rate using forward contracts on either the euro (EUR) or the Swiss franc (CHF) and has made the following estimates: a. If EUR forwards are used: The standard deviation of quarterly changes in the USD/SEK spot exchange rate is 0.007, the standard deviation of quarterly changes in the USD/EUR forward rate is 0.018, and the correlation between the changes is 0.90. b. If CHF forwards are used: The standard deviation of quarterly changes in the USD/SEK spot exchange rate is 0.007, the standard deviation of quarterly changes in the USD/CHF forward rate is 0.023, and the correlation between the changes is 0.85. c. Finally, the current USD/SEK spot rate is 0.104, the current three-month USD/EUR forward rate is 0.471, and the current three-month USD CHF forward rate is 0.602. i. Which currency should the Company use for hedging purposes? ii. What is the minimum-variance hedge position? Indicate if this is to be a long or short position 8. Suppose the spot S exchange rate is 0.008, the 1-year continuously compounded dollar- denominated rate is 5% and the 1-year continuously compounded yen denominated rate is 1%. Suppose the 1-year forward exchange rate is 0.0084. Precisely explain the transactions you could use (being careful about currency of denomination) to make money with zero initial 2 investment and no risk. How much do you make per yen? Repeat for a forward exchange rate of 0.0083 Years to Maturity Zero- Coupon Yicld One-Year Implied Forward Rate 1 2 3 6.00% 6.50% 7.00% 7.00236% 8.00705% 9. Consider the effective annual rates for the zero-coupon yield for years 1, 2 and 3, based on the table above a. Suppose that you observe in the market ro(1,2)=6.8%. Show how buying the 2-year zero-coupon bond and borrowing at the 1-year rate and implied forward rate of 68% would earn you an arbitrage profit. b. Suppose that you observe in the market ro(1, 2) = 7.2%. Show how borrowing the 2- year zero-coupon bond and lending at the 1-year rate and implied forward rate of 7.2% would car you an arbitrage profit. Term Rate 90 days 6.00% 180 days 6.20% 270 days 6.30% 360 days 6.35% 10. Find the rate on a new 6 x 9 FRA. 11. Consider an FRA that was established previously at a rate of 5.2 percent with a notional amount of $30 million. The FRA expires in 180 days, and the underlying is 180-day LIBOR. Find the value of the FRA from the perspective of the party paying fixed and receiving floating as of the point in time at which this term structure applies. Exercise Problems for Chapters 1, 2, 3, 4, and 5 1. Your friend saved 12,000 SAR during his studies in KSU. He wants to invest and he wants your help to choose one of the following two alternative investment opportunities. The first is buying 10 ounces of gold or buying 1,200 call options. The current price of gold is 1200 SAR, and the 6-month European call option with a strike price 1190 SAR is 10 SAR. He strongly feels that the price of gold will increase. a. What is your advice to your friend (explain your advice)? b. At what price both strategies will provide the same profit (or loss)? c. What is the risk associated with each type of investment? a 2. You have a financial consultation company and a farmer from Egypt needs your help to design a strategy that help him hedge his wheat production. He expects this year's harvest will produce approximately 15,000 bushels of wheat, which he will collect in September 2020. He needs your help to completely hedge his production using CME futures contracts. The following are the prices for different futures contracts: Month Last Price Aug 2020 508 cents Oct 2020 524 cents Dec 2020 545 cents a. What position should he take? If each wheat futures contract includes 5,000 bushels, how many contracts he should enter to hedge his harvest? b. Which futures contract should he choose? c. The initial margin is $4,000 and the maintenance margin is $2,500. What price would lead to a margin call? d. When could he withdraw $1,500 from the margin account? 4. It is Jan 31". A company has a portfolio of stocks worth $150 million. Beta of the portfolio is 1.75. The company would like to use the December futures contract on a stock index to change beta of the portfolio to 0.5 during the period Feb 1" November 16th. The index is currently 2,100, and each contract is on $250 times the index. a. What position should the company take and how many contracts? b. Suppose that the company changes its mind and decides to increase beta of the portfolio from 1.75 to 2.5. What position in futures contracts should it take and how many contracts? 5. A stock is expected to pay a dividend of $3 per share in four months, in eight months, and in twelve months. The stock price is $90, and the risk-free rate of interest is 3% per annum with continuous compounding for all maturities. An investor has just taken a short position in a ten- month forward contract on the stock. 2. What are the forward price and the initial value of the forward contract? b. six months later, the price of the stock is $76 and the risk-frec rate of interest changed to 4% per annum. What are the forward price and the value of the short position in the forward contract? 6. On June 17 of a particular year, an American watch dealer decided to import 100,000 Swiss watches. Each watch costs CHF 225. The dealer would like to hedge against a change in the USD/CHF exchange rate. The forward rate was $0.3881. Determine the outcome from the hedge if it was closed on August 16, when the spot rate was $0.4434. 7. AUS-based corporation has decided to make an investment in Sweden, for which it will require a sum of 100 million Swedish kronor (SEK) in three months' time. The company wishes to hedge changes in the US dollar (USD)(SEK) exchange rate using forward contracts on either the euro (EUR) or the Swiss franc (CHF) and has made the following estimates: a. If EUR forwards are used: The standard deviation of quarterly changes in the USD/SEK spot exchange rate is 0.007, the standard deviation of quarterly changes in the USD/EUR forward rate is 0.018, and the correlation between the changes is 0.90. b. If CHF forwards are used: The standard deviation of quarterly changes in the USD/SEK spot exchange rate is 0.007, the standard deviation of quarterly changes in the USD/CHF forward rate is 0.023, and the correlation between the changes is 0.85. c. Finally, the current USD/SEK spot rate is 0.104, the current three-month USD/EUR forward rate is 0.471, and the current three-month USD CHF forward rate is 0.602. i. Which currency should the Company use for hedging purposes? ii. What is the minimum-variance hedge position? Indicate if this is to be a long or short position 8. Suppose the spot S exchange rate is 0.008, the 1-year continuously compounded dollar- denominated rate is 5% and the 1-year continuously compounded yen denominated rate is 1%. Suppose the 1-year forward exchange rate is 0.0084. Precisely explain the transactions you could use (being careful about currency of denomination) to make money with zero initial 2 investment and no risk. How much do you make per yen? Repeat for a forward exchange rate of 0.0083 Years to Maturity Zero- Coupon Yicld One-Year Implied Forward Rate 1 2 3 6.00% 6.50% 7.00% 7.00236% 8.00705% 9. Consider the effective annual rates for the zero-coupon yield for years 1, 2 and 3, based on the table above a. Suppose that you observe in the market ro(1,2)=6.8%. Show how buying the 2-year zero-coupon bond and borrowing at the 1-year rate and implied forward rate of 68% would earn you an arbitrage profit. b. Suppose that you observe in the market ro(1, 2) = 7.2%. Show how borrowing the 2- year zero-coupon bond and lending at the 1-year rate and implied forward rate of 7.2% would car you an arbitrage profit. Term Rate 90 days 6.00% 180 days 6.20% 270 days 6.30% 360 days 6.35% 10. Find the rate on a new 6 x 9 FRA. 11. Consider an FRA that was established previously at a rate of 5.2 percent with a notional amount of $30 million. The FRA expires in 180 days, and the underlying is 180-day LIBOR. Find the value of the FRA from the perspective of the party paying fixed and receiving floating as of the point in time at which this term structure applies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts